You probably hear the term “Ponzi scheme” tossed around frequently out there, but you may not know what it is and why it matters. So here’s a little background from Wikipedia:

A Ponzi scheme (/ˈpɒnzi/, Italian: [ˈpontsi]) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors.[1] Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own.

In the 1920s, Charles Ponzi carried out this scheme and became well known throughout the United States because of the huge amount of money that he took in.[4] His original scheme was based on the legitimate arbitrage of international reply coupons for postage stamps, but he soon began diverting new investors’ money to make payments to earlier investors and to himself.[5] Unlike earlier similar schemes, Ponzi’s gained considerable press coverage both within the United States and internationally both while it was being perpetrated and after it collapsed – this notoriety eventually led to the type of scheme being named after him.[6]

The key takeaway is that a Ponzi scheme dies when the inflow of new money is insufficient to pay off existing investors victims. To understand why this matters today, let’s do a thought experiment. Say that in the coming year, the US has to pay out 5% more for Medicare and Social Security, and 7% more for its global military empire. Meanwhile, businesses with debts coming due have to roll them over at higher interest rates, while homeowners with adjustable-rate mortgages see their monthly payments rise.

In the aggregate, that’s a lot of new dollars — let’s say half a trillion — that didn’t exist a year ago but are needed now. And they have to come from somewhere. In a normal fiat currency system, the central bank simply creates the needed currency out of thin air, everyone gets paid, and the resulting decline in the value of the currency is small enough that few are bothered.

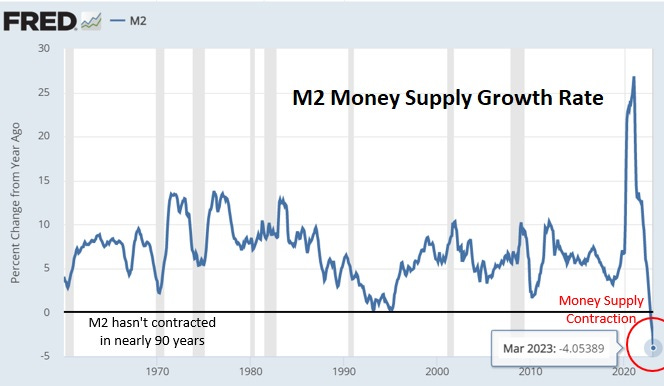

But that’s not what’s happening today. As the above obligations come due, the amount of available money is … shrinking. The following chart of the M2 money supply growth rate shows a massive spike from all the covid lockdown stimmy checks (which partially accounts for last year’s surge in consumer prices) and a correspondingly dramatic plunge this year. Note that during the entire fiat currency era, M2 has never before gone down.

This means some debts won’t be paid. Creditors thus stiffed will fail to pay their debts and so on until sectors start blowing up. Think back to last month’s local and regional bank near-death experience for a relatively benign example of what this unraveling will look like.

To sum up, the current global financial system is a Ponzi scheme and the new money spigot has been turned off. Excitement is about to ensue.

Here’s where it gets even more interesting

When today’s Ponzi scheme starts to unravel, those same governments will be faced with a choice between letting virtually everything grind to a halt as trouble at the collapsing periphery starts heading for the core (that is, as small players die in ways that threaten JP Morgan Chase), or restarting the stimmy check machine, but on a much bigger scale and with a major twist:

Instead of sending out paper or electronic checks to individual bank accounts, the Fed will roll out its much-discussed central bank digital currency and fund “free” account balances for everyone who it deems worthy of such a gift. The vast majority, traumatized by the disappearance of their jobs and stock portfolios, will willingly accept the free money. And just like that, the next financial system is born.

Which, as always, takes us back to gold and silver. History says the first phase of this process will feature an equities bear market that takes precious metals down for the ride. But in the second phase (i.e., the CBDC introduction), people who prefer not to own “programable” currency that’s monitored 24/7 by the NSA will convert their Fed bucks to real assets. Shortages of gold and silver will ensue and prices will respond accordingly.