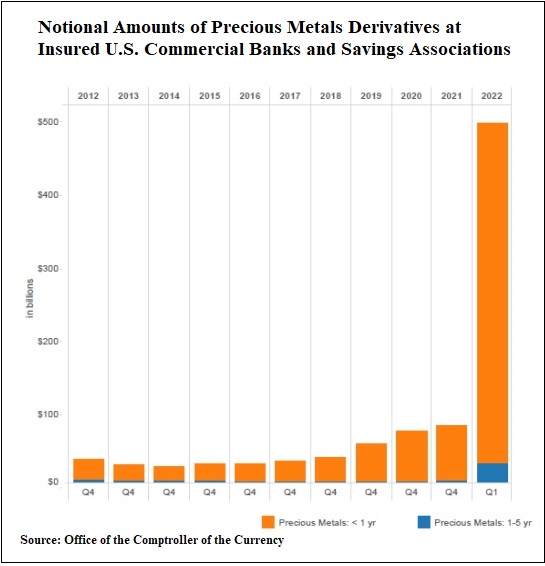

Last Tuesday, the Office of the Comptroller of the Currency (OCC) released its quarterly report on derivatives held at the megabanks on Wall Street. As we browsed through the standard graphs that are included in the quarterly report, one graph jumped out at us. It showed a measured growth in precious metals derivatives at insured U.S. commercial banks and savings associations over the past two decades and then an explosion in growth between the last quarter of 2021 and the end of the first quarter of this year.

In just one quarter, precious metals derivatives had soared from $79.28 billion to $491.87 billion. That’s a 520 percent increase in a span of three months. (See Figure 18 at this link. The last ten years of the graph is shown above.)

Having studied these quarterly reports since the 2008 financial crash, we knew where to head next. We went to the graphs in the OCC report showing the breakdown of different categories of derivatives at specific banks. Table 21 showed that precious metals contracts at JPMorgan Chase had spiked to $330.123 billion as of March 31, 2022. The same table showed that Citigroup’s insured commercial bank, Citibank, held $114.148 billion in precious metals derivatives.

…