by GoldCore

◆ JPMorgan’s head of precious metals trading and senior traders have been charged by the U.S. Department of Justice with rigging precious metal prices in a “massive, multiyear scheme”

◆ The DOJ’s indictment said the scheme generated millions of dollars in profits for JPMorgan Chase and caused millions in losses for counter-parties, prosecutors said

◆ JPM precious metals desk chief, Michael Nowak, who was indicted is a JPM managing director and London Bullion Market Association (LBMA) board member

◆ The U.S. DoJ has invoked RICO or Racketeer Influenced and Corrupt Organizations Act racketeering law in charging JP Morgan and racketeering is very rarely used in cases involving large banks

◆ JPM is accused of illegally monopolizing the silver futures market, engaging in “widespread spoofing, market manipulation and fraud” in the gold and silver market and defrauding investors

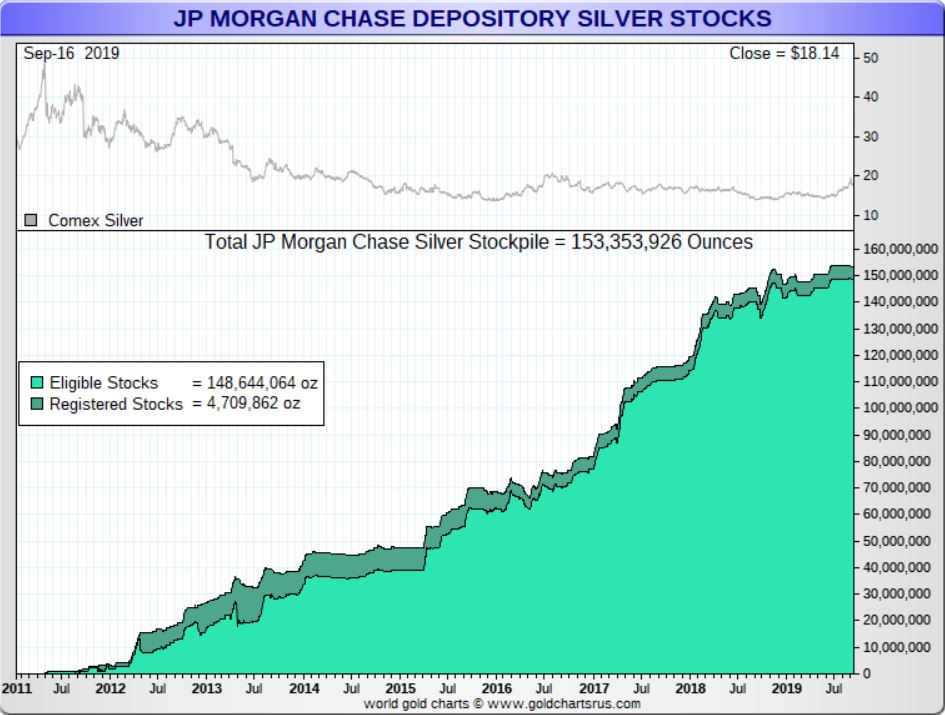

◆ JP Morgan may have accumulated the biggest stockpile of physical silver in history – See JP Morgan Cornering Silver Market?

NEWS and COMMENTARY

JPMorgan’s Metals Desk Was a Criminal Enterprise, U.S. Says

3 From JPMorgan Accused in Scheme to Game Precious Metals Market

Will Jamie Dimon finally lose his job over racketeering charges?

JP Morgan Racketeering Case Way More Than Gold & Silver Spoofing

How far will rigging probe go? Kennedy interviews GATA Chairman

Repo Market Chaos Signals Fed May Be Losing Control of Rates

Gold steady amid cautious mood, focus shifts to ‘losing control’ Fed

Gold notches second straight gain, adds to climb toward 1-week high