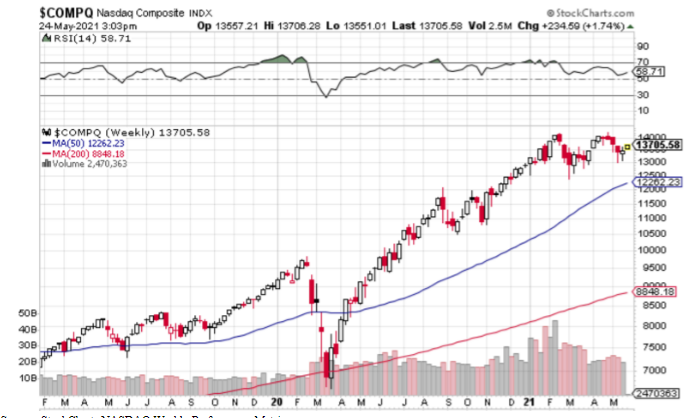

Financial markets reversed on Monday 24 May, 2021 as inflation concerns receded on the back of weaker-than-anticipated economic data. Tech stocks led the way.

Late Stock Surge in May Sets the Stage for June

Source: StockCharts NASDAQ Weekly Performance Metrics

In the stock market bearish trading sessions can wipe out profits in next to no time at all. What took years to build up can be vanquished by negative sentiment within a day. Such was the case for most of May 2021. Successive selloff periods placed heavy pressure on equities during the month, but ultimately the bears were stopped dead in their tracks. On Monday, May 24, 2021, economic data confirmed what many already knew: weaker economic data put the brakes on rising inflation. Once the inflation news permeated the markets, it didn’t take stocks long to react.

The major driver of stock market volatility vis-a-vis inflationary pressures, is the Federal Reserve Bank. Actions taken by the Fed have an outsized impact on the financial markets. Consider the quantitative easing policy currently in effect. The Fed is still maintaining near-zero interest rates and bond buying at a furious pace. This is all done in the interests of supporting economic activity by encouraging spending, borrowing, and overall enterprise. In April 2021, consumer prices rose appreciably above April 2020 figures, up +4.2%. But the data is skewed since it is measured over the biggest geopolitical shock the economy has known since the Great Depression, notably the Coronavirus Pandemic. The Fed, in its efforts to aspire towards full employment and 2% inflation has held back on raising interest rates, and reversing quantitative easing.

This news was greeted with thunderous applause from tech stocks which pulled the NASDAQ out of the doldrums, reversing multiple days of losses. Major tech companies such as Amazon (NASDAQ: AMZN), Google (NASDAQ: GOOG), and Apple Inc (NASDAQ: AAPL) led the charge. Heading towards June 2021, other financial instruments such as cryptocurrencies were being battered from pillar to post. After Tesla’s Elon Musk railed against Bitcoin, and China regulators berated the use of cryptocurrency, the digital asset and the entire market tanked. Almost $1 trillion was wiped off the markets within a week, but that too turned around on Monday, May 24, 2021.

It appears that the inflationary concerns are on the backburner, at least for now. This has helped to buoy financial markets. For the month, anaemic gains characterized major US markets such as the Dow Jones, S&P 500, NYC, and S&P/TSX. Were it not for Monday’s resurgence, the figures were trending bearish. Despite minimal gains month-on-month, the year-on-year performance for US indices is roundly positive, with at least 30.94% appreciation in the S&P/TSX composite index. Other indices are also up, such as the NYSE (+45.68%), NASDAQ (+46.45%) Dow Jones Industrial Average (+40.81), and the S&P 500 index (+42.41%). Elsewhere, European markets are equally strong, while Asian markets turned in a negative one month performance across the board.

Market Rally Instilling Confidence in Shares

Source: Google Finance Dow Jones Industrial Average

Stock screeners revealed the top performing stocks on the NASDAQ 100 index on Monday 24 May 2021. These include the heavy hitters, such as Tesla (+5.40%) Applied Materials Inc (+4.81%), Nvidia Corporation (+4.43%) and DexCom Inc (+4.30%). The majority components of the NASDAQ, including Google (4.01), Amazon.com Inc (8.421), Microsoft Corp (9.654), and Apple Inc (10.994) make up a weighting of approximately 33% of the NASDAQ, so their performance can certainly wrench the market out of the doldrums. And that is precisely what happened on Monday. Tesla and Facebook are approximately evenly weighted at 3.602 and 3.971 respectively, and both of them were up approximately 2.67% – 2.70% on Monday.

*Data sourced by: Slick Charts, NASDAQ index

Stocks Worth Watching as May Winds Down

Tech stocks are always an interesting prospect, particularly the volatile stocks like Tesla. However, there are also other lesser-known stocks – rising stars, or shooting stars – that have untapped potential. One category of stocks has been drawing retail traders into the fold for quite some time, are the low-cost options with the potential for substantial yields. There are several penny stocks you can buy now, OTC, as pink sheets, and at official exchanges too. These include a mix of biotech stocks, hemp stocks and energy stocks:

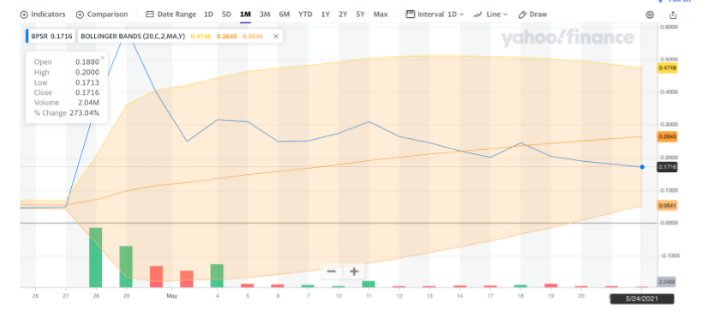

Organicell Regenerative Medicine Inc. (OTCPK: BPSR)

Source: Yahoo! Finance

Organicell Regenerative Medicine Incorporated (OTCPK: BPSR) is currently trading at around $0.1743, down markedly for the week. The company has a market capitalization of $181.454 million, with plenty of market news to keep investors and traders interested. Recently, the company entered an exclusive distribution agreement with the Pakistan-based

provider named Apex Services for the rollout of a Covid vaccine.

This clinical-stage biopharmaceutical company is going to have exclusive rights to promote and market Zofin™ under the auspices of the DRAP (Drug Regulatory Authority of Pakistan). Just before that, the company was in talks to file with the Indian Council for Medical Research. While the price performance of late has lagged somewhat, this penny stock performed well in late April, and held its value throughout May. Bollinger Bands suggest that it is trading within a

sustainable range, just below the center band at 0.2645.

Green Globe International Inc (OTCPK: GGII)

Source: Yahoo! Finance

On May 26, 2021, GGII presented to stock-market analysts, advisors, institutional investors, and individual investors at the Emerging Growth Conference, in San Diego California. The 30 minute presentation, give or take, was designed for investment opportunities. This is a CBD and hemp company, under new management. The stock shot up in early May, and then retraced, and is currently trading above the center Bollinger Band of 0.0638, at 0.0750.

This indicates bullish sentiment, and it will be interesting to see how the presentation affects the stock price in the days that follow. This penny stock company has a market capitalization of $266.816 million, substantial for a stock priced so low. For the year-to-date, the stock is up sharply, and has consolidated well above its early May lows. With penny stocks, news releases can have an outsized impact on volatility and pricing, as we have seen from recent developments with this particular stock.

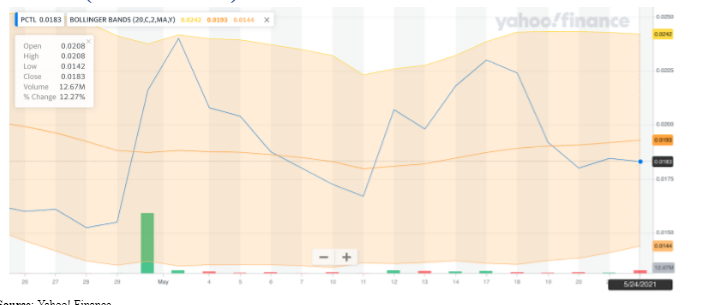

PCT Ltd (OTCPK: PCTL)

Source: Yahoo! Finance

PCT Limited is in the business of environmentally safe products. Some of its products are utilized in the energy sector, notably the oil and gas industry. The stock had a spectacular short-term spike in May, but has consolidated in a tight trading range since then of around $0.0183. Just recently, the company appointed Arthur E. Abraham as its Chief Financial Officer (CFO) effective May 17, 2021.

The news was met with tremendous optimism upon release on May 14, 2021, as can be seen by the trading chart spike. This stock has slightly tapered off since then, but plans are afoot to continue the deployment and testing of environmentally safe solutions around the world. These include microbicides, disinfectants, sanitizers, pre/post-harvest disinfection of crops, and the like. The stock is trading around the center Bollinger band price of $0.0193, with sideways movement of late.

Stock trading is inherently risky, and performance assessments are only valid at the time of writing. A myriad of factors can influence pricing, and affect supply and demand accordingly. This is particularly true of volatile penny stocks. The analysis is not intended as trading advice or as part of an investment strategy.

Disclaimer: This content does not necessarily represent the views of IWB.