by Natura Naturans

All China did was end subsidies. That did it. No one will buy electric cars that are so vastly overpriced without a government subsidy. The same thing happened in the US state of Georgia that saw EV sales collapse from 17% to 2% after the end of subsidies. The subsidy problem is compounded by the inequality of benefit, the only group that benefits from EV subsidies is the rich:

“Who bears the costs?

Another question is, who benefits most from subsidies? A Manhattan Institute report on EVs highlights the fact that more than 50% of EV buyers in the United States lived in households with annual income of at least $100,000, and 20% had yearly incomes over $200,000. The conclusion is that subsides come at the expense of lower-income drivers of gasoline-powered cars who cannot really afford to buy any new vehicle, much less an electric one. It is they who end up paying for highway maintenance costs through fuel taxes.

Also, as more electric vehicles hit the streets, electricity replaces fuel consumption. The International Energy Agency estimates that by 2030, electricity could displace about 4,8 million barrels of petrol and diesel used per day. This could result in revenue loss of close to $100 billion in fuel taxes, major source of financing infrastructure development. Thus, governments need to find alternative taxation income and someone needs to bear this cost.”

https://phys.org/news/2019-03-electric-v…ilure.html

Already some states are beginning to place taxes on miles driven rather than imbedded in gasoline taxes since EV owners don’t buy gasoline.

https://www.consumerreports.org/hybrids-…high-fees/

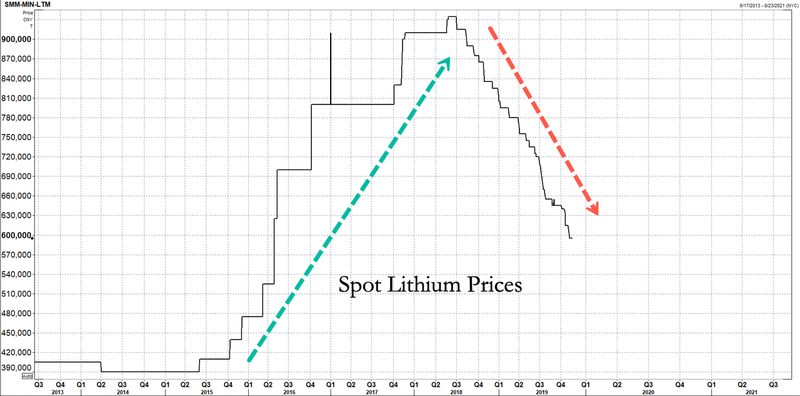

The consequence of the end of subsidies in China has been the collapse of the Lithium market. Here is a chart of lithium prices.

As a result of subsidy reduction as the market cools, going down the supply chain, battery makers have been some of the hardest-hit companies, which the slump has pressured spot lithium prices. As shown in the chart below, spot prices have plunged 37% since 2H18.