⬆ Perpetuates overcapacity

⬆ Promotes malinvestment

⬆ Incentivises debt

➡ Money velocity collapses

➡ Productivity Growth Stalls

➡ Real Salaries Fall

➡ Asset Bubbles Soar

Hey, but government debt and spending rise!

Massive Monetary Stimulus:

⬆️ Perpetuates overcapacity

⬆️ Promotes malinvestment

⬆️ Incentivises debt➡️ Money velocity collapses

➡️ Productivity Growth Stalls

➡️ Real Salaries Fall

➡️ Asset Bubbles SoarHey, but government debt and spending rise! 👏👏👏🤔 pic.twitter.com/hWRdznbhnC

— Daniel Lacalle (@dlacalle_IA) April 24, 2018

$90 billion in value wiped from the popular 'FANG' tech stocks – De-fanged! #NASDAQ #Bubble #DOTCOM.2.0 #Tesla Party Like It's 1929! pic.twitter.com/42qzPUKkBT

— Planet Ponzi (@PlanetPonzi) April 24, 2018

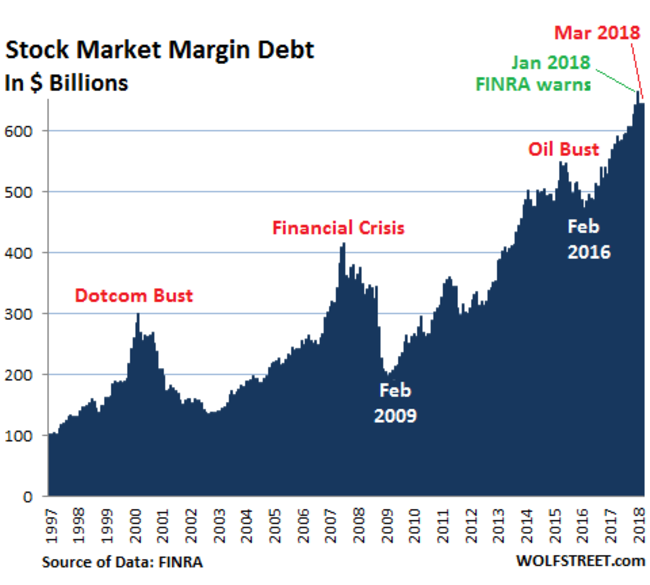

Record High Margin Levels Will Accelerate Coming Market Correction

Margin is wildly risky. No two ways about it. Warren Buffet “offers his strongest argument” against using it.

But in this heady market, with investors drunk on speculation, it’s at record high levels, and it will be a key component in a massive, blink-of-an-eye stock market decline. When brokerages are selling your positions with zero regard for getting the best prices and algorithms providing bids know this, liquidity can vanish in an instant.

It’s the perfect downside accelerant for a market in sharp decline, and we have seen nothing resembling a mass margin call from levels that have risen sharply (exactly as they did prior to the last three market corrections).

There is nothing like a good shot of leverage to fire up the stock market. How much leverage is out there is actually a mystery, given that there are various forms of stock-market leverage that are not tracked, including leverage at the institutional level and “securities backed loans” offered by brokers to their clients.

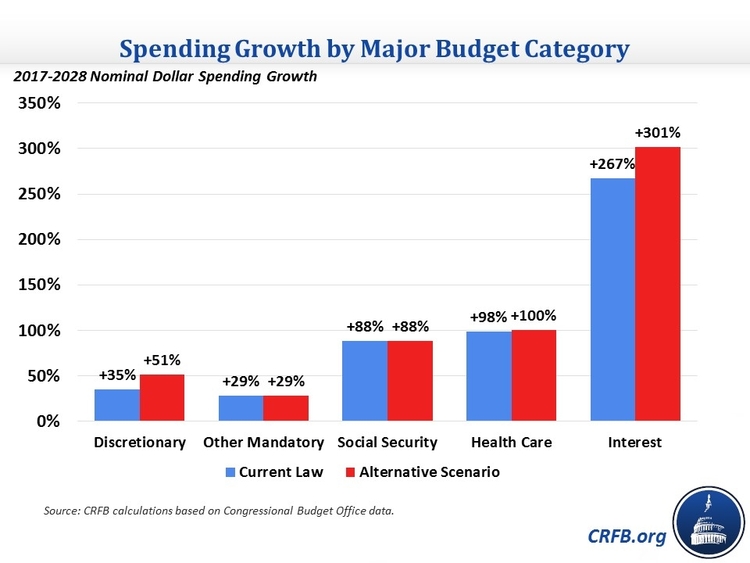

Next Decade, Us Will Accrue $55,000 in Fed Debt Interest Per Household

In addition to the law of diminishing returns bearing down on debt issuance, meaning that the more debt the government issues, the less good its doing the economy, remember why they need to issue so much of it.

To pay the interest on the debt they’ve already issued. Interest, far and away, is the fastest-growing government expense. Forget all the high-flown talk about rebuilding infrastructure and the mighty military; at an alarming rate, the new debt we’re incurring buys us absolutely nothing except the non-default of debt we’ve already issued.

It’s not just the repayment of debt that presents a potential crisis; it’s the interest payments. With a clear correlation between government debt and diminished growth, a natural first step would be for the government to ease its deficit spending on programs such Medicaid, Social Security, and Medicare to decrease the waste inherent in some of these programs.

Interest spending is expected to rise over $1 trillion during the next decade. That is more than the US spends each year on Medicaid and its military. It will cost $55,000 per household over the next ten years just to service debt.