via doctorhousingbubble:

The housing market now sputters into the summer selling season with very little momentum. Home sales are at post-recession lows and the labor force participation rate is collapsing because you have an army of Taco Tuesday baby boomers roaming the streets of California enjoying inflated real estate values while enjoying Whole Foods delivered to their front door without taking more than 5 steps on their Apple Watch. Yet many of these same boomers are now getting frustrated as their adult children are unable to purchase homes in the area and over 2.3 million are living at home. This notion that Millennials are going to save the market is simply not going to happen. You already see growth in other more affordable markets but in places like California, we’ve become a renting paradise. Let us look at some recent Millennial figures and understand why they are not going to save the California housing market.

Millennials to the rescue?

Millennials are the most educated cohort we have had in the U.S. but the challenge is that this education has come at a cost. There is now over $1.5 trillion in student debt in the U.S. And in many cases this debt is going to programs that simply do not align with careers that pay well. Take for example USC’s Master of Social Work. The program expanded online and can cost over six-figures. Keep in mind that social workers earn very little yet somehow, these students are paying as if they are pursuing a graduate degree in computer science, engineering, or say business where the salary may support the underlying degree cost. This is just one example where cheap money (aka, student loans) inflates an underlying product. I just want to note that a six-figure student debt is roughly what your mortgage would be in many parts of the country.

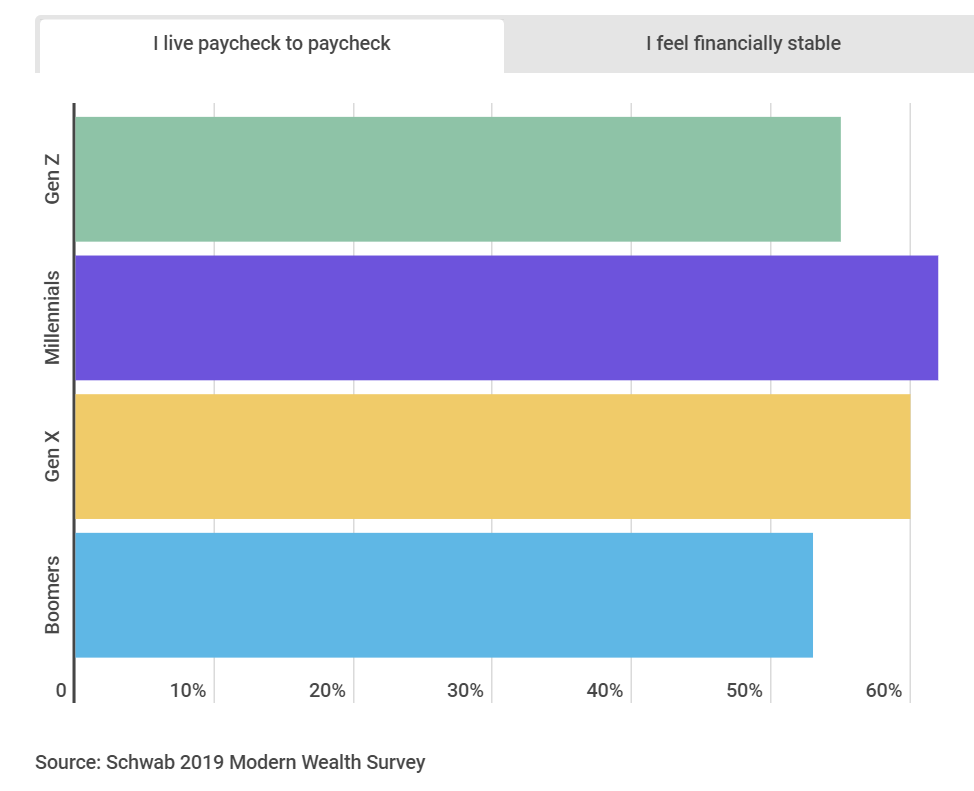

Millennials are having a tough go when it comes to buying homes. In inflated California, this is even tougher. Most Millennials are living paycheck to paycheck:

62% of Millennials surveyed said they are living paycheck to paycheck. So if you are to buy say a starter $600,000 condo in California, even coming up with 10% down is going to be difficult for this group. So the result ends up being Millennials getting roommates or simply living at home with their boomer parents. Many Millennials are simply sitting it out with their siblings waiting until mom and dad pass on to boomer paradise so they can inherit the family home.

Then you have the distorted property tax system in California. For example, take a look at this home in Culver City:

Modest home. The home has a Zestimate of $1.2 million but is currently paying taxes as if the home was valued at $330,658. But let us look at a new updated home next door that is on the market:

Based on current tax figures, that means that one home is going to pay $4,736 per year in taxes yet the neighbor next door is going to pay over $46,000? They both have access to the same public schools, the same street services, and all of the exact public services. Yet somehow, just because someone is buying “now” they are going to pay nearly 10 times the annual property taxes. So what you do of course is that you penalize Millennials at the expense of boomers here.

And let us forget about the grandma being kicked out argument. These property values are arguably going up because they are in hot economic centers. So the person living in the $1.2 million home can sell and cash out their million dollar ticket. They can rent in the area if they wish or move to a cheaper location. This is the “apocalyptic” scenario that people used in the 1970s to pass these laws. But now, you limit the number of homes for sale in the market, reward a first come first served market with subsidies, and then we are surprised why Millennial adults are stuck at home living with parents? And keep in mind Millennials and now Gen Z are the future workforce so we want these people living where they work – when you are retired you have more flexibility as to where you live and you are drawing down on local services less – that is public schools, parks, streets, etc.

I’ve mentioned this before but the state is leaning to a renting majority and you are already seeing legislation looking at Prop 13 and similar structures. There is now talk about doing a similar Prop 13 in Texas, a state with very high property taxes. If Texas goes this way, all you will do is inflate property values and tax revenue will need to come from somewhere else.

Very few young professionals can purchase California properties. This is why sales are pathetically low. Summer should be a hot selling season and this is the momentum the housing market will need going into fall and winter. But don’t expect Millennials to save the market.