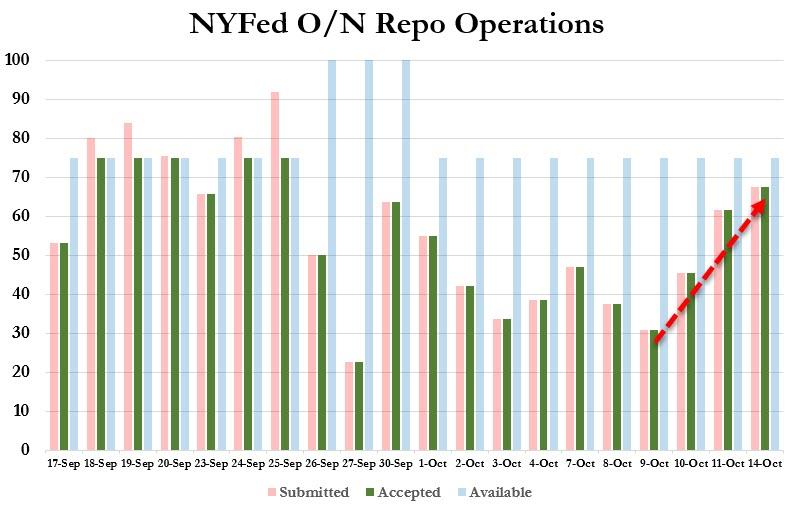

So much for the ‘transitory’ liquidity shortage arguments put forth by commission-takers and asset-gatherers, The NYFed accepted $87.7 billion (in o/n and term) repo today – the highest level yet.

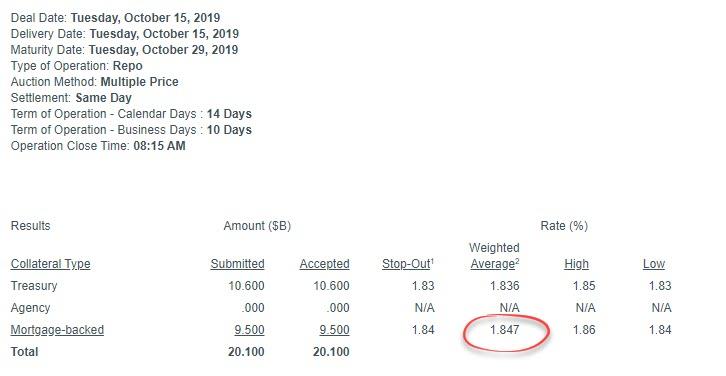

The Fed accepted $20.1 billion in 14-day term repo…

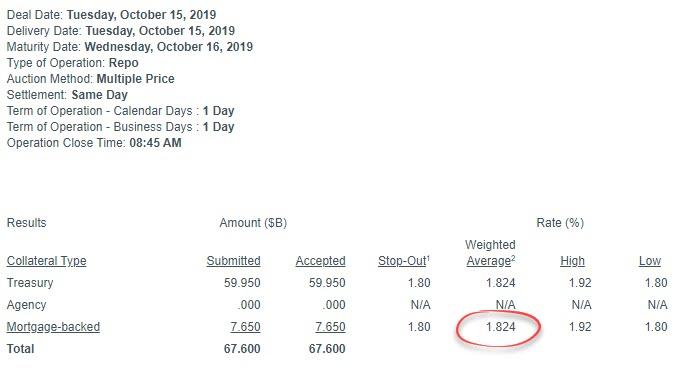

And $67.7 billion in overnight repo…

The biggest overnight repo (liquidity bailout) since September.

Having stabilized in the $30-40 billion range, liquidity needs have surged once again as it seems the big banks just cannot wait for The Fed’s NotQE in November.

https://www.zerohedge.com/markets/not-transitory-fed-liquidity-handout-surges-near-90-billion