by Dana Lyons

Following the recent stock market breakout, stock options traders have significantly trimmed their hedges.

With the popular stock indices hanging near all-time highs for most of the year, one might think that stock sentiment would be extremely bullish. However, among the indicators that we monitor, we have observed very little evidence of unhealthy bullish extremes. That has made for an investing climate that is conducive to further market gains, including the recent, long-awaited breakout in the large-cap averages. With the breakout, however, we may be seeing signs of traders letting their guard down, so to speak. At least one data point pertaining to the equity options market suggests that.

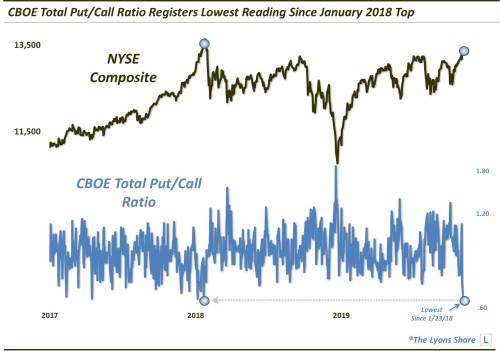

Options traders use calls to bet on market gains and use puts as protection against declines. When a disproportionate amount of volume is going into calls relative to puts, it generally means traders are very bullish — and potentially too complacent about risk. On Monday, we saw potential evidence of that. Via the CBOE, the ratio of total volume going into puts relative to calls registered its 2nd lowest reading in 2 years. Ominously, the only lower reading occurred on January 23, 2018, just before a big decline.

Now, before folks get too alarmed, this is but one data point — and one day’s worth at that. Further, prior to 2 years ago, this series dropped to this low level, and lower, on a more frequent basis. However, it is one piece of evidence of complacency among the investment community that has predominantly been absent throughout the recent stock market strength.

So how alarmed are we about this data point? What would make us more alarmed, to the point of getting out of stocks — or going short? If you’re interested in an “all-access” pass to all of our charts, research and investment moves, please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!