via seekingalpha:

Global debt is officially $184 trillion, which is 225% of global GDP. This is $86,000 for every person in the world, which is 2.5 times annual income.

We estimate that official figures are understated by a factor of 2.5, so debt is actually $460 trillion, which is 560% of GDP and $215,000 per person.

These numbers are astronomical, raising the risk of economic blowback once interest rates and inflation rise, as they eventually will.

Official World Debt

The International Monetary Fund reports that global debt has reached a record high, raising serious implications for the global economic outlook. The worrisome details include:

The International Monetary Fund reports that global debt has reached a record high, raising serious implications for the global economic outlook. The worrisome details include:

- Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017. On average, the world’s debt now exceeds $86,000 in per capita terms, which is more than 2½ times the average income per capita.

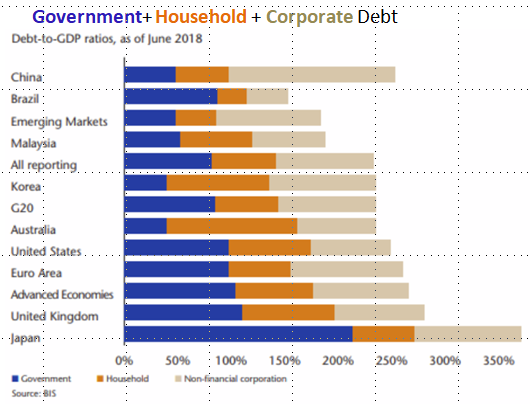

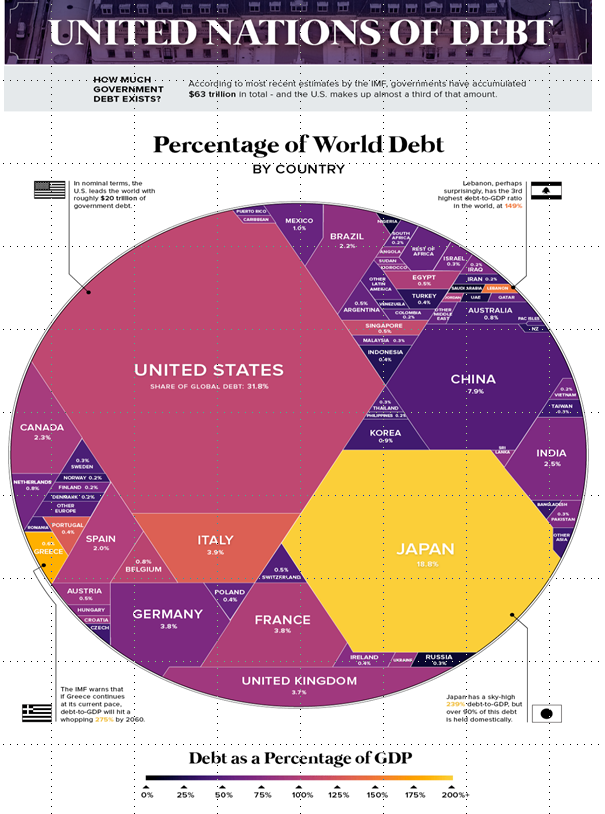

- The most indebted economies in the world also are the richer ones. The top three borrowers in the world — the United States, China, and Japan — account for more than half of global debt, exceeding their share of global output.

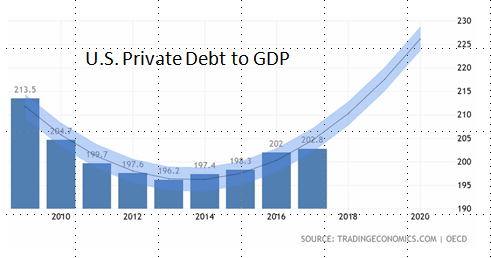

- The private sector’s debt has tripled since 1950. This makes it the driving force behind global debt. Another change since the global financial crisis has been the rise in private debt in emerging markets, led by China. At the other end of the spectrum, private debt has remained very low in low-income developing countries. See the section below on “Why Worry.”

- Global public debt, on the other hand, has experienced a reversal of sorts. After a steady decline up to the mid-1970s, public debt has gone up since, with advanced economies at the helm and, of late, followed by emerging and low-income developing countries.

The Visual Capitalist breaks global debt out by country as follows:

The “Real” numbers are much bigger

The official numbers are understated. In this article, I show that the official US figure of $20 trillion in public debt is 5.5 times less than the actual debt of $110 trillion, which is 390% of GDP. Public debt in the US is about one third of total debt, so real total debt is 2.5 (5.5 X 1/3 +2/3) times higher than the official number

Using this 2.5 times multiplier applied against the official $184 trillion, global debt is really more like $460 trillion which is 560% of global GDP. It’s beyond belief.

Why Worry?

Debt brought the world to its knees in 2008. Paradoxically, disaster was circumvented by doubling down with even more debt, deferring the consequences to sometime in the future. That future is rapidly approaching. In The Coming Global Financial Crisis: Debt Exhaustion, Charles Hugh Smith observes:

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion: a sharp increase in defaults, a rapid decline in demand for more debt, a collapse in asset bubbles that depend on debt and a resulting drop in economic activity, a.k.a. a deep and profound recession that cannot be “fixed” by lowering interest rates or juicing the creation of more debt.

Even if it’s not the cause, debt has a history of predicting market crashes. In A Brief History of Doom: Two Hundred Years of Financial Crises author Richard Vague demonstrates that the over accumulation of private debt does a better job than any other variable of explaining and predicting financial crises. The 2008 crash is a recent example.

A number of other economists agree. Steve Keen, an economics professor who heads the School of Economics, Politics and History at Kingston University, outlines a persuasive case in his book “Can We Avoid another Financial Crisis?” for why rising private debt tops the list of possible triggers for the next financial crisis and recession.

Consider private debt with the current gargantuan public debt and it’s clear that we need to worry about a double whammy of a market crash exacerbated by stagflation, or even hyperinflation. The next recession also will be compounded by the toppling of the share buyback dominoes.

Much of the “real” debt is for government promises that cannot be kept – Medicare in the US, for instance. These are promises that the people have made to themselves, so it’s conceivable that some generation will simply refuse to pay, causing social disorder.

Foreign affairs may bring trouble, too. The so-called Thucydides’ Trap is a related threat that sees the US and China heading toward war, and everyone’s hoping that it might be a relatively benign conflict like the Cold War that was waged with Russia, or that it might end with a battle using only tariffs as weapons. Yet the great Greek historian Thucydides foretold that irresistible rising forces (like China) would collide with immovable super powers (like America). Nouriel Roubini, known for his correct warnings of the 2008 recession, believes that the China-US trade war will push the US economy into recession in 2020 or sooner. It doesn’t help that China is one of America’s largest lenders. There’s a good chance that China’s US loans will be withdrawn, or no future loans will be made, leaving the US with limited funding sources. The next time the Debt Limit is raised, Congress might discover that there are no lenders.

Some say that the world has bigger problems to worry about like the possible use of nuclear weapons, and that’s true. No one knows which threat(s) will send the world into turmoil or when it will happen, but we do know that if something cannot go on forever, it will end. All we can do is prepare as best we can.

Some say that the world has bigger problems to worry about like the possible use of nuclear weapons, and that’s true. No one knows which threat(s) will send the world into turmoil or when it will happen, but we do know that if something cannot go on forever, it will end. All we can do is prepare as best we can.

These Bills Will Not be Paid

The official estimate is that every person on the planet owes $86,000 but we estimate that the actual number is around 2.5 times that amount – $215,000 per person, which is more than 6 times average income per capita. In other words, every person on the planet owes six years of labor. No one cares at the moment, partly because no one intends to pay their share, but mostly because we choose to deny the problem’s very existence.

The world economy is running on the fumes of delusory borrowed money, playing an outlandish game that will not end well. We owe each other money that won’t be paid in today’s dollars. That’s why crypto currencies were invented. Fiat money only works if we all agree to honor it. Otherwise it’s just pieces of paper. US currencies were debased in 1971, when they were taken off of the gold standard and replaced by “In God We Trust.” Now debasing means printing money, or monetizing the debt. Lenders lose when borrowers control payment values.

The world economy is running on the fumes of delusory borrowed money, playing an outlandish game that will not end well. We owe each other money that won’t be paid in today’s dollars. That’s why crypto currencies were invented. Fiat money only works if we all agree to honor it. Otherwise it’s just pieces of paper. US currencies were debased in 1971, when they were taken off of the gold standard and replaced by “In God We Trust.” Now debasing means printing money, or monetizing the debt. Lenders lose when borrowers control payment values.

Signs of weakening credit quality also are appearing in China, where 2018 was a record year in corporate bond defaults, and 2019 looks like it will be even worse.