"EM crisis spreading: #Argentina Peso has dropped another 5% this week, South Africa Rand, #Turkey Lira, #Brazil Real almost 4%, and even #Poland Zloty and #Hungary," h/t @Schuldensuehner pic.twitter.com/5tzuEek73s

— Alastair Williamson (@StockBoardAsset) May 20, 2018

Global QE Dream Ends, ECB Sees Rate Hikes, “Normalization” Becomes a Thing

via Wolf Richter

The Fed leads, the ECB follows.

The voices are getting clearer: The ECB will end QE likely this year and begin raising rates possibly as soon as 2019. For now, these are not official announcements, but central bankers talking — not just German central bankers anymore, who have a more hawkish bend to begin with, but now even Francois Villeroy de Galhau, the head of the Bank of France and member of the ECB’s Governing Council.

They’re preparing markets for a new reality, the era of QE Unwind and rising rates. And the end of NIRP. The key word, so effectively etched in stone by the Fed, will be “gradual.”

Villeroy was talking on Monday at a central banker conference by the Global Interdependence Center and the Banque de France in Paris. Cleveland Fed President Loretta Mester also spoke there; more on her speech in a moment. Villeroy was talking to the media too to make sure his message got out.

The ECB’s current QE program is scheduled to run through September. It already tapered its asset purchases from €85 billion a month at the peak in 2016 to €30 billion a month starting in January. It includes an alphabet soup of assets: government bonds (PSPP), corporate bonds (CSPP), asset-backed securities (ABSPP), and covered bonds (CBPP3):

So what everyone wants to know is what happens after September.

In his speech, Villeroy said that “the time when our net asset purchases will end is approaching,” but whether net purchases end in September or December is not “a deep existential question.” But they will end. The last time the ECB tapered, as the chart above shows, it took its purchases from about €60 billion in November 2017 and prior months to €50 billion in December and to €30 billion in January 2018. If this pattern holds, Eurozone QE will drop to zero sometime before the end of December.

And Villeroy added that, as the ECB approaches the end of QE, it will need to adjust its guidance on the “timing” of future rate hikes. These rate hikes are coming. The ECB has consistently said that rate hikes would begin “well past” the end of QE. In his speech, Villeroy defined this phrase, “well past,” as “meaning at least some quarters but not years” after the end of QE. So rate hikes in 2019?

….

All Roads Lead To Stagflation – This Is How We Got Here

via Adem Tumerkan

Summary

- I’ve been very critical of the mainstreams ‘growth story’ they continue to push. There are very troubling cracks widening in the economy they seem to ignore.

- The last 15 months has seen U.S. GDP rise, but most of this came from increased exports which has benefited from the declining USD.

- As we learned from the Austrian Economist F.A. Hayek – this is only temporary growth – and the effect of this is rising inflation, which is becoming a problem now.

- This puts the Fed between a rock and hard place – they either fight inflation by hiking rates (which U.S. economy can’t handle) causing a recession. Or they let inflation run higher.

- Either way, there is a trade off. And the short-term growth has led us down the road of Stagflation.

There’s been a lot of talk lately about the dollar and the United States’ economy.

I don’t think people realize how the latest ‘growth’ the U.S. has had is superficial – all thanks to a weaker dollar.

Most CNBC pundits don’t even mention how the weaker dollar has given the economy a short-term spurt. And the couple that won’t even acknowledge that it’s temporary.

Let me explain. . .

A country can weaken their currency to make their exports look more attractive abroad.

Look at these three charts

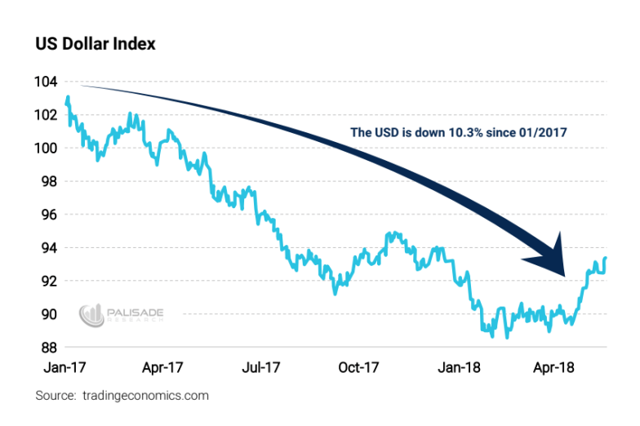

First – and most importantly – the U.S. dollar has been in a steep decline over the last 17 months – regardless of the recent rally.

Why does this matter?

When a country needs to boost economic growth – a key thing they can do is to weaken their currency. This matters because. . .

1. It will give the nation a trade advantage and make their exports look attractive abroad.

2. The weaker currency will make imports more expensive, discouraging domestic consumers from buying foreign goods.

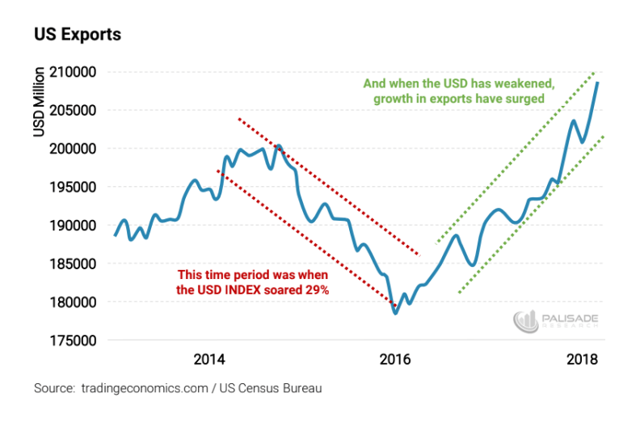

And since the USD has declined, exports have grown considerably. . .

This is what President Trump has wanted – all this talk of trade deals and trade wars with China is his way of increasing U.S. exports. He wants to make sure when foreigners look at the tags on their products it says “made in America”.

Now, as we’ve learned from the over-rated economist – John Maynard Keynes – when you cheapen your currency and boost exports, it will increase your economic output.

Economic growth = GDP (gross domestic product). . .

The formula for GDP is C (consumption) + G (government) + I (investment) + NX (net-exports).

And if you have more net-growth in any of those four, your GDP will be positive.

But notice the last one – that’s the important key here. Boosting exports will therefore grow the GDP.

“In calculating the GDP, imports and exports are balanced with each other, with the net difference either increasing or decreasing GDP. If exports are greater than imports then GDP increases. This is also called a current account surplus…”

As we saw above, U.S. exports have risen sharply since the currency has weakened.

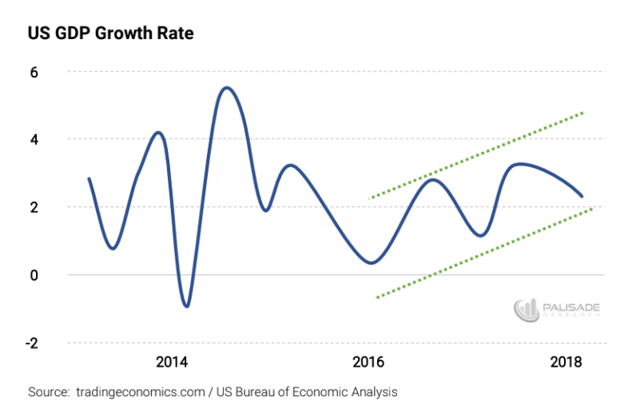

Let’s see how GDP has done since. . .

It’s been choppy – but the trend is upwards. So it looks like the weakening dollar has helped U.S. growth.

But, here’s the problem – you can’t just cheapen your currency to get never-ending growth. There’s no such thing as a free lunch.

BLUNDERING INTO RECESSION

That’s when the Federal Open Market Committee, FOMC, the Fed’s interest rate policy arm, will in all likelihood raise interest rates another 0.25%, the seventh such rate increase since the “liftoff” in interest rates in December 2015.

The market is currently putting the odds of a rate hike at 95%.

This is the most aggressive tempo of rate hikes of any major central bank and puts U.S. policy rates significantly higher than those in the U.K., Japan or eurozone.

The issue for investors is whether the Fed is raising rates too aggressively considering the strength of the U.S. economy. Higher rates imply a stronger dollar, imported deflation and head winds to growth.

If the U.S. economy is on a firm footing, then the rate hikes may be appropriate, even necessary to head off inflation.

But if the U.S. economy is vulnerable, then the Fed’s actions could trigger a recession and stock market sell-off unless the Fed reverses course quickly.

My view is that the latter is more likely.

The Fed is tightening into weakness and will reverse course by pausing rate hikes later this year.

When that happens, important trends in stocks, bonds, currencies and gold will be thrown into reverse.

Outwardly, the Fed is sanguine about the prospects for monetary normalization. Both Janet Yellen and new Fed chair Jay Powell have said that interest rate hikes will be steady and gradual.

In practice, this means four rate hikes per year, 0.25% each, every March, June, September and December, with occasional pauses prompted by strong signs of disinflation, disorderly markets or diminution in job creation.

Lately job creation has been strong. And inflation has picked up. But it’s been spotty. The Fed still faces head winds in achieving its inflation goal.

The Fed is targeting a 2% annual inflation rate as measured by an index called PCE core year over year, reported monthly (with a one-month lag) by the Commerce Department.

That inflation index has not cooperated with the Fed’s wishes, and despite recent gains, hasn’t been able to hold consistently above 2%.

This has been a persistent trend and should be troubling to the Fed as it contemplates its next policy move at the FOMC meeting on June 12-13.

I’ve warned repeatedly that the Fed is tightening into weakness. The Atlanta Fed is projecting a 4.1% growth rate for the second quarter. But it’s known for its rosy projections that are almost always revised downwards once the data come in,

It had to lower its estimate of first quarter growth from over 5% to 1.8%. You can pretty much bet they’ll have to significantly reduce this projection as well.

The economy has been trapped in this low-growth cycle for years. The current economic recovery shows none of the 3% to 4% growth that previous recoveries have shown.

Meanwhile, the Fed is plowing ahead with its policy of quantitative tightening (QT), or cutting into its balance sheet.

…

The Bubble of Everything pic.twitter.com/tg7l2a1OJC

— Daniel Lacalle (@dlacalle_IA) May 19, 2018

Walmart Credit Card Bubble pic.twitter.com/YEoKVqZOok

— Alastair Williamson (@StockBoardAsset) May 19, 2018

RIP Deutsche Bank $DB pic.twitter.com/EUa8oFFhu9

— Alastair Williamson (@StockBoardAsset) May 19, 2018

Chart of the Day: Bear Market Repo’s—A Concise History

h/t David Stockman

Harry Dent: EVERYTHING Is In A Bubble Right Now And That INCLUDES GOLD

For thousands of years, people have turned to gold and other precious metals to safeguard their savings… but with cryptocurrencies skyrocketing in value and popularity, could they be a better crisis hedge than the yellow metal?

According to renowned Harvard economist and forecaster Harry Dent, “If you think either gold OR bitcoin is going to protect you from the upcoming market bloodbath… well, you’re in for a nasty surprise.”

“Everything–– and I mean everything–– is in a bubble right now. That includes gold and cryptocurrencies.”

Dent––one of the world’s leading experts on why (and how) economic bubbles begin, boom, and eventually bust––has accurately predicted many of the worst financial crises of the last thirty years… including the fall of Japan in the early 90s, the housing crisis and market crash of 2008, and the 2011 top in gold and silver prices.

“Just like the housing bubble––and every other bubble for that matter–– once prices start to go parabolic… speculators pile in and try to get rich quick using cheap credit, and that’s what winds up collapsing the whole thing,” says Dent in his latest forecast.

With Bitcoin breezing through the $11,000 mark… along with the recent surge in Google searches for the term “buy bitcoin with credit card”… more than a few people are starting to worry if this is the beginning of the end.

Google trends show a massive spike in the search term “buy bitcoin with credit card”. Is this the sign of “crypto mania” reaching a top? Click here for Harry’s latest forecast to find out.

Should You Buy Bitcoin or Gold?

“Let me make one thing perfectly clear. We are dangerously close to witnessing the worst economic crisis since the Great Depression,” says Dent” But these so-called ‘safe assets’ you think are going to save you could wind up ruining your savings.”

“And no, gold isn’t going to save you either. Just look at what actually happened in 2008”

While most gold investors believe the yellow metal’s value should skyrocket during times of financial crisis, history suggests otherwise.

As markets around the world began to unravel in 2008, gold actually fell 33%.

Gold and silver would go on to rally to new highs, but Dent again accurately identified precious metals were in a bubble. He issued a strong sell signal on April 25th, 2011… the exact day silver prices peaked, and just a few months before gold’s eventual crash.

And now Dent is again warning gold could plummet back down to it’s November 2011 low of $700 during the next financial crisis.

Experts Warn: “Market Crash Imminent”

“The gold bugs and cryptocurrency fanatics are right about one thing. We ARE headed towards one of the most epic economic meltdowns in history. Central banks are out of control and they’ve created a huge mess,” says Dent.

“But there’s no way we’re going to see runaway inflation. If that were gonna happen, we would have seen it when the Federal Reserve pumped trillions of dollars into the US economy after 2008.”

According to Dent, investors should actually be much more concerned the opposite is going to happen. With near zero (or negative) interest rates around the globe––and unprecedented levels of debt–– Dent says the central banks have only one option left.

“Once the next crash hits, trillions of dollars in debt is going to be defaulted on. We’ve reached the point where trying to inflate our way out of debt is no longer possible.

“We HAVE to go through a painful deleveraging period… and that’s why we’re going to see deflation, not inflation.”