Now is the time to be extra careful.

The US has erupted in riots/ civil unrest. The economic and cultural impacts of these events will be extreme. History has shown us that riots can have long-lasting, highly negative effects on local economies for years after the riots have ended.

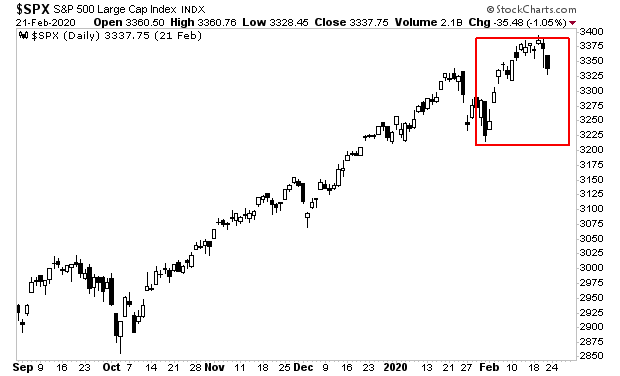

Despite all of this horrific news, the markets are up somewhat this morning. And that is a bad sign. It reminds me of what the markets were doing in late February: while the COVID-19 pandemic/ economic shut down was just around the corner, the markets were actually rallying (red square in the chart below).

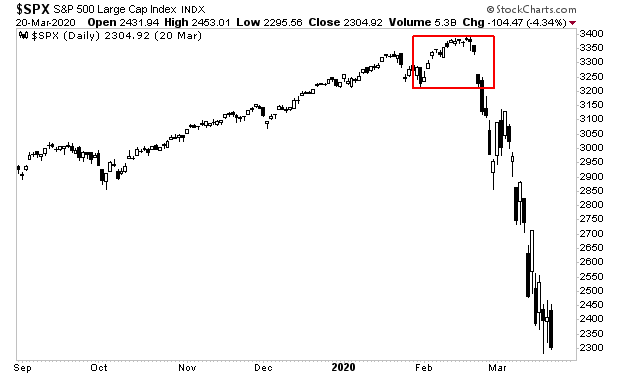

Then this happened.

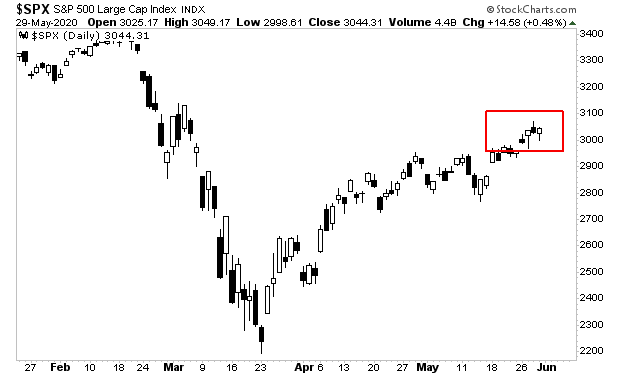

Fast forward to today, and the week before a large portion of the economy literally went up in flames, the markets are rallying once again.

Let’s be clear… the US economy was already in a depression before the riots started. The riots have made things exponentially worse. The potential fallout from this is tremendous. And we could indeed see another crash hit.

Again, now is the time to be careful, with yourself, your loved ones and your investments.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research