by UPFINA

One of the themes we have discussed in the past 10 months is that forbearance isn’t an issue. If you want to focus on housing issues, look at renters. They are the ones in trouble. This matters for policy makers because it’s best they focus on the real issues. Imagine if an investor thought homeowners were in trouble. They would be flabbergasted by the massive increase in spending on home improvements.

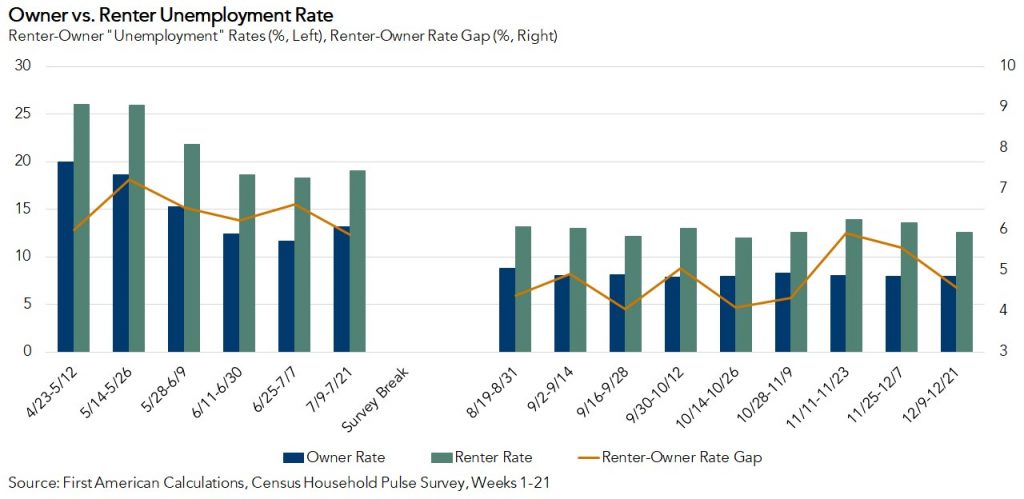

Homeowners are less likely to be unemployed, and even in a time of economic distress, the rate of unemployment for homeowners doesn’t increase as dramatically as for renters. In fact, the unemployment rate for renters since 2000 has averaged 4.4 pp more than for homeowners. pic.twitter.com/pJkORNH2bp

— Odeta Kushi (@odetakushi) January 26, 2021

As you can see from the chart above, historically renters always have a higher unemployment rate than owners and the difference rises during recessions. It’s great to be a home owner because your mortgage payment stays the same while your income increases. The home will be the most expensive in the first year. This is why there are so few foreclosures. The housing bubble in the early 2000s ruined this benefit because there were teaser loans where rates were lower in the beginning. When rates spiked, people suddenly couldn’t afford their mortgage.

As you can see from the chart below, the economy is basically back to normal for homeowners. Their unemployment rate is about 7%. No wonder housing demand is so strong. Another way of looking at this is to say the increase in demand obviously came from people with jobs, so they lowered the rate. On the other hand, renters are in dire trouble as their unemployment rate is near 13%. That’s borderline depressionary results. If it wasn’t for boosted unemployment benefits, they would be in deep trouble. Obviously, eviction bans also lessened the blow.

The good news is renters have the most room to improve when the economy reopens this spring. The unemployment gap is about the same as August. 7.1% of America has been vaccinated which has caused hospitalizations to plummet from above 130,000 to 110,000 in a couple weeks.

Homeowners Are Fine

Homeowners are doing well outside of the few who lost their job due to the pandemic and can’t work from home. Homeowners are not going to cause a crisis. They are the top half of the K shaped recovery. The homebuyers in the last cycle were the best buyers in any expansion because mortgage requirements were really tough coming out of the bust. That’s like how the best time to buy oil stocks was in 2020 or the best time to buy tech stocks was in 2002.

As you can see from the chart below, the percentage of mortgages in forbearance has fallen steadily across the board. This will be back to normal a few months after the economy reopens. This was one of the bullish arguments for the banks. The biggest issues the banks have are loans in the leisure and hospitality industry not housing loans.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%" https://t.co/CaHJrFr722 pic.twitter.com/XS1PQlYHj9

— Bill McBride (@calculatedrisk) January 25, 2021

No More Physical Branches

The long term trend is for fewer bank branches as people use cash less and get paid less with checks. Those who do get paid with checks are using apps to deposit the money. Plus, there are ways to get a mortgage without going to a branch. This has led to the chart below which shows the yearly median change in total bank branches.

Bank branch consolidation looks set to be a long-tailed effect of the pandemic. The ubiquity of smartphones had already locked a secular decline in bank branches into place long before 2020. https://t.co/c3s3iyh9td pic.twitter.com/Z27uQNXouD

— FactSet (@FactSet) January 25, 2021

The only thing surprising about this chart is there wasn’t much of an acceleration of closures in Q2 2020 and Q3 2020. There definitely was less use of physical branches during the pandemic. It probably pushed people away from going to the bank for the long term as these habits stick. Once you try something that’s easier, you don’t go back to doing the harder thing.

When Will The Fed Taper QE?

A couple weeks ago we were discussing the market pricing in rate hikes as early as 2022. Maybe that was a contrarian signal that the market had gotten ahead of itself. It’s very difficult to predict what will happen to the economy in the next 3-4 months. We know there will be an improvement, but how much will job creation and inflation increase?

Majority of economists surveyed by @Bloomberg believe it will be another year before @federalreserve starts tapering asset purchases pic.twitter.com/JbiCZRlsLU

— Liz Ann Sonders (@LizAnnSonders) January 25, 2021

As you can see from the chart above, most economists expect the Fed to taper QE between Q4 2021 and Q2 2022. We could be eight months from a taper. Furthermore, we could be a few months from the Fed guiding for a taper which is more important. Usually, these programs are gradual, so the Fed might not end its bond buying until the end of 2022 if it announces it will start tapering in Q4 2021. Nothing will change at the next Fed meeting on Wednesday because the economy hasn’t reopened. We are within a few weeks of seeing real improvements caused by the reopening. Look for more hawkish guidance on March 17th which is the following meeting.

Bubble Or Normal Expectations?

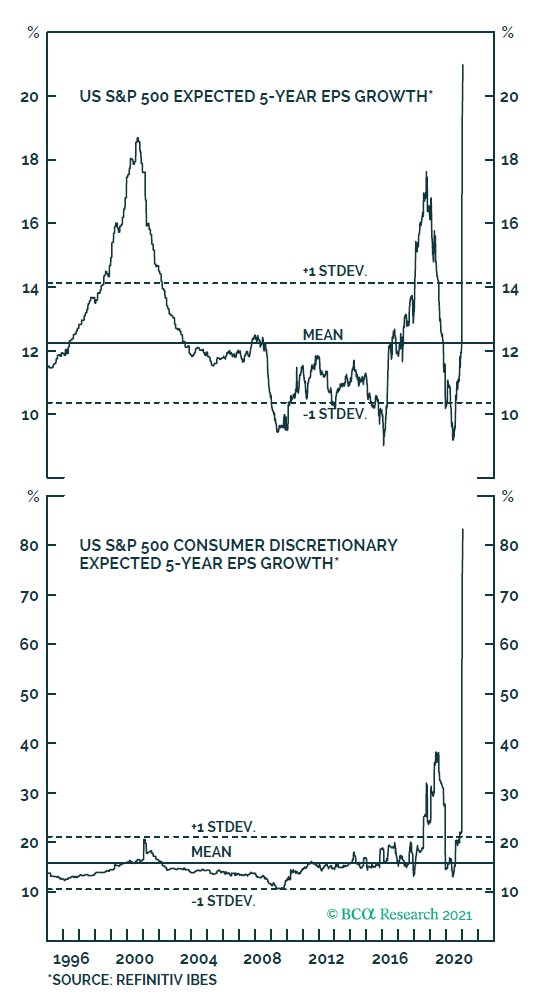

Have earnings expectations gone insane? The stock market is certainly in a euphoric state. The earnings catalysts are the economy reopening and another stimulus on top of the recently passed $900 billion one. As you can see from the top chart below, 5 year expectations for EPS growth are about 21% which is higher than ever. It’s higher than after the corporate tax cut was passed and during the tech bubble. There has never been an elongated period where expectations were either high or low, so this should reverse within the next 6 months.

The bottom chart is crazier. The 5 year expected EPS growth for consumer discretionary stocks is above 80%. They will have strong growth in 2021 because of the stimuli, reopening, and consumer’s spending their boosted savings. However, after that EPS growth will probably be weak because of tough comps. Taxes might even be raised in 2022 or 2023 if the government wants to get its fiscal house in order following the recession and three stimuli.

Conclusion

Renters are still in trouble. They are in a recession while homeowners thrive. The Fed could turn hawkish within the next couple meetings in which case it would guide for tapering within the following few quarters. EPS expectations are quite high. They will come down following 2021 which has easy comps, the reopening, and the stimuli in its favor.