by Frank Holmes, CEO, U.S. Global Investors

Terbium is used to make flat-panel displays. Thulium can be found in your microwave. Dysprosium demand is growing with increased production of wind turbines and electric vehicles.

The 17 so-called “rare earth metals,” of which the three mentioned above are members, may not have household names like gold or copper, but they play strong supporting roles in many of the consumer electronics we enjoy on a daily basis, from our TVs to smartphones.

They also have important high-tech military, energy, health care and transportation applications. According to the Rare Earth Technology Alliance (RETA), each Lockheed Martin F-35 requires some 920 pounds of the metals. Some nuclear-powered submarines use up to 9,200 pounds.

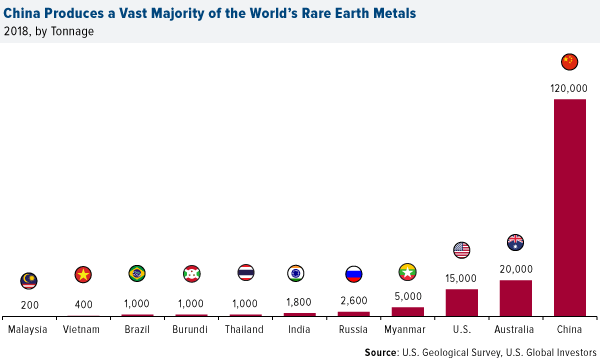

All of this could be something of a concern in the near term. China, which accounts for close to 80 percent of the world’s annual production of rare earth metals, is allegedly preparing to curb the export of these important materials to the U.S. as a bargaining chip in the ongoing trade war between the two superpowers, and as retaliation for the recent U.S. ban on imports from Chinese telecommunications firm Huawei. In a tweet dated May 28, Hu Xijin, editor of the Chinese state-controlled Global Times newspaper, said that he believes the country “is seriously considering restricting rare earth exports to the U.S.” Some market commentators are already calling this China’s “nuclear” option.

“Rare,” by the way, is a misnomer here. The metals are actually more plentiful than precious metals such as gold and platinum. But because processing them is costly and leads to heavy pollution, China has risen to become the global leader. As few as six state-owned enterprises (SOEs) dominate the Chinese rare earth metals mining and refining industry.

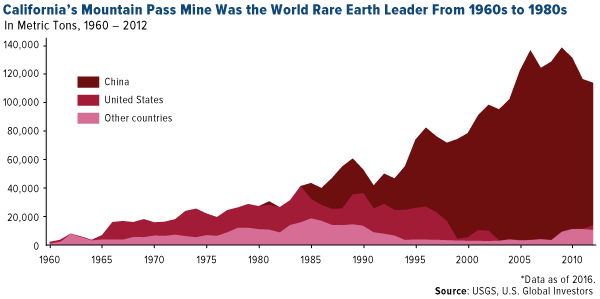

The U.S. was actually the leader in global rare earth production from the 1960s to 1980s, but today, California’s Mountain Pass mine is the only such mining and processing facility in the U.S. As such, China supplies some 80 percent of U.S. rare earth requirements.

Obviously this has some serious national security as well as economic implications. There are other countries the U.S. can import these metals from—including Australia, Estonia and Myanmar—but it would be challenging to make up the difference.

American Ingenuity to the Rescue

If you remember, the U.S. faced a similar “crisis” involving oil around 20 years ago. Some people were talking about “peak oil.”

But American ingenuity gave us hydraulic fracturing, or fracking, and today the U.S. is the world’s largest producer of crude, having surpassed Russia and Saudi Arabia sometime last year.

Should China follow through with its threats and cut off its rare earth exports, I believe the U.S. should build up its own mining and refining capacity aside from finding new suppliers. American innovators gave the U.S. fracking and soon-to-be energy independence. They can and should do the same with respect to rare earth metals.

Where to Invest?

As expected, Hong Kong and Shenzhen-listed rare earth miners surged this week and last. China Rare Earth Holdings gained more than 108 percent in a single session on May 21. JL Mag Rare-Earth Co., which Chinese president Xi Jinping recently visited, has had a remarkable 13 straight days of positive returns , and is now up 171 percent since May 13.

Seeing as how this rally is driven purely by geopolitics, it’s hard to say at this point how much gas is in the tank, so to speak.

I still find more traditional materials and resources attractive—crude oil, copper, paper products, chemicals and more. The rare earth trade flare-up may expose America’s own vulnerabilities, but it also demonstrates just how much we depend on natural resources in general to keep our lives running smoothly. For my money, that’s worth betting on.