by Dana Lyons

Recent new highs in the tech sector have occurred on decreasing participation.

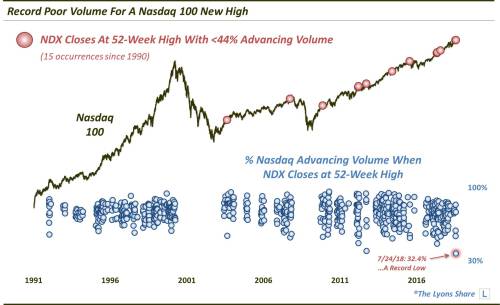

For the most part, the rally off of the early 2018 correction lows has occurred on strong breadth, or widespread participation from individual stocks. We are starting to see some potential signs of a change in that trend this week, however. As we mentioned yesterday, the small-cap market failed to keep pace with the new high in the Nasdaq 100 (NDX) on Tuesday. We saw another manifestation of the possible “thinning” of the tech rally as well on Tuesday (7/24). While the NDX closed at an all-time high, the accompanying breadth was relatively very weak for a new high.

As evidence, the % of both advancing issues and advancing volume on the Nasdaq exchange equated to less than one third of all exchange data on Tuesday. In the history of the NDX, that is the only time we have ever observed such conditions on the occasion of a 52-week high in the index. Furthermore, at 32.4%, the advancing volume was the lowest on record for any NDX 52-week high.

As the chart indicates, there have only been 15 occurrences now when the NDX closed at a new high with less than even 44% of advancing Nasdaq volume. A few of those instances marked tops of at least short-term significance in the index. So should we be concerned – or is this just a 1-day fluke data point?