by Cheapbastard

So they “lend” the fed the money overnight while the Fed gives them collateral 9Treasuries) overnight and 0.05% for the use of that overnight money.

Usually it’s the other way around which is the stunning issue. That’s the way I understand it.

Bottom line:

- No one wants to hold on to cash; and,

- essentially only the Fed itself is buying it’s own Treasuries at this point (foreigners no longer want them)

At some point, this will crash down BIG time from what George Gammon and Druckenmiller have said with serious problems for the dollar.

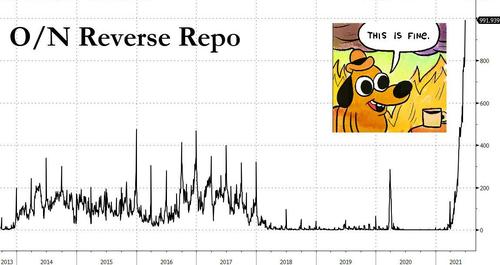

Do We Hear A Trillion: Fed’s Reverse Repo Hits Record $992 Billion, Up $150 Billion In One Day

There’s not much we can add here: after all we have beaten to death the topic of the Fed’s soaring reverse repo facility (see “With Fed’s Reverse Repo Hitting Half A Trillion, Wall Street Scrambles To Figure Out What Comes Next” and especially “Powell Just Launched $2 Trillion In “Heat-Seeking Missiles”: Zoltan Explains How The Fed Started The Next Repo Crisis“), but while many were expecting fireworks for month and quarter end, nobody expected that a record 90 counterparties (up from 74 on Tuesday) would park an additional $150 billion in loose liquidity (for context, all of QE2 was $600 billion) at the Fed’s reverse repo facility where it is now earning 0.05% compared to the 0.00% rate prior to the June FOMC, bringing the total reverse repo usage to a mindblowing $991.9 billion, after printing a record $841.2 billion on Tuesday (across 74 counterparties).