The bond market is calling the Fed’s bluff.

The single most important bond in the world is the 10-Year U.S. Treasury. The yield on this bond serves as the “risk free” rate of return for the world: it is the rate against which all risk assets (real estate, stocks, commodities, etc.) are valued.

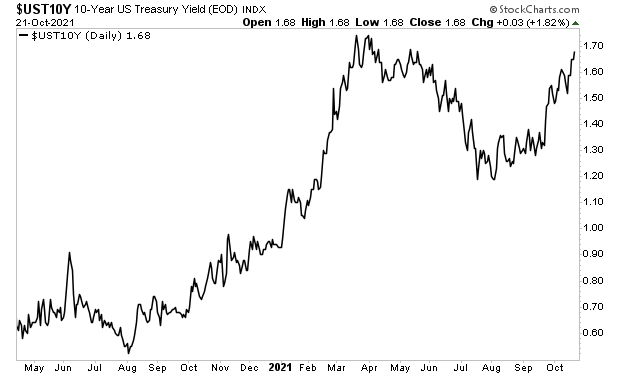

I mention all of this because the yield on the 10-Year U.S. Treasury is exploding higher. As I write this Friday morning, it is closing in on 1.7% and is just a hair below its March 2021 high.

Why does this matter?

Because this yield moves based on inflation (among other things). And the speed of this move is suggesting that the inflation situation is getting worse.

Remember, the only reason bond yields fell from March until July of this year was because the Fed promised to tighten monetary policy. Put another way, the bond market believed the Fed would take the necessary steps to stop inflation from getting out of control.

Not anymore.

The bond market is now showing us that the Fed won’t act in time and inflation is going to spiral out of control.

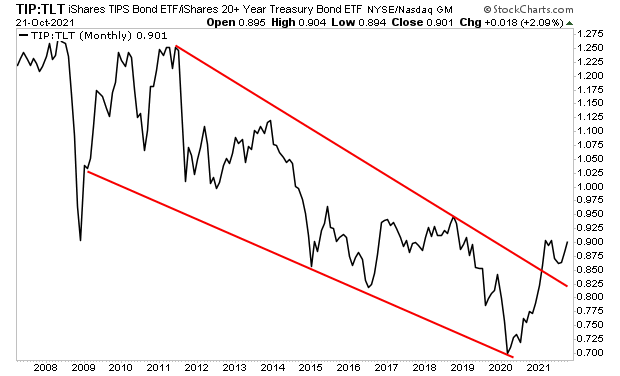

You can see this clearly in the below chart which illustrates the ratio between Treasuries that trade based on inflation (TIPS) and long-term Treasuries (TLT). I call this the “inflation vs deflation ratio.”

When inflation is the primary driver of the financial system, the chart rallies. And when deflation is the primary driver of the financial system, the chart falls.

As you can see, this ratio has just broken out of a 14-year downtrend. What this means is that for the first time in 14 years, the financial system is moving into an inflationary regime.

And the Fed is WAAAYY behind the curve.

This has presented us with the opportunity to profit from once in a lifetime event: the arrival of an inflationary crisis that cannot be slowed or stopped by the Fed.

During the last major bout of inflation in the 1970s, smart investors locked in gains in the QUADRUPLE digits (1,000% or higher). And THAT version of inflation was the kind the Fed could stop!

So, you can imagine the profit potential of this crisis today.

I outline five investments that could explode higher as inflation rips through the financial system in a Special Investment Report titled Survive the Inflationary Storm.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards,