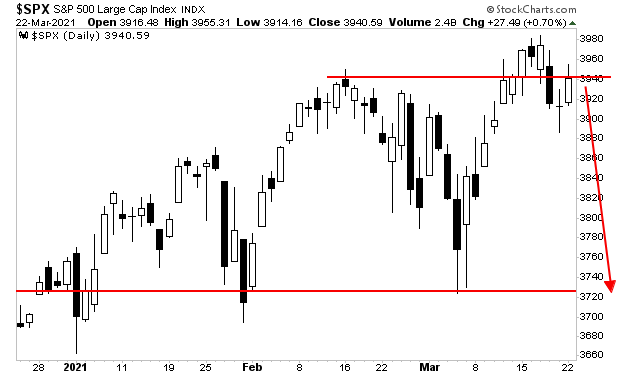

The trend has ended for stocks. We can now expect a lot of chop.

The bulls really fumbled last week. They not only had the Fed behind them (the Fed printed over $100 billion that week), it was also options expiration week, which is Wall Street’s favorite time to manipulate the markets to insure as many options expire worthless as possible.

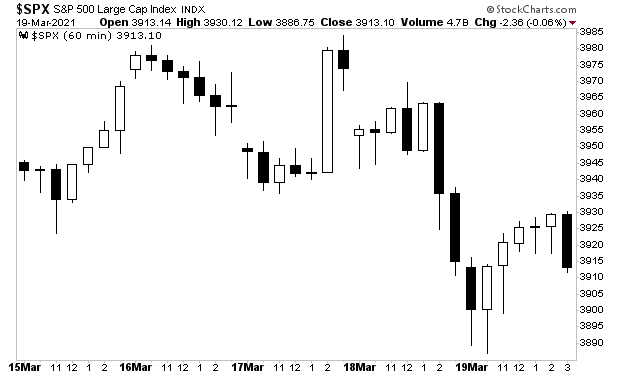

Despite this, stocks closed DOWN for the week. The S&P 500’s chart was truly pathetic.

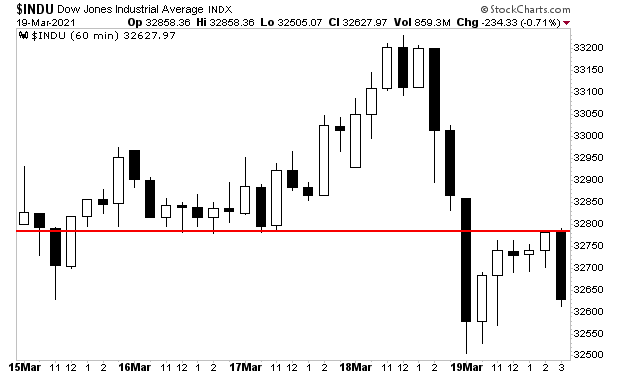

Even the Dow Jones industrials, which has been a clear market leader, failed to end the week up. You can see how this index failed took out support (red line) and then failed to reclaim it. In technical analysis terms, this means former support is now resistance. And it is very bearish.

The onus is now on the bulls. They need to step in right here, right now and push the market up in a big way. If they don’t the trend is dead and we’re in for a correction down to the 3,700s.

You’ve been warned.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research