via valuewalk:

Crescat Capital’s commentary for the month of March 2020, titled, “This Is It”, discussing the economic crisis and the repo liquidity crisis.

Dear Investors:

Many of you understandably have been asking for more frequent performance and positioning updates now that we are in a bona fide financial crisis. We are happy to oblige.

Crescat Fund’s Performance

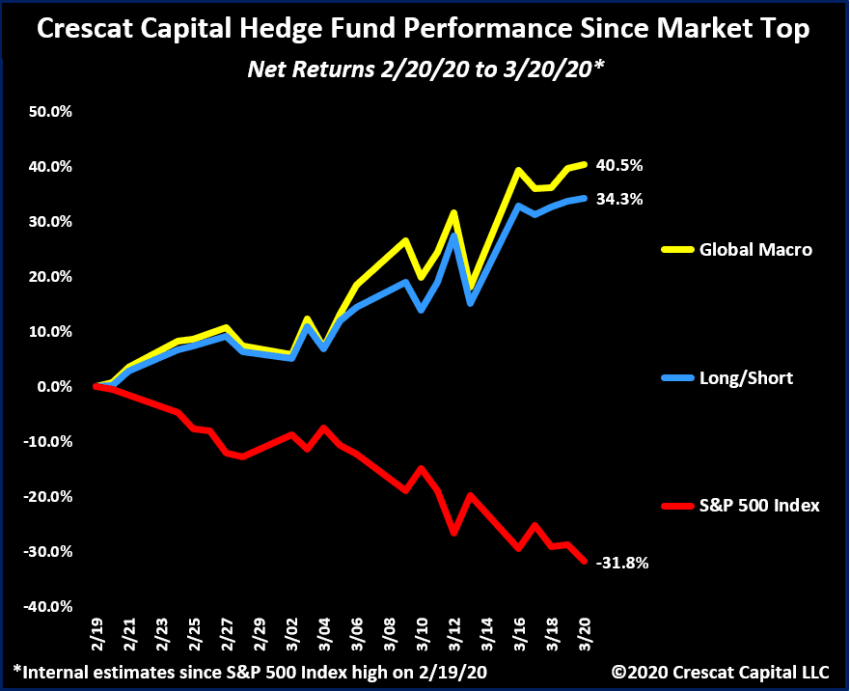

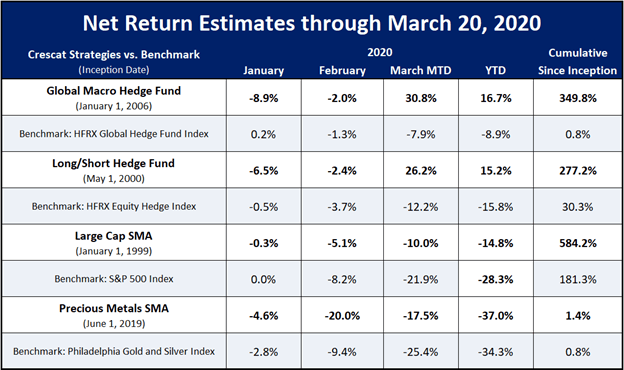

The good news is that since the market top on February 19 and through last Friday, Crescat Global Macro Fund LP is up approximately 40.5% net while Crescat Long/Short Hedge Fund LP is up 34.3%. At the same time, the S&P 500 Index has declined 31.8% including dividends:

This is it! It’s the market and economic downturn we have been preparing for since late 2017. That’s when we first showed that the US stock market was in historic bubble territory across a composite of valuation and leverage measures. We believe the swiftness of the decline now unfolding is a strong justification for why we insisted on staying positioned net-short ahead of it in our hedge funds. This allowed our clients to reap the benefits while others scramble to unwind and reposition under severe stress. Our macro model is what guided us.

We adopted a bearish view and significant tactical net short equity position in our hedge funds in late 2017. That positioning enabled us to have two of the world’s top performing hedge funds in 2018.

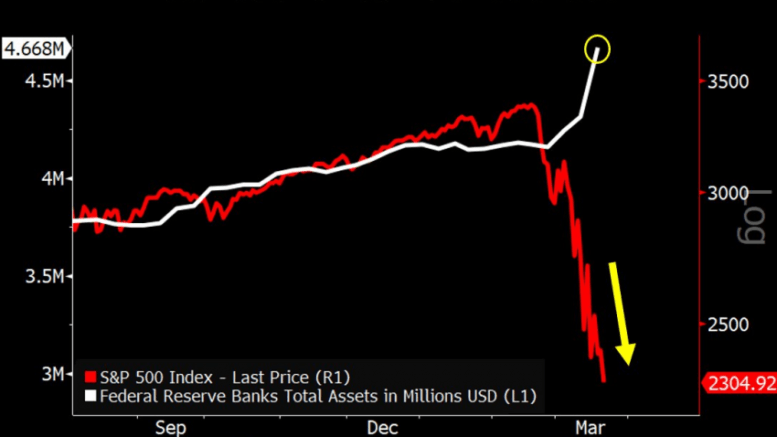

The Major Repo Liquidity Crisis Of 2019

Then came 2019. The Fed curtailed its interest rates hikes after the Q4 2018 slip in the markets. The downturn in the business cycle that we were expecting failed to materialize in 2019. We certainly did not expect the market to push to new highs last year. Our 16-factor macro model and many other indicators continued to warn us that the market was extremely overvalued and the economic expansion overextended. After the US Treasury yield curve inverted more than 70% in August amidst a major repo liquidity crisis, we were as convinced as ever that a significant bear market was imminent. August indeed was a big month for Crescat as the Chinese yuan broke down, breaching the 7 level on USDCNY, and our long precious metals positions screamed higher, two key legs of our Macro Trade of the Century.

Global equity shorts, including US stocks, are the third leg. But in the wake of a repo liquidity crisis, late-cycle bulls twisted the new Fed money printing into an excuse to drive the stock market even higher. From October onward, the S&P 500 just kept melting up to new highs. All the while, corporate earnings in the US were already turning down and China was hurtling toward recession. The economic downturn was so threatening that Trump and Xi agreed to a panic Phase 1 trade deal to try to stem the downward spiral. That only made stocks go higher.

…

…