via confoundedinterest:

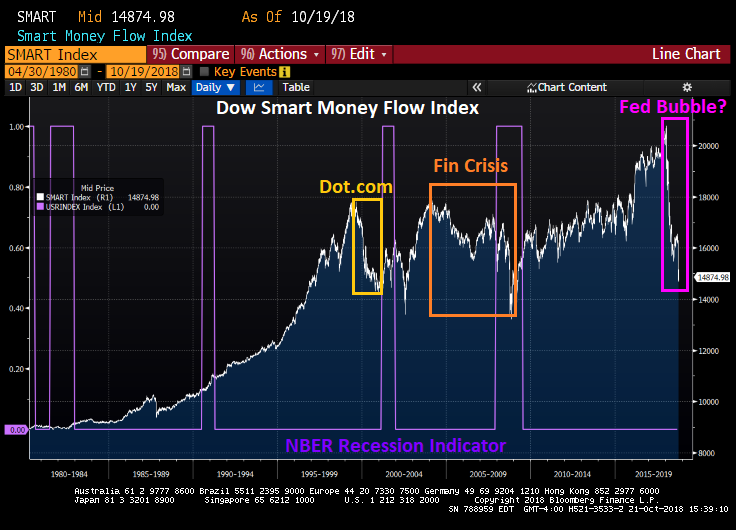

The Smart Money Flow Index is a sentiment index attempting to measure “skittishness” in the markets. Particularly at stock market opening in the US for the Dow.

We saw a collapse in the Smart Money Flow index in 1999 as the Dot.com bubble exploded. Then we saw a slower decline starting in 2004 in front of the housing bubble burst and financial crisis.

Now we have a third collapse of the Smart Money Flow Index, likely related to economic uncertainties like trade wars, Brexit, Nancy Pelosi being House majority leader … again and the policy errors of Central Banks including our own Feral Federal Reserve.

To paraphrase Leslie Gore, “It’s their party and they’ll do what they want to.”