As I warned two weeks ago, the Fed is going to start buying “everything”… AKA Weimar lite.

The Fed has faced a choice… either let debt deflation clear the bad debts from the system, even if it means major corporations and banks failing, OR start buying “everything” in an effort to prop up the system (even if it induces raging inflation).

Well, the Fed officially crossed the Rubicon over the weekend. Going into the weekend the Fed had already…

1) Cut interest rates from 1.25% to 0.15%.

2) Launched a $1.5 trillion repo program.

3) Launched a $700 billion QE program.

4) Begun buying commercial paper debt instruments.

5) Opened the discount window to the eight largest banks in the US.

6) Expanded the repo program to $1 trillion per day.

7) Opened dollar swaps with international central banks.

8) Opened credit windows to the money market funds market.

9) Begin buying municipal bonds.

Well, buckle up, because over the weekend, the Fed announced it would make its QE program “open ended” meaning it would buy Treasuries and Mortgage Backed Securities as needed.

Put another way, the Fed announced unlimited QE. And to top it off, the Fed ALSO added that it was expanding its QE mandate to buy corporate debt (for the first time in history).

Put another way, the Fed has announced it is going to effectively monetize “everything,”… Treasuries, Mortgage Backed Securities, Municipal debt, Corporate debt, etc. The only thing debt assets left are student debt, auto loans, and credit card debt.

In simple terms, the Everything Bubble burst… and now the Fed is dealing with it by buying EVERYTHING.

Whether or not this will work remains to be seen. But this is the NUCLEAR option. And if it doesn’t work, there is nothing left for the Fed to do. Remember, technically the Fed isn’t supposed to be able to buy municipal debt or corporate debt. So, it is moving FAR beyond its mandate with these actions.

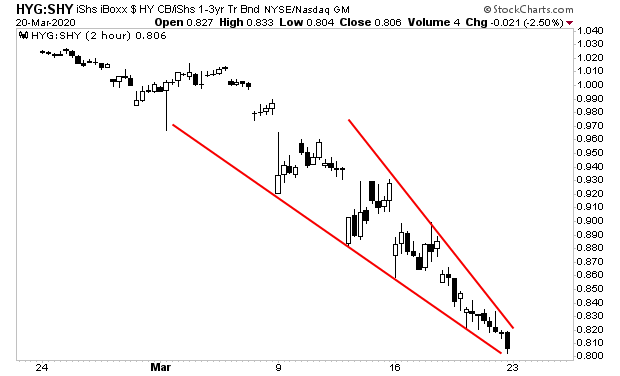

The key chart to watch is the credit spread on Junk Bonds. While stocks tried to bounce time and again in the last few weeks, credit had continued to break down, warning that there was no bottom in sight.

If this chart breaks out to the upside, then we will finally get a bounce. We’re more than due for one…

The bigger issue… is if this works too well, and between the Fed pumping trillions into the financial system, and the federal government launching helicopter money, we begin to see roaring inflation.

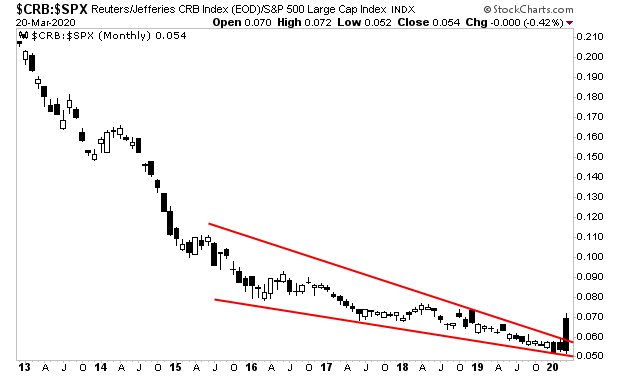

Bond yields have begun rising, suggesting the bond market is beginning to discount inflation hitting the financial system. Moreover, the ratio between commodities and stocks has broken out of a multi-year falling wedge, which suggests commodities will be dramatically outperforming stocks going forward.

This too is signaling higher inflation is coming.

This is telling us that the first round of the crisis, the deflationary collapse, will be ending. But the second round, the INFLATIONARY tidal wave, is only just beginning.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay ou as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research