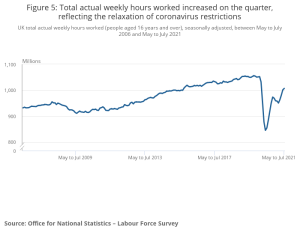

This morning has brought us up to date with the UK jobs market and the news has been positive with one particular threshold being passed. Let us start with the best signal of the employment situation which is hours worked.

Total actual weekly hours worked in the UK increased by 43.2 million hours from the previous quarter, to 1.01 billion hours in May to July 2021.

We continue to see improvements here with the number up some 5.5 million hours on the previous release. That is stronger than the economic growth figures of last week where GDP only rose by 0.1%. A curious result in that GDP was supposed to have been dragged down by lack of labour supply due to the NHS app pingdemic but hopeful for growth prospects. We have seen the labour market be a better guide than GDP before especially around 2013. We still have some distance to travel though.

Jobs

These numbers were also strong.

The UK employment rate was estimated at 75.2%, 1.3 percentage points lower than before the coronavirus pandemic (December 2019 to February 2020), but 0.5 percentage points higher than the previous quarter (February to April 2021).

These are more difficult to interpret because of the swings within them as self-employment and there was a move to employment as described by the Resolution Foundation below.

The Foundation notes that the number of employee jobs increased by 241,000 in August, taking total job levels to 29.1 million – above pre-pandemic levels…….

Self-employment has also started to recover, after falling by 15 per cent at the height of the crisis.

However, with self-employment still down 700,000 since the start of the pandemic….

With there being quite a bit of variability in what people think of as a job these numbers are less help right now in aggregate although there are welcome features.

Over the last quarter, however, there was a strong increase in the employment rate and decrease in the unemployment and inactivity rates for young people

They had been disproportionately affected by the pandemic. Also there was another signal of improvement in the breakdown.

The number of part-time workers decreased strongly during the pandemic, but has been increasing since April to June 2021 (Figure 4), making up the majority of the increase in employment in the latest period.

Curiously we find the overall picture in the vacancies section.

The total number of workforce jobs in the UK in June 2021 was an estimated 34.8 million, down by 856,000 from December 2019; both employee jobs and self-employment jobs showed upward movement to increase the overall workforce jobs figure by 293,000 on the quarter, the highest quarterly increase since March 2014.

Vacancies Surge

These numbers are an attempt to make the series more timely as they bring August into the equation in this instance. This time around they were particularly strong.

The number of job vacancies in June to August 2021 was 1,034,000, the first time vacancies has risen over 1 million since records began, and is now 249,000 above its pre-coronavirus (COVID-19) pandemic January to March 2020 level.

The improvement was very broad.

The number of vacancies reached record levels across all size bands in June to August 2021.

Also we got another hint that the economy was stronger than the latest GDP report suggested.

June to August 2021 saw vacancies grow on the quarter by 269,300 (35.2%), with all industry sectors increasing their number of vacancies, with the majority reaching record levels; the largest increase was seen in Accommodation and food services, which rose by 57,600 (75.4%).

With the supply shortages that we keep noting the only surprise in the second category below is that it is not higher.

The fastest rate of growth was seen in other service activities, which grew by 93.3% (12,500), followed by transport and storage at 76.3% (20,300) and accommodation and food service activities at 75.4% (57,600).

I do hope the group below does not include HGV drivers.

In the latter two categories labour demand has increased rapidly while staff availability fell because of a mix of employees leaving these sectors to find employment elsewhere and a reluctance of workers to return to their previous roles.

The hospitality industry always struggles at times like this because of the low wages it pays. For example we are told that average weekly earnings are £578 whereas the wholesaling,restaurants,hotels and retailing category only has weekly earnings of £382. It was put another way recently as people noted how long it took workers at the sandwich chain Pret a Manger to earn enough to buy lunch there.

Wages

These numbers are in la-la land right now.

Growth in average total pay (including bonuses) was 8.3% and regular pay (excluding bonuses) was 6.8% among employees for the three months May to July 2021, however, since this growth is affected by base and compositional effects, interpretation should be taken with caution.

They have changed the warning since I reported them to the Office for Statistics Regulation back in the spring. But they do at least merit a mention in Alice in Wonderland.

“When I used to read fairy tales, I fancied that kind of thing never happened, and now here I am in the middle of one!”

The attempt to modify them does not really help that much.

Latest figures show that for May to July 2021, the regular earnings growth rate is 6.8%. Using the same two methods set out in the blog published in July, we estimate that the base effect will reduce the regular earnings growth rate by between 1.9 and 3.4 percentage points. In addition, the compositional effect we estimate at 0.2 percentage points below pre-pandemic levels. This would give an underlying regular earnings growth rate of between 3.6% and 5.1%.

Not surprisingly they have little faith in it.

Given the uncertainty around this range, interpretation should be treated with caution.

How the rubbish below retains its National Statistics moniker is an embarrassment.

In real terms (adjusted for inflation), total and regular pay are now growing at a faster rate than inflation, at 6.0% for total pay and 4.5% for regular pay.

So all we needed to fix the lost decade for real wages was an economic collapse….

Unfortunately the numbers from the tax data ( HMRC) seem to have a similar problem.

Early estimates for August 2021 indicate that median monthly pay increased by 5.3% compared with August 2020 and by 6.5% when compared with February 2020.

I am reminded of this from the Bank of England Agents.

Nonetheless, pay growth remained modest overall, with settlements continuing to be in the 1.5%–2.5% range. But there were some reports of higher pay awards, for example for skilled workers or as compensation for pay freezes in 2020.

The numbers are for the second quarter so out of date and if we give them a boost due to the shortages we get to say 3%? After all the Costa Coffee rise of 5% attracted a lot of attention suggesting it was rather unusual.

Comment

The UK labour market looks to have had a good summer and goes into the autumn with welcome positive momentum. Let us hope that the echo of 2013 repeats with it being more accurate than the output ( GDP) data and it is true that the Bank of England was wrong then as well. There is a catch in that we know so little about the wages numbers with the official data being misleading rather than useful.

The main issue is the fact that the furlough scheme still had around 1.5 million people on it, which is why I have ignored the unemployment numbers.It ends in a fortnight and we will then learn what it really is.

There is also an issue with local labour shortages and I mean in particular industries. The most publicised case is the one of HGV lorry drivers, but there are quite a few others. The work below from Pawel Adjan shows that it looks a very complex picture.

From February to July 2021, average advertised pay grew 6.7% in construction, 5.7% in driving, 4.8% in manufacturing and 3.7% in food preparation & service vs. 0.8% for all jobs, adjusted for compositional changes.