by Umar Farooq

Housing Bubble

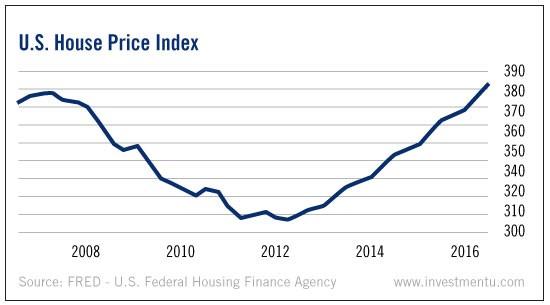

Property values in affluent urban centers could be headed for an “adjustment” as homeowners and investors may find they have overpaid. This is exactly what happened during the savings and loan crisis of the 1980s and the more recent financial meltdown.

Moreover, Federal Reserve tightening could push up interest rates enough to depress the monthly payments and prices that prospective homeowners can afford. Similarly, overbuilding of apartments is stressing the rents big-city landlords can charge.

Source: seekingalpha

In the recent past housing sector saw a great deal of robust advancement in big cities that was mainly aided by low mortgage rates and Dodd-Frank regulations that push banks toward lending to the upper middle class and wealthy. This is now going to change very soon.

Student Debt

Trump administration has very few pleasant choices when it comes to student debt. It’s another unpopular bailout in the offing or as we saw with Lehman Brothers in 2008, another opportunity for federal authorities to risk financial instability. Outstanding student loans now exceed $1.4 trillion and more than 40% of borrowers are in default or behind on payments.

Either the banks and bond investors will take big losses or Federal government will need to intervene with a huge bailout package.

Source: huffingtonpost

European Banks

The banks all across Europe are suffering from slow-growing economies and ultra-low interest rates that make difficult moving bad loans off their books. Germany’s largest bank, Deutsche Bank, was recently hit with a large fine by the Justice Department for its role in the financial crisis. About 17% of Italian bank loans are underwater, and conditions are troubling elsewhere too.

Bail-ins of these European banks would impose huge losses of savings and purchasing power, and a contagious recession with severe repercussions for other European and American banks.

China

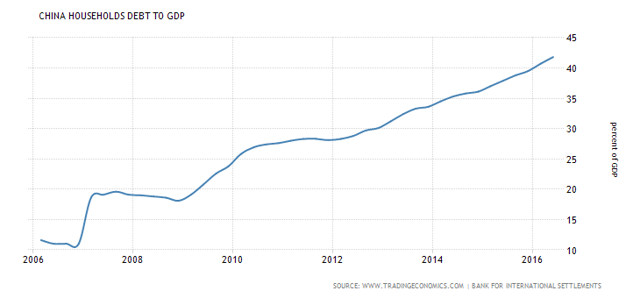

Inefficient state-owned enterprises and exporters are heavily subsidized in China by the government with easy credit and propped up growth through excessive borrowing for wasteful public works and urbanization projects. Government deficits are estimated at least 15% of GDP, and cumulative public and private debt at 250%.

Moreover in China, stocks, bonds, commodities and housing prices have reached to threatening levels, thanks to printing of more money, and large investors are fleeing China, further driving down the dollar value of the yuan.

Source: seekingalpha

Many Asian and other developing economies that are dependent on exports to China could easily become unable to service their dollar-denominated debt if those bubble burst with a resulting yuan collapse. All this is indicative of the Asian currency crisis of the 1990s, which left many American lenders holding the bag.

Trump’s Promises and Political Divisions

The hard right and Democrats appear willing to cripple an American president to serve ideological purity and win political advantage — even at the risk of plunging the global economy into yet another massive crisis.

Trump’s economic program could boost global growth and make problems in particular markets easier for regulatory authorities to manage. However, he faces tough challenges unifying the GOP to first pass a new health-care law and corporate tax changes. And failure on those fronts could easily deflate stock prices and corporate investment, panic consumers, ignite another recession and cause the above listed problems to hemorrhage simultaneously.