by Jim Quinn

Trump is right. The Fed is to blame for the coming crash. But, the crash is not because of their tightening. The crash is coming because of their 8 years of 0% interest rates. Real interest rates are still negative. Only an idiot would say the Fed is too tight. Trump reveals himself again.

Guest Post by John Hussman

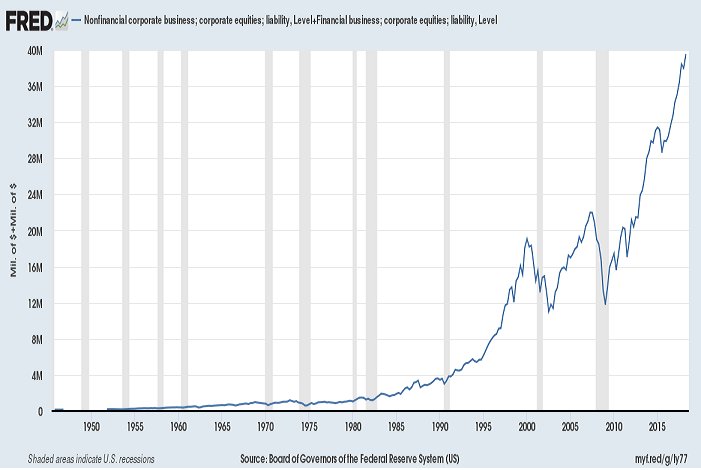

Yesterday, the U.S. market lost over $1 trillion in market cap. Who got it? Where did it go? Nobody, nowhere. Market cap = price x shares outstanding. Every share has to be held by someone every moment until it’s retired. There is no “getting in” or “getting out” in aggregate.

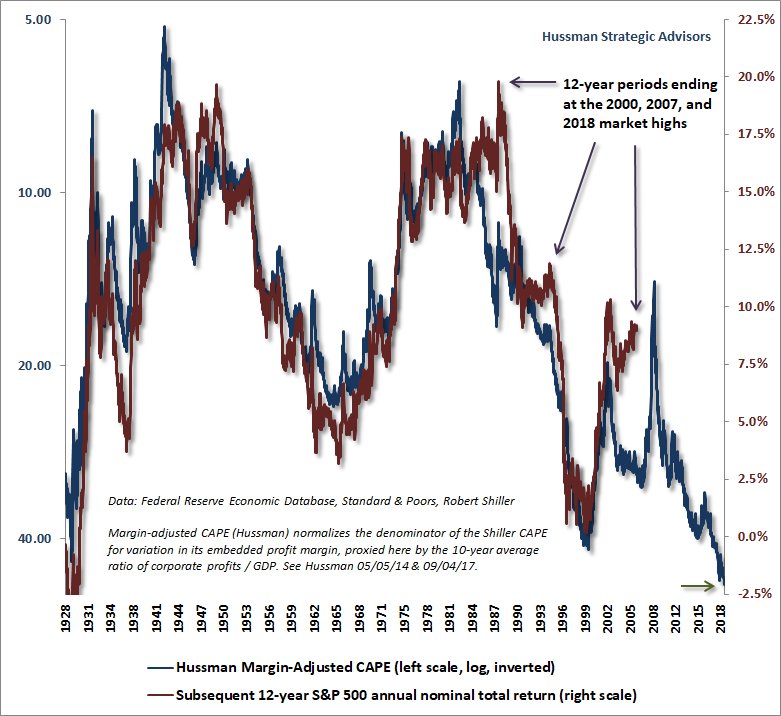

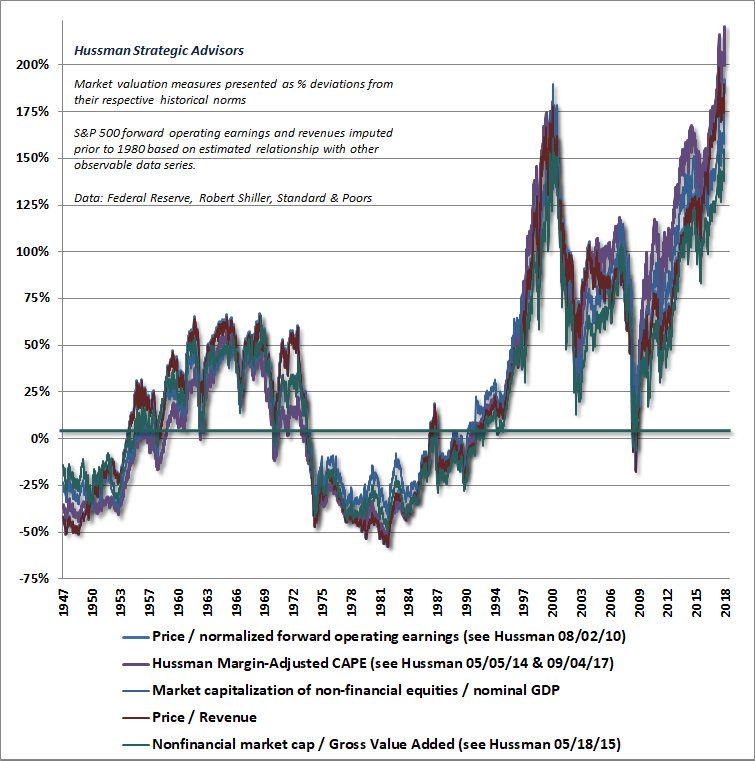

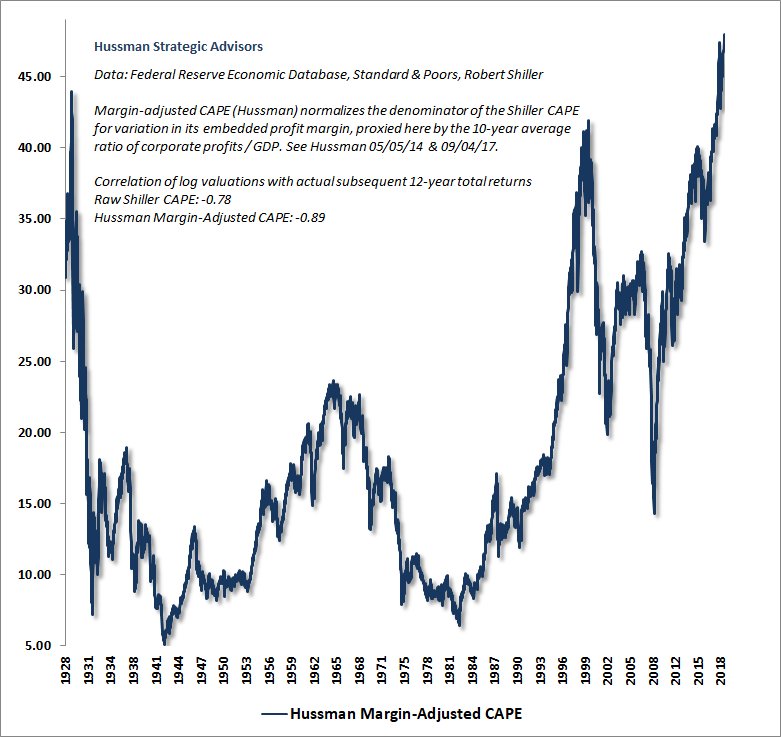

At the recent market peak, the most reliable measures of U.S. equity market valuation (those best correlated w/actual subsequent long-term returns) were ~200% above (3 times) historical norms. No market cycle, not even 2002, 2009, has ended at valuations even half that level..

What is half of $40 trillion in U.S. market cap? $20 trillion. The reason I use words like “offensive” and “obscene” to describe valuations in this Fed-induced yield-seeking bubble is that many innocent investors will lose massive amounts of what they came to view as “wealth”.

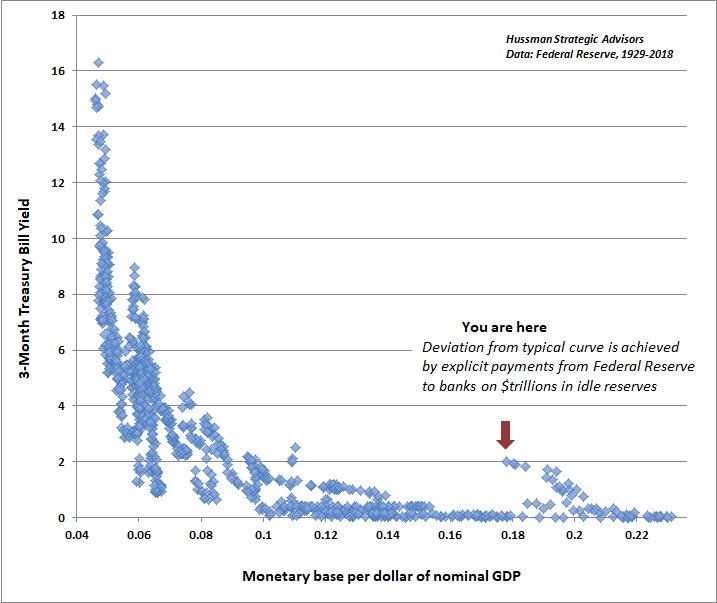

Now, when base money earns zero, the first refuge is safe alternatives like T-bills. So more base money/GDP first depresses T-bill yields. *When* investors are inclined to speculate, they chase riskier securities too. Fed can “tighten” by cutting balance sheet or paying IOER.

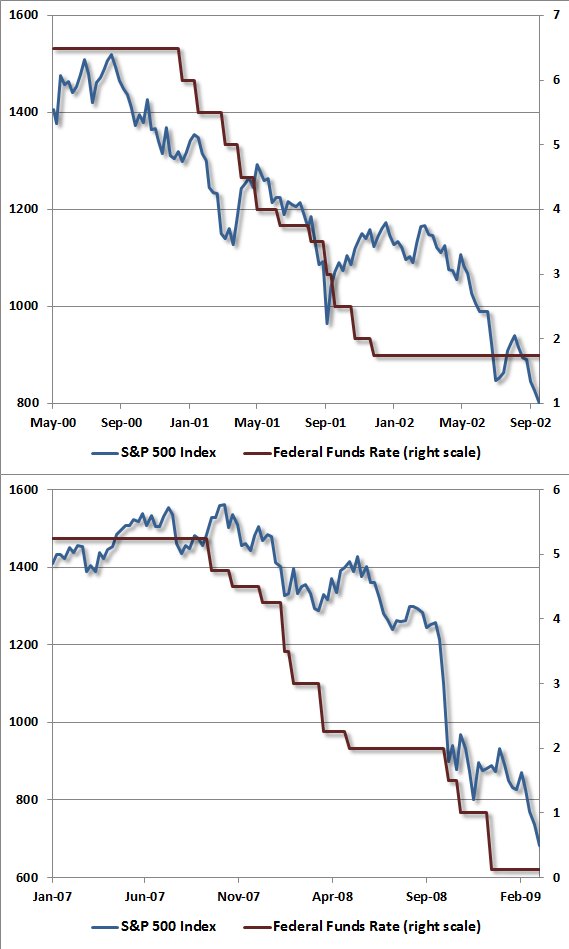

When investors are inclined toward risk-aversion, safe liquidity becomes a desirable asset (even at low yields) rather than an “inferior” one. That’s why Fed easing had no effect in supporting the market throughout the 2000-2002 and 2007-2009 collapses.

So while Fed policy encouraged recent speculative extremes, it also created a situation where investors, in aggregate, are likely to experience poor long-term returns and lose enormous amounts of perceived “wealth.” The root cause is deranged Fed EASING, not Fed tightening.