by GoldCore

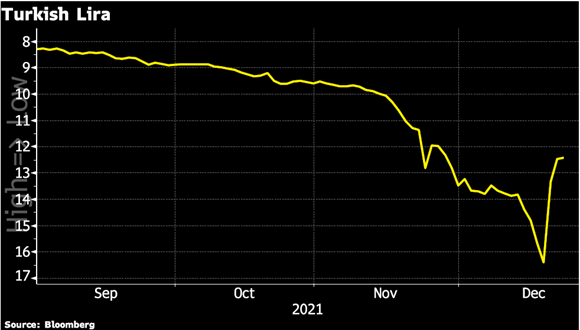

The Turkish lira has been on a wild ride the last few weeks. The lira had lost roughly half its value against the US dollar since in the beginning of September. This is before rallying back 25% at the beginning of this week.

The plummeting lira – which accelerated in November was a result of President Erdogan meddling in central bank policy.

The high rate of consumer price inflation, at 21% in November from the previous year, had the central bank on a path of policy tightening. But President Tayyip Erdogan demanded that the central bank slash rates. Turkey’s central bank did cut its benchmark rate again on December 16th to 14% from 15%. This rate cut follows several others since the beginning of September.

Higher Interest Rates Lead to Higher Inflation?!?

President Tayyip Erdogan believes that higher interest rates lead to higher inflation. This is contrary to what has been experienced by other economies and most governments and central banks around the world. The president is also putting on policy makers to promote growth ahead of the 2023 elections. This is primarily to promote exports and lending (at lower interest rates).

The declining lira is particularly difficult domestically because more than half of all household mortgages are owed in US dollars. Therefore with the 50% decline in the lira household mortgage payments doubled – this alone is putting quite a strain on household budgets!

Then add in that the weakening lira is exacerbating the inflation problem by driving up the cost of imports. This is especially the case for essential items such as natural gas, medicine and some food items. The price increase for many items is likely much higher than the official 21% increase reported in November.

In order to protect themselves from the plunging lira citizens are exchanging their lira for foreign currencies and for gold.

Normally when the price of gold rises this much, people sell their gold and buy a house or a car. But in this situation, there is an ever-increasing demand for gold

Ozgur Anik, a gold dealer in the Grand Bazaar (WSJ, 12/16)

Turkish Central Bank Handcuffed

Some confidence was restored in the lira on December 20th after President Tayyip Erdogan and the central bank announced measures to protect depositors such as protecting depositors from losses on deposits due to fluctuations in the currency – the program only covers depositor losses that exceed interest rates promised by banks.

The problems are likely to continue into 2022 however, as the programs announced this week are only a band aid fix. A change in policy is difficult though. It is reported that President Tayyip Erdogan has fired anyone that has opposed him, including a series of central bank chiefs.

The Turkish central bank has already made several attempts to arrest the plummeting lira by intervening in markets over the last several weeks – the Turkish central bank sells foreign reserves and buys lira. But the Turkish central bank is thought to have little fire power left as its foreign currency liabilities now exceed its reserve assets.

A Warning for All Governments & Central Bankers

Although the situation in Turkey is extreme it serves as warning to governments and central banks around the world. The proverbial “line in the sand” protecting central bank independence is becoming more blurred. Historically central bank’s main objective was price stability. Increasingly this objective has moved into full employment, wage inequality, and even climate change strategy. Furthermore, government officials increasingly comment on central bank policy. They even threaten to fire central bank officials when the government policy is not carried out by the central bank. Is it a coincidence that central banks have added trillions of government debt onto their balance sheets? Or is it that modern monetary theory has become more popular?

Modern Monetary Theory

We leave the reader with a reminder of the definition from Investopedia of Modern Monetary Theory. We have bolded the key sentence about printing as much fiat currency as needed to carry out government initiatives:

Modern Monetary Theory (MMT) is a macroeconomic framework that says monetarily sovereign countries like the U.S., U.K., Japan, and Canada, which spend, tax, and borrow in a fiat currency that they fully control, are not operationally constrained by revenues when it comes to federal government spending.

Put simply, such governments do not rely on taxes or borrowing for spending. This is because they can print as much as they need and are the monopoly issuers of the currency. Since their budgets aren’t like a regular household’s, their policies should not be shaped by fears of rising national debt.