There are riots in France as their government mandates vaccine passes and mandate vaccination …. as the Covid Delta Variant case skyrocket. Covid vaccination protests are occurring in Italy, Britain and Greece as well. Threats of a resurgence of economic lockdowns are being tossed about.

So, where does the US economy sit as the likelihood of another round of economic-crippling shutdowns is discussed in Washington DC? Let’s hope there isn’t another devastating economic lockdown.

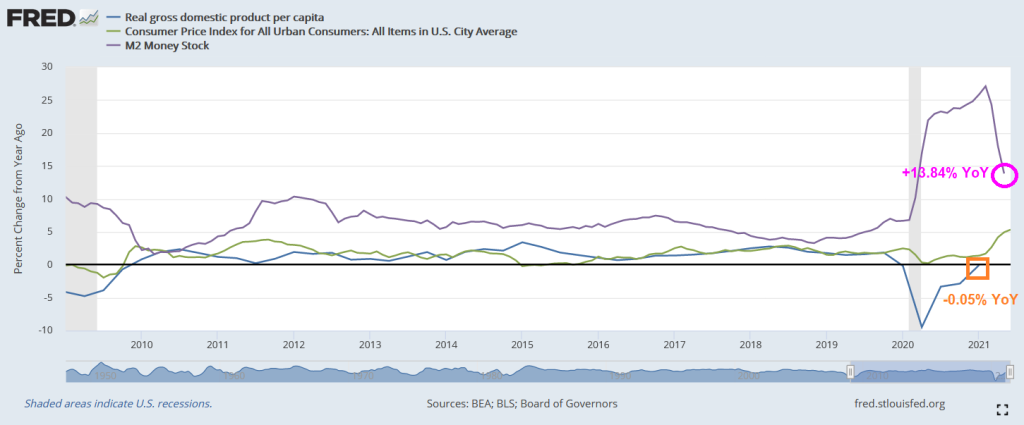

The Q2 GDP numbers will be out on Thursday, July 29th. But for Q1 2021, we saw real GDP PER CAPITA fall 0.052% YoY. While M2 Money Velocity sank -18.64% YoY.

Headline inflation for June is running at 5.32% YoY ahead of Thursday’s GDP report.

The old adage in economics was that money printing was fine, as long as it didn’t exceed real GDP growth. Well, that old adage was shot to hell with M2 Money growing at 13.84% YoY while real GDP per capital is growing at -0.05% YoY in Q1 2021.

As of July 14th, we have seen bank deposits growing at 10.24% YoY while loans and leases at all commercial banks remain at negative growth at -2.3655 YoY.

Let’s hope that the US avoids going into economic lockdown … again … like the UK and Europe have done.

The Ride of The Federal Reserve … coming to the “rescue”?