Many talking heads think the worst is over, at least for financial markets, the virus is peaking we’re told (and will presumably just disappear), governments and central banks are apparently flooding the world with “money”. The tone has become decidedly more optimistic than late march, even as the economy hurtles toward the ground.

Ben Bernanke Quotes from the financial crisis…

17th May 2007

“We believe the effect of the troubles in the subprime sector on the broader housing market will be limited and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system,”

10th January 2008

“The Federal Reserve is not currently forecasting a recession.” (The recession had started December 2007)

18th January 2008

“It has a strong labor force, excellent productivity and technology, and a deep and liquid financial market that is in the process of trying to repair itself”

June 9th 2008

“Despite a recent spike in the nation’s unemployment rate, the danger that the economy has fallen into a ‘substantial downturn’ appears to have waned”

July 16th 2008

Chairman Ben Bernanke of the Federal Reserve told Congress on Wednesday that he believes Fannie Mae and Freddie Mac will make it through the storm in the U.S. housing market.

On Bernanke’s second day before Congress, this time in front of Rep. Barney Frank’s House Financial Services Committee, the Fed chairman said the troubled Fannie Mae and Freddie Mac were adequately capitalized, and were in no danger of failing. Forbes

(Fannie and Freddie were bailed out on September 6th)

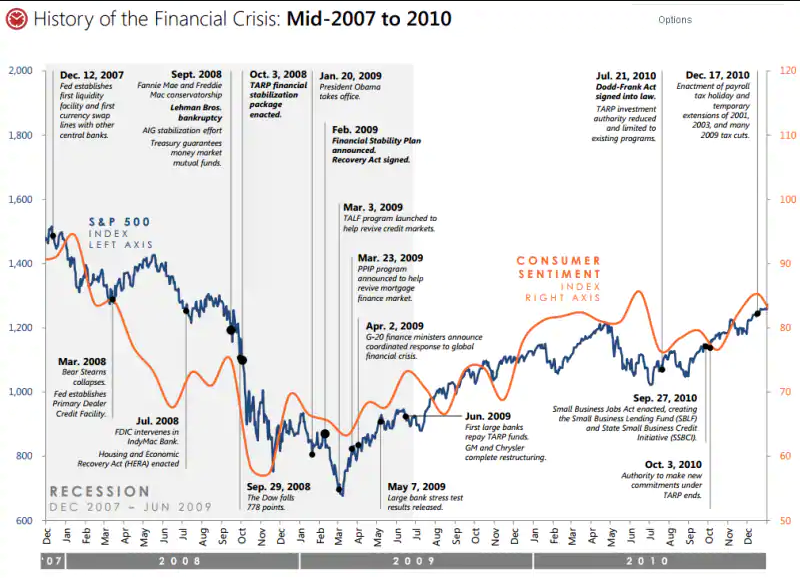

Here is a chart showing some Fed and government bailouts during the financial crisis.

The Fed made interventions all the way down. The bailouts this time around are much much larger. All that tells us is the beast they are fighting is also much larger this time around.

Markets are pushing the Fed around. When times are good the Fed looks omnipotent, when things go bad they are like a helpless kitten playing a bad game of Whack-a-mole.

The stock market does not track news or economic fundamentals. People will always try to interpret the stock markets moves in light of the current news but really half the time this never really makes sense.

/u/MakeTotalDestr0i recently posted this image on the subreddit

It did’t make any sense the market screamed higher into late Feb as the pandemic emerged.

It made sense for a few weeks as the market crashed until about march 20th.

But since then the situation, especially economically has deteriorated dramatically yet the financial markets are doing fine.

A better way to view financial markets is social mood.

In this bear market you’re going to see periods of panic and periods where the market recovers and people think the worst is over. Take note of how the deterioration in the economy and news FOLLOWS deterioration in the stock market (and the stock market is just following social mood). Just as during the financial crisis.

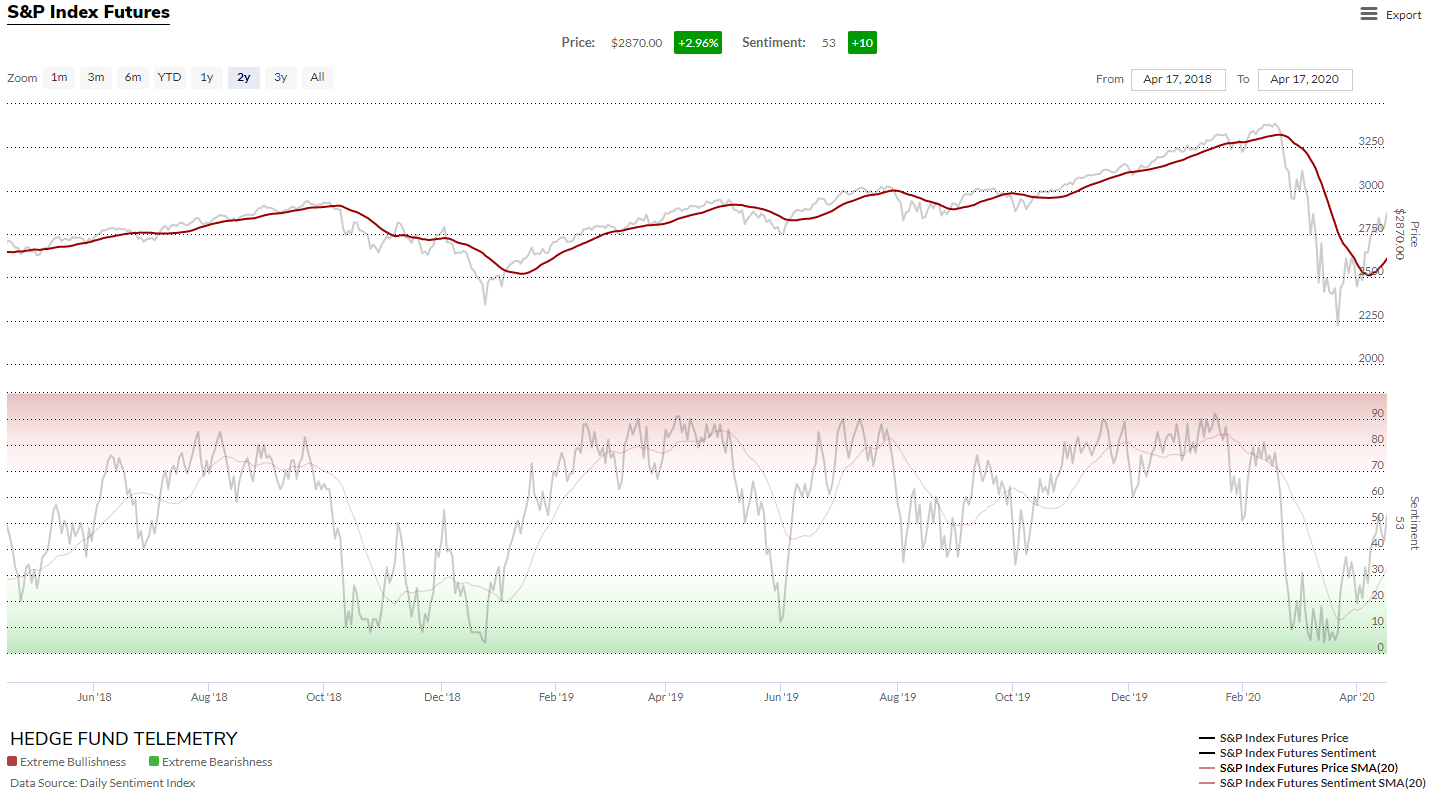

The stock market has retraced a large portion of its decline. This sort of retracement is normal early within a bear market. What it has done is alleviate the oversold condition and bring back optimism to financial markets — as shown by the daily sentiment index here which has reached about the 50% level.

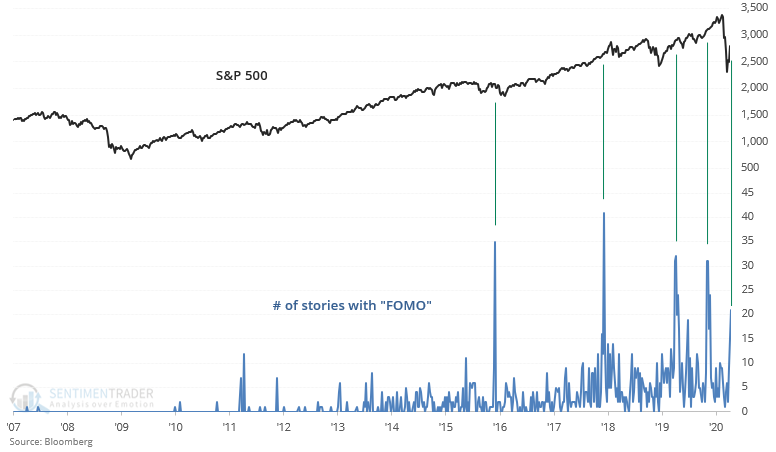

“FOMO” stands for “fear of missing out”. It was a common rallying cry in the bull market and it has come back into fashion. The term is used to describe the fear of missing out on rising prices. Its renewed usage probably relates to tech stocks which I will get too in a moment.

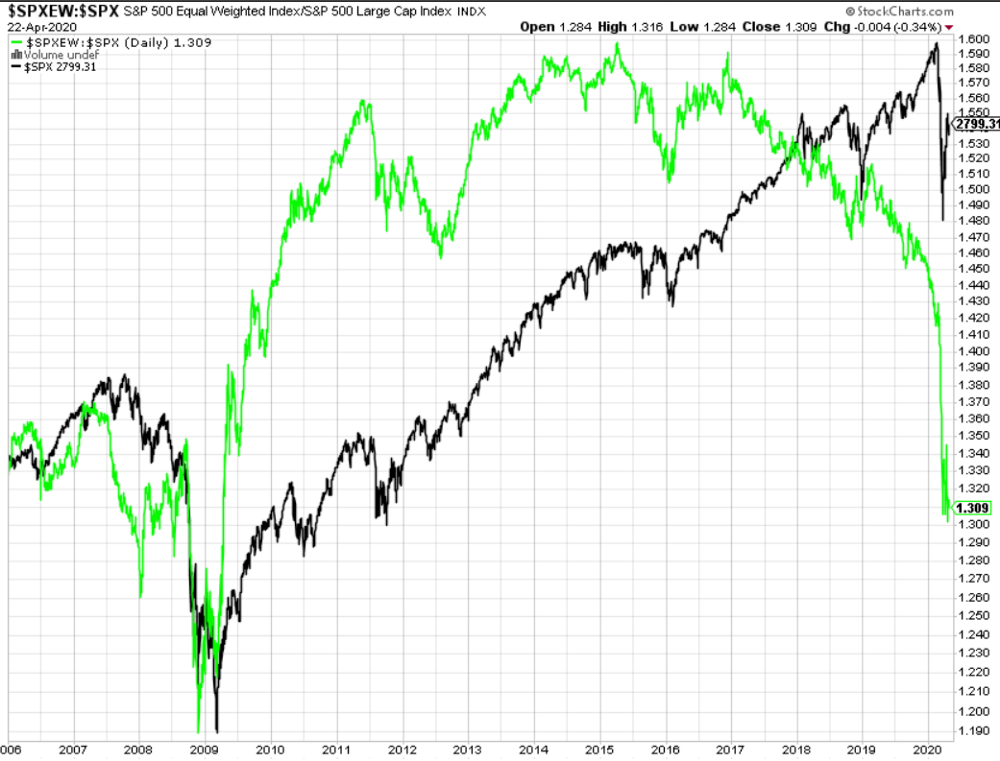

Market breadth remains weak despite the rally. I’ve shown this measure before which shows the ratio S&P500 equal weight/S&P500. It goes down as large market cap stocks get relatively stronger. The ratio typically bottoms before the market.

Narrowing market breadth is a sign of growing risk aversion as investors focus on a narrow slice of the market. Investors are piling into large cap tech still. The Nasdaq 100/S&P 500 ratio is surging.

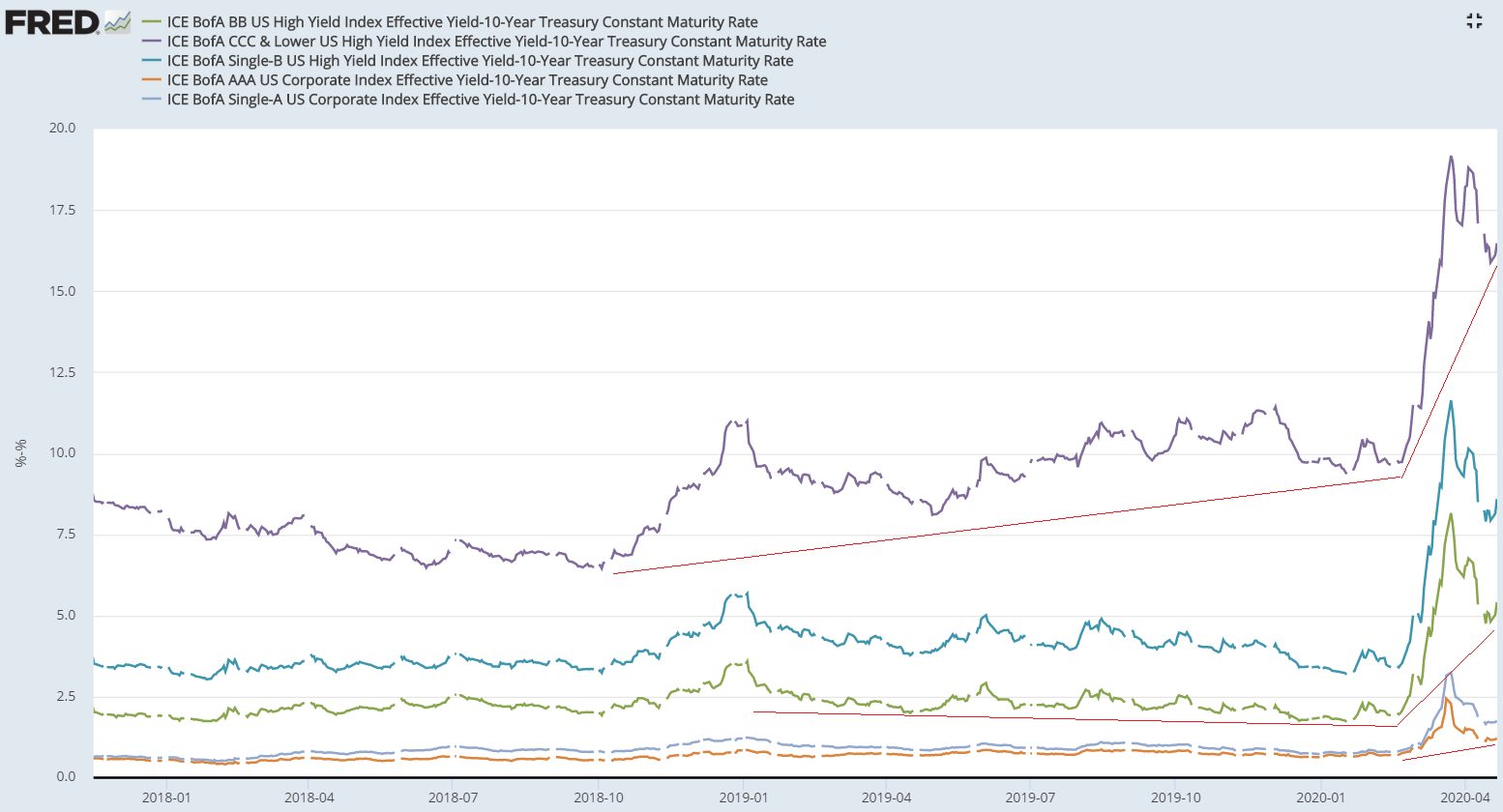

A divergence can also be seen between higher and lower rated corporate bonds. This divergence actually started in 2019.

I think another good sign of this extreme optimism still focused on tech is the price of Tesla, which is valued at $135bn despite never producing more than 500,000 cars in a year, never making an annual profit, a junk debt rating in the worst car market ever and the biggest oversupply of oil ever.

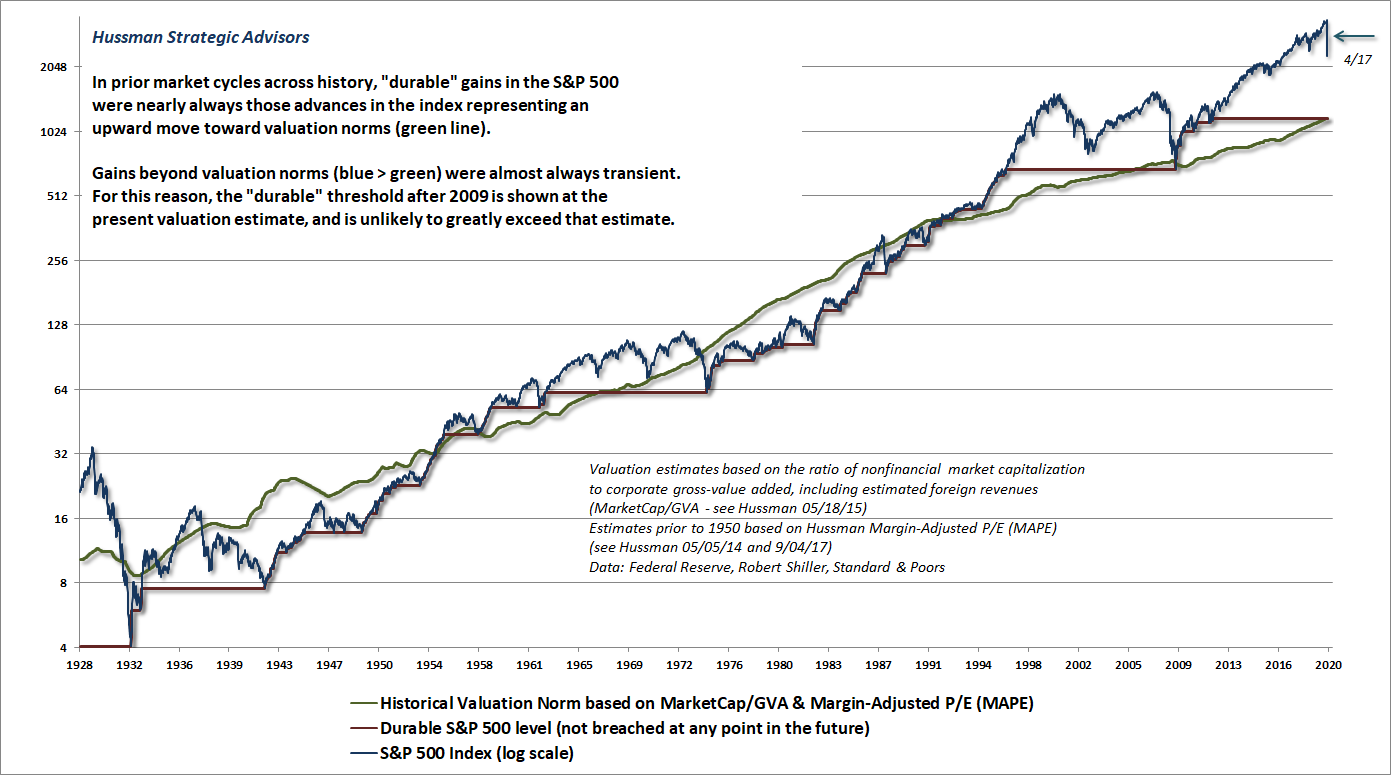

US stock valuations are still at some of their highest levels in history and would have to fall over 50% to reach the green line which represents “normal” valuations.

I think this still rampant optimism combined with a narrowing environment of risk taking is a setup for a much larger decline in the months ahead. At present the Fed is credited with this bear market rally but they shouldn’t be. Its just the way bear markets work

Once the financial markets resume their descent optimism over reopening the economy will descend with it.

“We are moving with alarming speed from 50-year lows in unemployment to what will likely be very high, although temporary, levels,” Powell said in a speech Thursday at the Brookings Institution. “When the virus does run its course, and it’s safe to go back to work and safe for businesses to open, then we would expect there to be a fairly quick rebound.”

Jerome Powell — 9th April

One extra thing. Another interesting chart from EWI — Specs have gone heavily long the Euro despite there not being much upward price action. Since the Euro is basically the mirror image of the dollar it adds to the bullish picture for the dollar I’ve discussed in prior posts.