From Frank Holmes at Frank Talk:

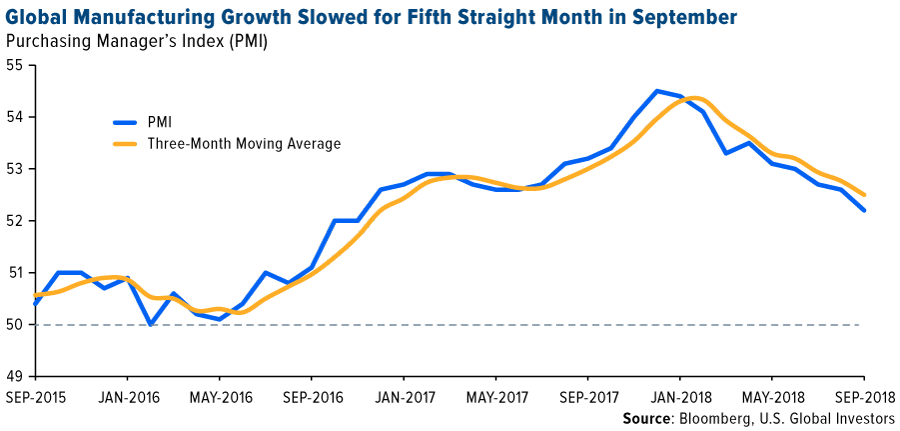

According to a recent Cornerstone Macro report, the three most influential macro trends this year have been 1) the strengthening U.S. dollar, 2) the flattening yield curve and 3) slowing global manufacturing expansion. I’ve written about all three topics numerous times this year, but the one I’ve watched the most closely has been global manufacturing, as measured by the purchasing manager’s index (PMI). Since its 12-month high of 54.5 in December 2017, the PMI has declined in eight of the past nine months. September marked the fifth straight month of slower manufacturing growth.

This matters because the PMI is a useful, forward-looking indicator of the economic health of the manufacturing sector, which accounted for around 15.6% of global gross domestic product (GDP) in 2016. Our research has shownthat the index can be used to forecast world demand for materials and energy one, three and six months out, with a reasonable measure of accuracy.

Take a look below. The chart shows that, based on 10 years’ worth of data, copper and West Texas Intermediate (WTI) crude, as well as energy and materials equities, all benefited in the three months after the PMI crossed above its three-month moving average. WTI saw the biggest jump; 64% of the time, it gained 5% on average.

Conversely, in the three months after the PMI crossed below its three-month moving average, those same assets either fell or were effectively flat. Seventy-one percent of the time, copper lost a little over 1.5% on average when manufacturing growth began to slow.

Energy Up, Materials Down

So how accurate has the PMI been so far this year? The index crossed below its moving average in February, and since then, materials have predictably failed to gain traction. The S&P 500 Materials Index is down about 6%, while copper prices are off 13% on fears that demand in China, the world’s largest consumer of the metal, is shrinking. (Australian miner BHP Billiton reported last week, however, that it believes Chinese copper consumption is actually set to increasesubstantially, by as much as 1.6 million metric tons, between now and 2023, thanks to its ambitious Belt and Road Initiative (BRI)).

Crude oil and energy stocks, on the other hand, have fared very well on tightening supply in Venezuela and Iran, the latter of which is scheduled to face a new round of U.S. sanctions effective November 4. Since February, WTI prices have surged 13.6% and are now at four-year highs, while the S&P 500 Energy Index is up 2.7%. Oil traders are now betting that crude could rise to as high as $100 a barrel by next year, Reuters reports.

Does oil’s outperformance, despite a steadily cooling PMI, mean our research is flawed? Hardly. The index, remember, only tells us the probability that a price change will occur. Extraordinary government policies, such as the U.S. reimposing sanctions on Iran, must also be taken into consideration. If the PMI alone were 100% accurate 100% of the time, we would all be multibillionaires from betting on the winners every time. Sadly, that’s not the case…