Now is the time to be particularly careful in the markets.

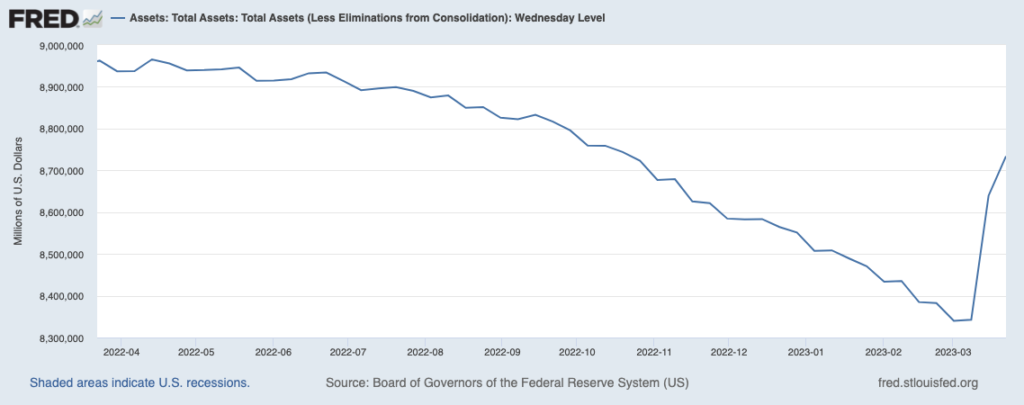

First and foremost, the banking crisis is not over. This is quite concerning, because the Fed has pumped nearly $400 BILLION into the financial system in the last two weeks.

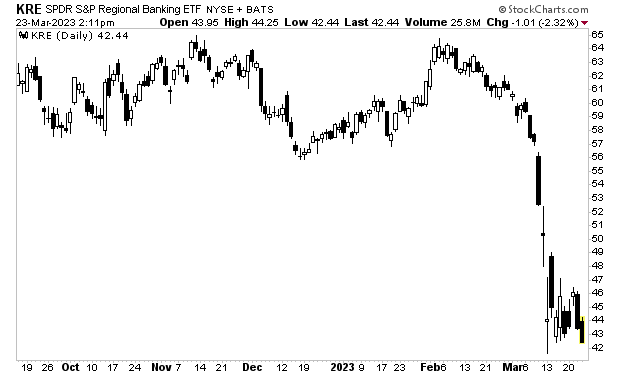

Despite these emergency loans/ access to credit, the regional banking ETF is right back near its panic lows. What does it say about the issues in the financial system that $400 billion in additional liquidity combined with verbal backstops by the Fed/ Treasury isn’t enough to reverse the decline?

The next leg down is coming and coming soon.

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.