From Richard Smith, Founder, TradeStops:

Stan Druckenmiller is one of the best money managers of all time. He has a track record of better than 30% compound annual returns, over 30-plus years, with no losing years.

And Druckenmiller accomplished that track record while managing billions — which is harder than with smaller amounts — and made more money in down markets than up markets, which is harder still.

In a sit-down interview with Bloomberg, recorded a week before Christmas 2018, Druckenmiller explained one of his most important rules of thumb: Paying attention to the “inside of the stock market.”

Here is how Druckenmiller explained it in the Bloomberg interview:

If you look inside the stock market, the cyclical elements of the economy — particularly the front-end cyclicals — show a completely different picture than the defensive parts of the stock market.

… So that’s one of the things. The inside of the stock market — which is the best economist I know, and which I’ve used every cycle when I have invested — is saying there’s something not right here.

That may sound obvious now, but in the early weeks of December, it was prescient. So, what did Druckenmiller mean?

In the form of industries and sectors and bellwether companies, the stock market has multiple moving parts.

Some of those parts do better in “defensive” environments — when the economic outlook is negative or worsening — and others do better in healthy environments, when the economic outlook is positive.

When Druckenmiller says “the best economist I know” is the inside of the stock market, his point is that actual price movements are more useful than human predictions for gauging an economic outlook.

If the market is worried, that is a better guide than whether professional economists are worried — and vice versa if the market is upbeat.

Human economists and Wall Street analysts are notorious for falling behind the curve. They are too optimistic at the end of long bull runs, and too pessimistic at bear market bottoms.

Analyst predictions are also vulnerable to cognitive biases, like the desire to stick with herd consensus or please their clients with positive news.

The market itself, on the other hand, doesn’t care what anyone thinks. Price movement is a forecast mechanism that is too big to be manipulated.

A simple way to think about a market forecast — what the inside of the stock market is saying — is whether investors are moving towards cash or away from cash, as determined by what different parts of the market are doing.

At one end of the spectrum, “cash is king.” When investors move toward cash, the market is signaling economic pessimism. If a downturn or a decline in profits is coming, it’s better to have cash than investments that lose value.

At the other end of the spectrum, “cash is trash.” This happens when the desire to invest is high, the economic outlook is healthy, and asset prices are expected to rise.

Because markets and economies move in cycles, and economic conditions go from boom to bust and back again, the desire for cash swings like a pendulum over time. In boom times, cash is trash. In gloomy times, cash is king. Then the pendulum swings back again.

Heading into the new year, cash is in high demand. Over the past nine weeks, the Financial Times reports, U.S. money market funds saw $175 billion worth of inflows — a streak not seen since the 2008 financial crisis.

Four areas of the market that are extremely cash-like, besides money market funds, are U.S. treasuries, gold, gold stocks, and utility stocks.

- U.S. treasuries are a deeply liquid “safe haven” asset. Investors buy them to reduce exposure to stocks, or if they fear hard times are coming. The value of USTs goes up as interest rates fall.

- Gold is a kind of crisis insurance. It tends to go up when investors fear the outlook for paper currencies, or the possibility of central banks doing wild or dangerous things.

- Gold stocks have long-term leverage to the price of gold, which makes them a kind of proxy for cash in scary times. Gold stocks did quite well in the 1930s and generate high returns in both inflationary and deflationary environments.

- Utilities have a cash-like stream of payments because their main product — electricity to power homes and businesses — is always in steady demand.

All these areas of the market are doing well right now. In recent weeks IEF, the iShares 10-year treasury bond ETF, has been in a near-vertical rise.

At the same time, gold and gold stocks appear to have bottomed out, with gold stocks entering a new bull market trend (as we explained a few weeks ago). While December 2018 was a horrible month for most industries and sectors, it helped gold stocks extend their best rally in a decade or more.

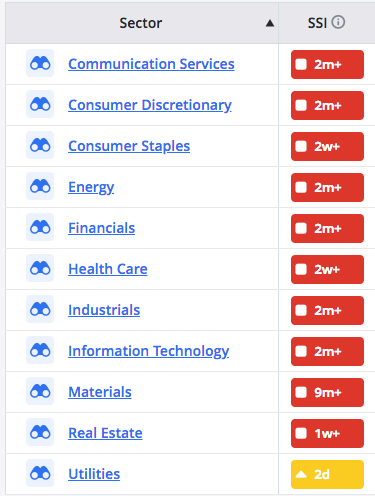

Meanwhile utilities, while taking a hit in recent weeks, have held up far better than the rest of the market. XLU, the SPDR utilities ETF, hit all-time highs in December (while much of the market was tanking) and remains above its September 2018 lows, while many other areas of the market have given back all their 2018 gains and then some. As you can see, of the 11 S&P Sectors, Utilities is the only one that is not in the Stock State Indicator (SSI) Red Zone in the Ideas by TradeSmith Market Health tab.

This is the market telling us that “cash is king” right now — or is well on the way to being such.

The outperformance of cash-like safe haven assets is even easier to see when compared to front-end cyclical areas of the market like autos, transports and industrials.

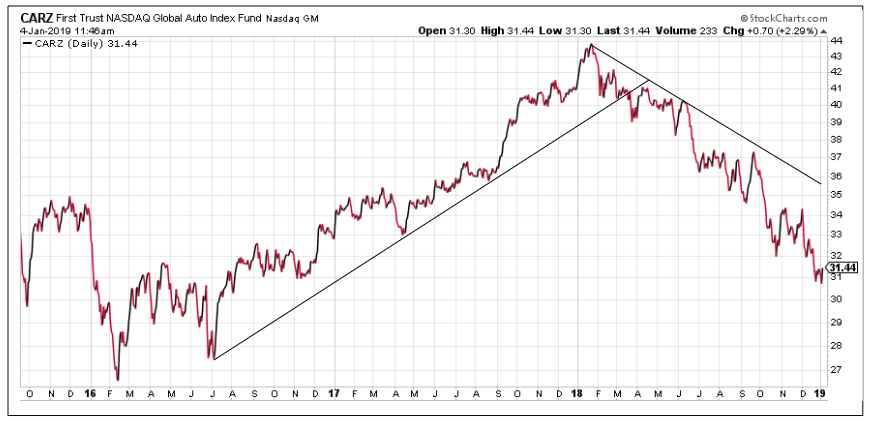

For example, the First Trust Global Auto Index Fund, symbol CARZ, is an ETF focused on the big global auto makers — names like Toyota, Honda, Daimler, General Motors, Ford, BMW, and so on.

As you can see from the CARZ chart below, the market’s opinion of global autos has been negative for quite some time. The auto outlook is dark and getting darker, a sign of pessimism for global growth expectations.

Transports, industrials, and homebuilders are telling a similar story. The Dow Jones Transportation Average has declined sharply in recent weeks, with bellwethers like FedEx issuing profit warnings.

Price action in bellwether industrial names like Caterpillar (CAT) and Home Depot (HD) has the same message.

And none of this touches on what’s going on with Apple, China, and big tech in general — a discussion for another time (perhaps soon).

In sum, the “inside of the stock market” is the best economist Stanley Druckenmiller knows, and Druckenmiller is one of the best money managers of all time. Right now, the market is forecasting investor gloom and a transition towards cash and cash-like assets.

On the long side, assets like gold, gold stocks and utilities still top the general attractiveness list.

Richard