by Jesse Colombo via RealInvestmentAdvice.com,

In a speech in Hong Kong this week, former Fed chair Janet Yellen stated that “global central banks don’t have adequate crisis tools.”

According to that logic, she believes that launching additional multi-trillion dollar rounds of quantitative easing and cutting interest rates into negative territory – two aggressive and controversial monetary tools that are currently available – are simply not enough. Yellen’s comments this week echo comments that she made in September 2016 when she was still Fed chair:

The Federal Reserve might be able to help the U.S. economy in a future downturn if it could buy stocks and corporate bonds, Fed Chair Janet Yellen said on Thursday.

Speaking via video conference with bankers in Kansas City, Yellen said the issue was not a pressing one right now and pointed out the U.S. central bank is currently barred by law from buying corporate assets.

But the Fed’s current toolkit might be insufficient in a downturn if it were to “reach the limits in terms of purchasing safe assets like longer-term government bonds.”

“It could be useful to be able to intervene directly in assets where the prices have a more direct link to spending decisions,” she said, adding that buying equities and corporate bonds could have costs and benefits.

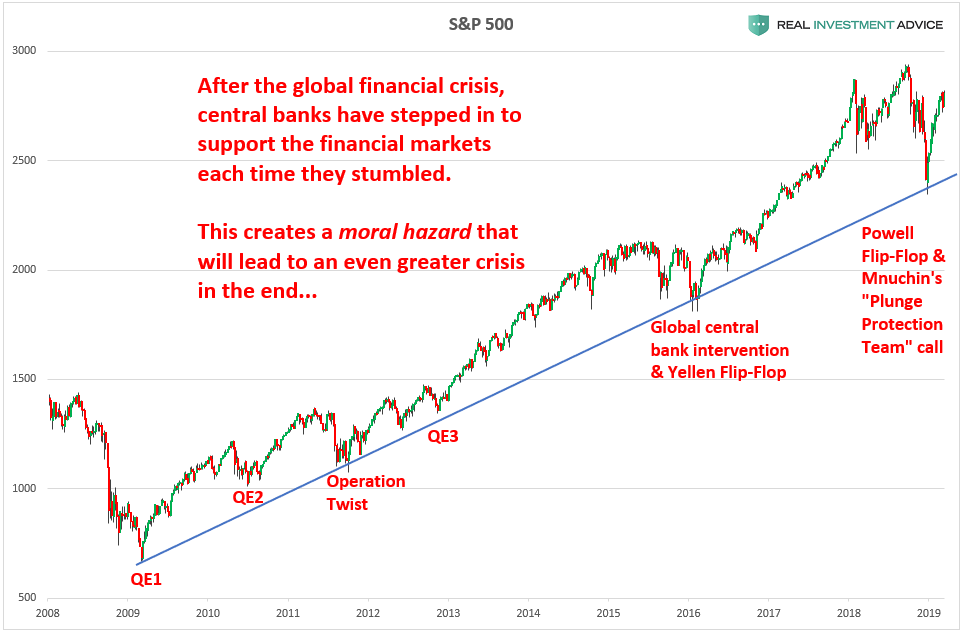

If the Federal Reserve is ever allowed to buy stocks and corporate bonds, it will create an extremely dangerous situation in which investors, speculators, and business leaders will feel that they can take virtually unlimited risk and will still be backed by the Fed. This phenomenon is known as a moral hazard or the Fed Put. As I discussed in a piece last week called “Why The Fed Keeps Propping Up The Market,” the Fed has already created an unprecedented moral hazard by stepping in to prop up the stock market every time it has tumbled in the past decade (see the chart below). If the Fed can buy stocks and corporate bonds, it will compound moral hazard on top of more moral hazard – moral hazard squared, basically. The result will likely be a stock market bubble that is more extreme and dangerous than any other stock market bubble in history.

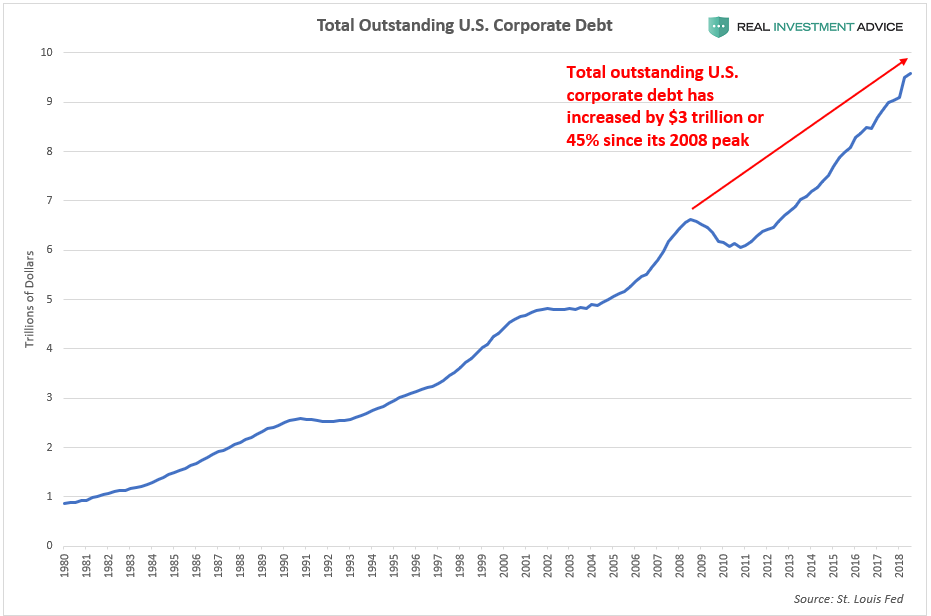

If the Fed changes its policy to allow the purchasing of stocks and corporate bonds, it will likely further encourage the growth of the U.S. corporate debt bubble that I have been warning about. To summarize, ultra-low bond yields over the past decade have encouraged a corporate borrowing bubble that has also been funding the stock buyback boom. As a result, total outstanding U.S. corporate debt has increased by $3 trillion or 45% since the last peak in 2008:

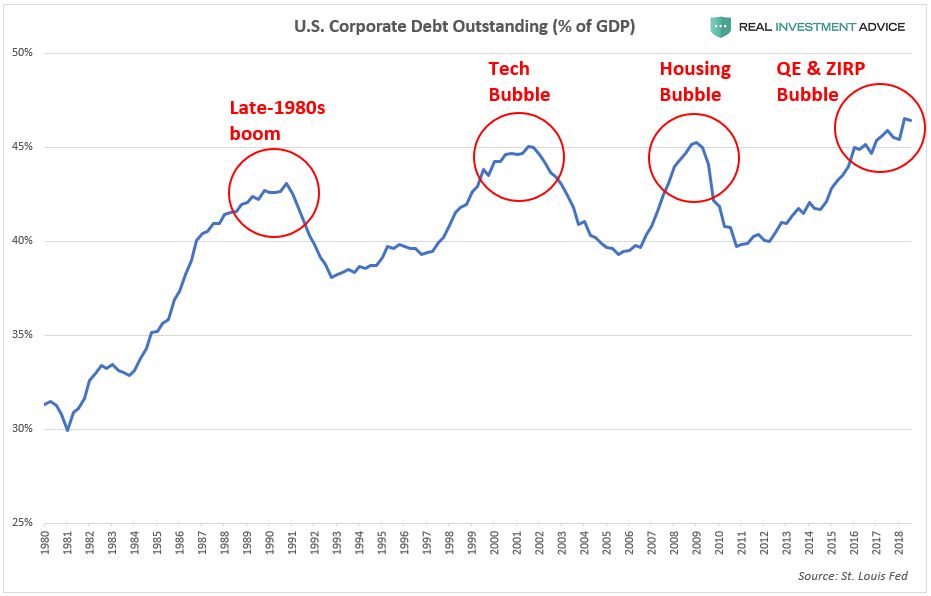

U.S. corporate debt is now at an all-time high of over 46% of GDP, which is even worse than the levels reached during the dot-com bubble and mid-2000s housing bubble. If the Fed is able to purchase stocks and corporate bonds, corporate debt may grow to an even higher proportion of the GDP before the bubble bursts.

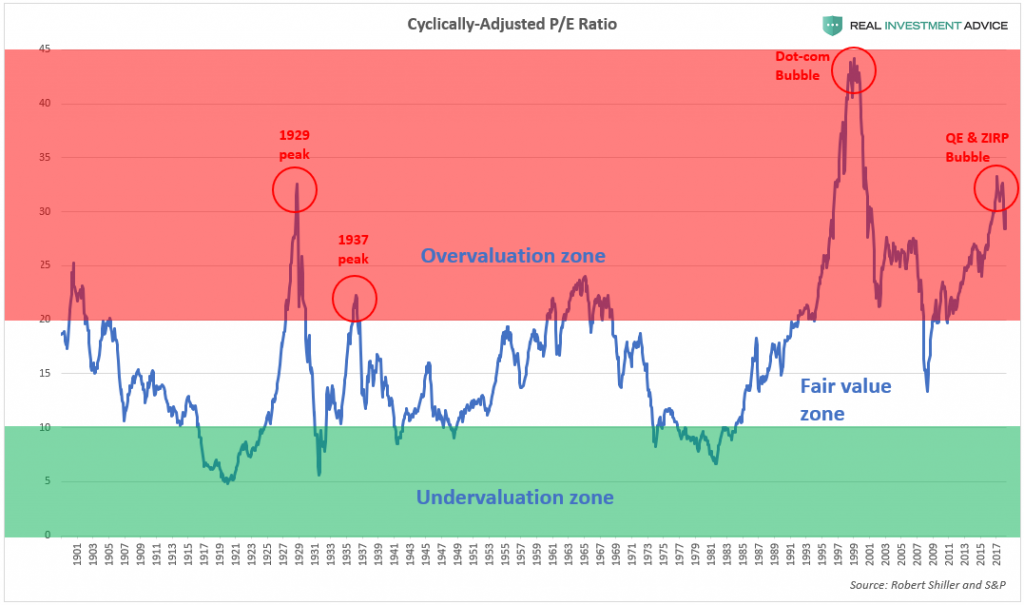

As a result of the Fed’s stimulative monetary policy and frequent market interventions in the past decade, the S&P 500 rose much faster than earnings and is now at 1929-like valuations, as the chart below shows. If the Fed is able to purchase stocks and corporate bonds, valuations may hit late-1990s dot-com bubble levels or even higher before the bubble bursts. Of course, the more the bubble inflates, the harder it’s going to ultimately crash.

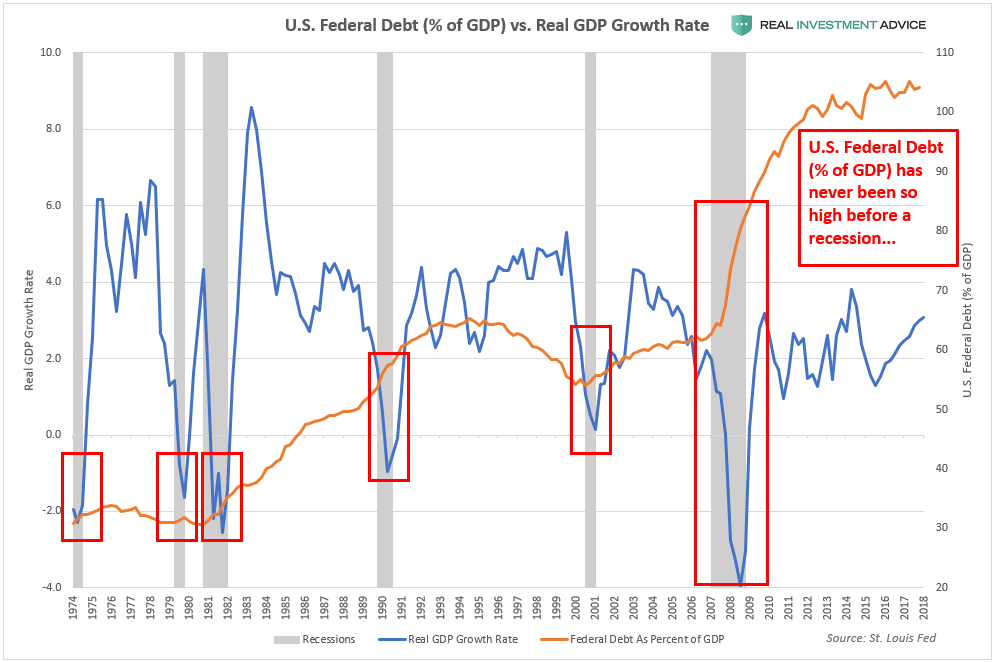

Why is the Fed becoming increasingly desperate for new monetary policy tools to use in the next recession or crisis? It’s because the record federal debt load severely limits the government’s ability to use fiscal stimulus like it did during the Great Recession:

It’s very likely that the Fed will dramatically expand the range of monetary tools it can use. While these tools – or simply the threat to use them – may calm the fears of investors for a time and support the continued inflation of the stock market bubble, they will encourage risk to build up to such a high level that will eventually overwhelm the Fed’s ability to control it, which is when the ultimate crash will occur.

How We Are Positioning

In our portfolios, we have remained bullish on high quality bonds since 2013 despite the litany of calls to the contrary. Our premise is simple, in that given the current demographic, debt, pension, and valuation headwinds, the future rates of growth are going to be low over the next couple of decades – approaching ZERO. As we wrote previously:

“While there is little left for interest rates to fall in the current environment, there is also not a tremendous amount of room for increases. Therefore, our equity and bond strategies have adopted a “tactical” approach is rates start to flat-line over the next decade and equities begin to underperform.

Whether, or not, you agree there is a high degree of complacency in the financial markets is largely irrelevant. The realization of “risk,” when it occurs, will lead to a rapid unwinding of the markets pushing volatility higher and bond yields lower. This is why we continue to acquire bonds on rallies in the markets, which suppresses bond prices, to increase portfolio income and hedge against a future market dislocation.

In other words, we get paid to hedge risk, lower portfolio volatility, and protect capital.

Bonds aren’t dead, in fact, they are likely going to be your best investment in the not too distant future.

‘I don’t know what the seven wonders of the world are, but the eighth is compound interest.’– Baron Rothschild”

* * *

Please sign up for our free newsletter to learn how to grow your wealth while minimizing risk in these unusual times.