by investeror

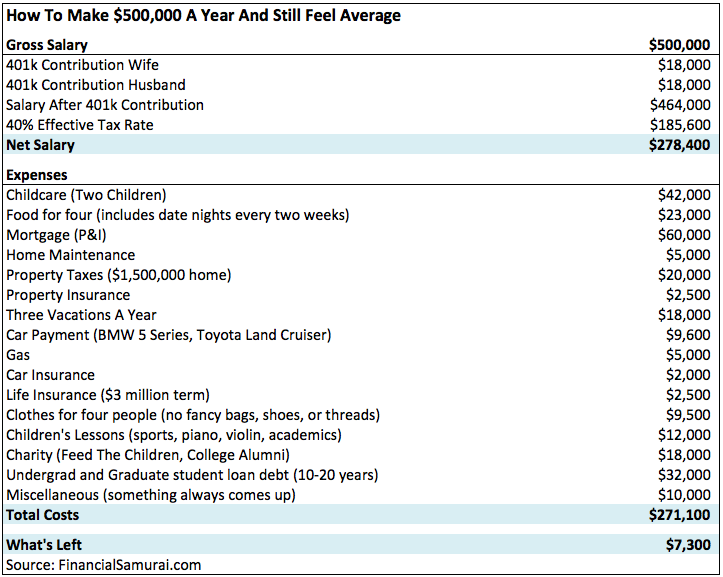

I came across this article about a couple making $500k/year that was only able to save $7.5k/year other than 401k. Their budget is pretty interesting. At a glace, I could see how someone could look at it and not see many areas to cut. It’s crazy how it’s so easy to just spend your money instead of saving it.

Here’s the article: https://www.cnbc.com/2017/03/24/budget-breakdown-of-couple-making-500000-a-year-and-feeling-average.html

Just the budget if you don’t want to read the article:

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2017/03/24/FS-500K-Student-Loan.png

The thing is, yeah. they can cut here and there, but nothing to move the meter significantly, imo. It’s the cost of living in NYC. A couple of things…

1) do they really need 2 cars in NYC? If they live in NJ, or CT, then yeah, I get they need 2 cars and $10k per year is not terrible although they should have paid cash for their cars (used).

2) food – you all squabble over this but imo, family of 4 in NYC plus a couple date nights…I can easily see $23k. Yeah, you can shave off a couple hundred here and there but feeding a family of 4 nutritiously and in NYC can cost that much. I see a lot of “cut it in half” – do you have a family of 4 and eat well?

3) 3 vacations per year. No need to spend $18k per year with vacations.

4) $10k in clothes seems excessive

5) $12k in children’s lessons is way excessive

6) $42k childcare – I’m guessing this is a nanny? Makes sense – nannies are expensive. I’m surprised it’s that low, tbh. However, if they are thinking of enrolling their kids in private schools, that number will go up!