via The Gold Telegraph:

The primary benefit of being a private corporation is the ability to operate in near total secrecy. When you don’t have to report earnings, you don’t have to report on how you obtained those earnings, what goals you aim to achieve via your internal decision making, or much of anything else, for that matter.

So what extraordinary power you wield as the Fed. A private corporation whose actions have a massive impact on every American citizen can do as it sees fit, accountable to no one, forced to explain nothing. So zealously hidden are its motives and means that nobody is allowed to know who owns the Fed, who is throwing those levers behind the curtain. The Wizard of Oz, for all we know, dictates American fiscal policy.

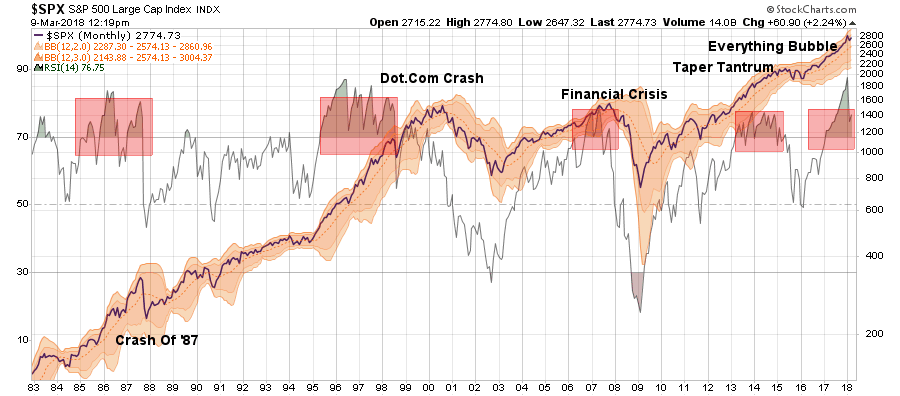

Against this backdrop of non-information we have an entity whose market interference effectively forestalled the bulk of the free-market correction pain of both 2000 and 2009. First ZIRP, and then QE and ZIRP, engineered a costly and false soft landing for the US economy in both instances.

But such machinations do not and can not diffuse free-market reality; they simply delay it. The accumulated pain not felt after 2000 and 2009 has simply been kicked down the road to a time when the Fed is unable to engineer it into the future via ZIRP and QE.

Rates are rising. QE is being unwound. When the Fed finally loses control of the economy once and for all, does anyone dare imagine how widespread and profound the damage as the piper is finally paid for all its arrogant, profligate money printing? Who will bail out the Fed?

Many central banks have become more independent of their governments. This has led to increased power, and economic chaos, global debt and inflation continues almost unabated. The central banks’ response of the 2008 financial crisis, which was to create new fiat currency as fast as the printing presses would allow, placed the recovery emphasis on bailing out banks rather than helping the economy, as a policy labeled, “favoring Wall Street over Main Street.”

The initial purpose of central banks has clearly changed as their powers and responsibilities have broadened. They have become crisis managers, but have not always proven effective in that role. What their future role will be is uncertain. But once power is acquired, it is rarely given up easily.

Since the 2008 financial crisis, the Federal Reserve’s balance sheet, consisting of assets, liabilities, and equity, has come under closer scrutiny.

Central banks have increased their assets considerably since 2008. At $4.476 trillion, the Federal Reserve assets comprise 23 percent of GDP. That number is actually low when compared to the 93 percent held by the Bank of Japan.

The big question is, who will bail out the central banks this time around in the “everything bubble?”

ORIGINAL SOURCE: The History And Rising Power of Central Banks by Alex Deluce at The Gold Telegraph on 6/8/18