by Ok_Significance_4008

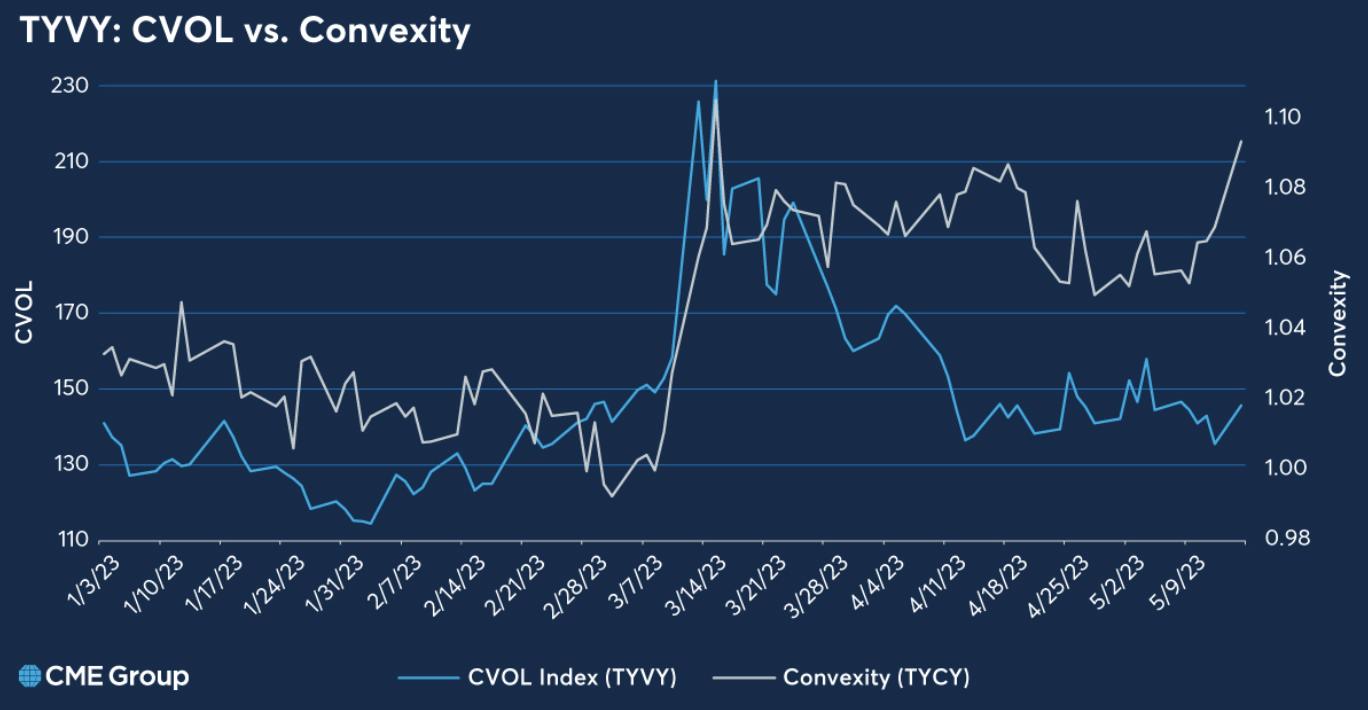

I believe that the CVOL vs. Convexity (TYCY) ratio is a good indicator of market conditions. When the CVOL is high and the Convexity is low, it indicates that there is more risk in the market and investors are less confident. This could be due to concerns about future economic growth or political instability. When this ratio is reversed, it means that investors are more confident and they see less risk in the market.

Views: