by UPFINA

The temporary elimination of the $600 in weekly jobless benefits was the biggest negative catalyst for the consumer since COVID-19. We say temporary because states are starting to pay the unemployed $300 to $400 extra from the federal government via Trump’s executive order (30 states are on board). The GOP is attempting to pass a $500 billion stimulus which grants money for unemployment benefits, schools, testing, and small businesses, but doesn’t come with another round of $1,200 checks. The Dems have a $2 trillion proposal. In theory, you’d think the Dems would choose a smaller stimulus over nothing. Then again, you’d think right before an election the GOP would want to give out a stimulus since the party is running on the economy. They want to run on the economy pre-COVID-19, but surely it would help if consumers are confident this fall.

The August BLS report will be pivotal since we have mixed data. It’s the most widely covered in the news which means it will have political ramifications. There has been some weakness in Indeed job postings and consumer confidence. However, RedBook same store sales growth improved last week.

JPMORGAN: “Thus far, .. we see little sign that the [enhanced unemployment] benefit expiration has marked a major turning point for the overall economy, as many other high-frequency spending and activity indicators have continued rising into August.” pic.twitter.com/fOXHtcOMQp

— Carl Quintanilla (@carlquintanilla) August 26, 2020

As you can see from the chart above, Chase card spending wasn’t impacted by the expiration of the benefits on July 25th. This makes sense because people knew the benefits would go away ahead of time, so they saved up some money in July. Don’t be foolish. Unless there is rapid job creation or more stimulus, spending growth will slow. It’s impossible for a $600 decline in weekly income to have no impact on spending.

As the chart shows, states with high jobless claims had a 7.8% decline in spending and states with low claims had a 4.1% yearly decline. This difference has always existed, so the expiration didn’t cause a change. The trend of improving growth continued in August. It’s interesting that throughout the recession, states with higher claims had worse spending growth considering benefits gave people more money than they normally make. This speaks to our point about people saving money. Some people who aren’t on unemployment benefits don’t get how uncertain the process is. No one wants to be on unemployment. You never know when the money will go away even though people are entitled to it because they paid into the system. Higher benefits for longer wouldn’t encourage people to stay unemployed.

Tech Stock Crash & Economic Recovery

This is an unusual market. If you told investors in mid-March that there would be outright euphoria this summer, no one would have believed you. In 2009, retail investors were scared of the market. There were stories about how retail investors would never come back. Journalists were exhibiting recency bias by thinking pessimism would last and retail traders were exhibiting recency bias by avoiding stocks after a major crash. 2020 is nothing like 2009. Investors now believe because a recession occurred, this bull run has years to go. That’s a hypocritical thesis because they are also bullish on stocks because they say the economy doesn’t matter.

Where the economy is headed matters. However, normally the stock market isn’t this ahead of the recovery. On the one hand, if COVID-19 fully goes away, the economy can recover quickly. On the other hand, the stock market is actually relying on a weak economy because low rates and staying at home are good for tech; tech controls this market. As we have mentioned, usually cyclical stocks outperform early in the cycle, but not this one. Since this year has been so unprecedented can we really rule out a tech crash even if the economy keeps improving?

The next question is if that’s possible. Is the tech sector too big to fail without taking down the consumer with it? It might not be too big to fail because consumers weren’t confident in August even though the S&P 500 and Nasdaq hit record highs. Therefore, a bear market in the Nasdaq might not have a big enough impact to hurt overall spending. Certainly, an improved jobs market would more than cancel out some people losing the money they speculated on tech stocks. Furthermore, people invested in cyclical stocks could make money.

Bigger Burst Than The Late 1990s?

We’re always looking for stats that show this bull run is greater than the 1990s. Saying it’s the most speculative since the 1990s doesn’t impress us anymore. As you can see from the chart below, the Nasdaq 100’s monthly price series is 14.4% above the upper end of the Bollinger bands. That’s higher than the peak in 2000.

"At market extremes, price becomes it's own fundamental." -Soros, paraphrased.

NDX100 monthly price series has now surpassed envy levels last visited in 1q2000. pic.twitter.com/JAs6VjRKhB

— DC (@dimit) August 26, 2020

Breadth is weak like in early 2000. On Wednesday, the Nasdaq 100 was up more than 2% and the Russell 2000 was down more than 0.5%. That’s the 8th time in the past 30 years. Salesforce.com rose 26% even as it announced layoffs. If the cyclical economy rose while tech fell, it would be great for the labor market because these tech firms are firing people while they do well. Furthermore, Facebook stock rose 8.2% after announcing iOS 14 could cut its Audience Network sales by 50% (yes, that’s a bad thing).

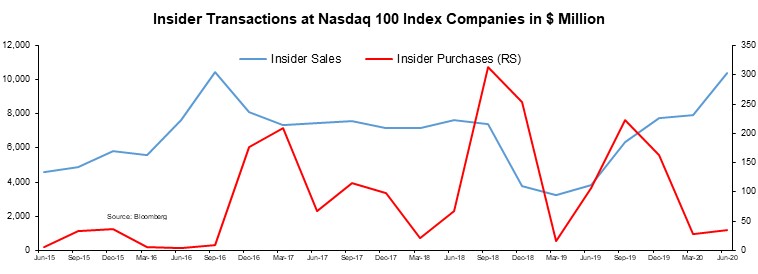

Insider Selling

There is intense insider selling at tech stocks. Plus, there have been new software IPOs announced to take advantage of the euphoria. Tech firms don’t care about the election. They want to IPO now because the market is hot. As you can see from the chart below, insiders at Nasdaq 100 firms sold $10.4 billion this quarter which is a 171% increase from last year. Insider buys fell to $35 billion which was a 67% decline from last year.

Conclusion

Consumer spending is fine now, but don’t delude yourself into thinking a $600 weekly decline in income doesn’t matter. People saved up in anticipation of this decline. The hope is the $300 in benefits and an improved jobs market will cushion the blow this fall. Stimulus checks might not be coming even though the election is in November and consumer confidence could help the GOP. Tech stocks are in a bubble. Insiders know this is a frothy market. That’s why they are selling more shares and buying less. Furthermore, IPOs are coming as early as they can to take advantage of the euphoria.