via Grant’s Interest Rate Observer

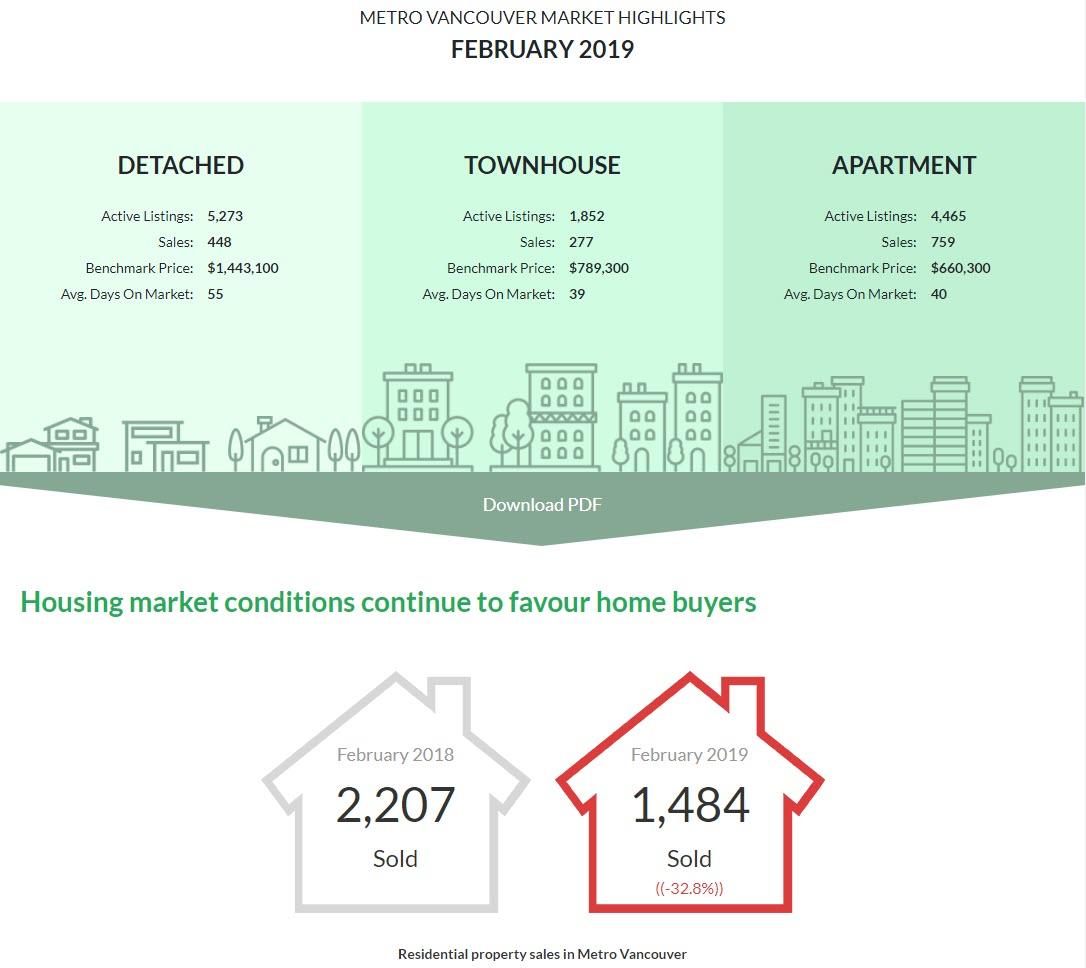

On Monday, the Real Estate Board of Greater Vancouver reported February results that could be classified as ghastly, with residential home sales plummeting 32.8% year-over-year to 1,484 units. That’s the lowest February sales total since 1985 and 42.5% below the 10-year average.

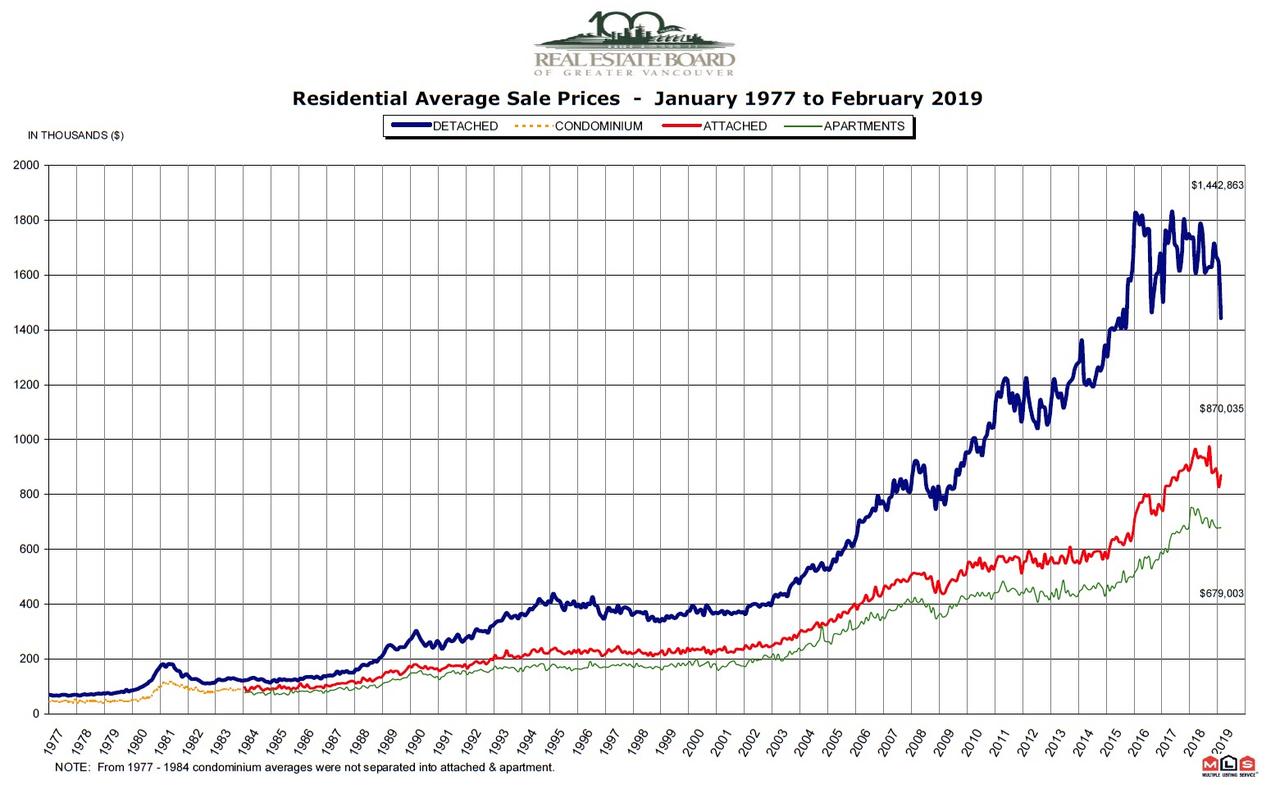

Prices have also broken lower, with the composite index sinking by 6.1% year-over-year. In addition, inventories have jumped, with total listings in metro Vancouver up to 11,590 homes at month end. That’s up 48.2% from February 2018.

Toronto, Canada’s largest city, has held up better, with February prices rising 1.6% year-over-year, while new listings dropped 6.2% to outpace the 2.4% decline in sales. Nevertheless, TREB president Gurcharan Bhaura asked for regulatory relief from the mortgage stress test mandated by the Office of the Superintendent of Financial Institutions. These subject borrowers to the greater of the five-year benchmark rate or the contracted mortgage rate plus 200 basis points (Almost Daily Grant’s, May 31):

The OSFI mandated mortgage stress test has left some buyers on the sidelines who have struggled to qualify for the type of home they want to buy. The stress test should be reviewed and consideration should be given to bringing back 30 year amortizations for federally insured mortgages. There is a federal budget and election on the horizon. It will be interesting to see what policy measures are announced to help with home ownership affordability.

On the score of home affordability, there is certainly room for improvement. According to Demographia’s International Affordability Survey for 2019, Toronto ranked 294th out of 309 metropolitan housing markets, with a median house price of 8.3 times median annual gross pre-tax household income, up from 7.9 times year-over-year. For context, the United States national median multiple registers at 3.5 times, while the organization designates anything beyond 5.1 times to be “severely unaffordable.” Vancouver puts Toronto in the shade, ranked second to last by Demographia (only Hong Kong is more expensive) with a median multiple of 12.6 times.

As Canada’s long-running housing bull market teeters, economic data continue to disappoint. Friday’s release of fourth quarter GDP showed annualized growth of just 0.4%, well below the 2% third quarter reading and the 1% consensus expectation, while December retail sales fell by 0.5% ex-automobiles, also worse than the expected 0.3% decline. M2 money supply growth registered 4.99% in December, down from 5.83% year-over-year and 8.65% in the final month of 2016.

Perhaps most importantly, total residential mortgage growth fell to just 3.1% year-over-year in December, the worst monthly reading since May 2001. That last data point may be especially concerning for Canada’s banks: Craig Fehr, investment strategist at Edward Jones & Co., told Bloomberg that the mortgages are, “in many cases, the largest and most profitable and steady of the businesses that these banks operate.” Fehr concludes: “The bread and butter of profitability for Canadian banks – is going to have a little less butter on the bread.”

Early indications bear that out, as a trio (the Bank of Nova Scotia, Toronto-Dominion Bank and Canadian Imperial Bank of Commerce, or CIBC) of Canada’s five largest banks reported earnings shortfalls in the quarter ended Jan. 31. Increased credit losses figured in two of those reports, with Toronto-Dominion raising its loan loss provision to C$850 million ($645 million), up 23% year-over-year. CIBC’s provision for credit losses jumped to C$338 million, more than double last year’s C$153 million and well above the expected C$258.5 million.

CIBC CFO Kevin Glass told Bloomberg that “three big” non-performing loans across different sectors hurt the bank’s credit portfolio, while asserting that the jump “is certainly not representative of any sign of underlying problem.”

Glass may not be worried, but an extended housing downturn may cause CIBC particular discomfort. For more, see the Feb. 9, 2018 edition of Grant’s.

In other news from formerly-booming housing markets, yesterday The Australian reported that Queensland-based bank Suncorp Group Ltd. warned that some investors in an A$120 million ($85 million) residential mortgage bond may not be repaid. The problem: An increase in borrowers at least 60 days past due on their mortgages to above 3% of the loan pool has triggered a clause prioritizing senior claims holders, potentially diverting principal repayment from those farther down the creditor food chain.

Meanwhile, Australian new auto sales fell by 9.3% year-over-year in February, the eleventh straight decline. On Feb. 21, Fitch Ratings reported that Australian prime auto loan asset-backed securities in arrears rose to a record high in the fourth quarter, with loans past due more than 30 and 60 days rising to 2.05% and 1.03%, respectively. That compares to a five year net loss rate of 0.51%.