By: Frank E. Holmes, Chairman/CEO/CIO of U.S. Global Investors, Inc.,

Strengths

- The best performing metal for the week was platinum, which gained 3.02 percent. Both platinum and palladium seem to be playing catch up to gold’s strong move last week. Gold extended its rally this week, pushing past $1,400 an ounce and fueling investors to pour cash into funds backed by the yellow metal. As Bloomberg reports, gold is set for its best month since the Brexit vote and comes ahead of the highly anticipated G20 meeting. Exchange-traded funds added 70,951 ounces of gold to their holdings in the last trading session, bringing this year’s purchases to 2.96 million ounces.

- On the prior Friday, investors added a net $1.57 billion to State Street’s gold shares ETF, reports Bloomberg, increasing the fund’s assets by 4.6 percent to $35.9 billion and riding the new week with further gains. This was the biggest one-day increase in at least a year. Central banks are also gobbling up gold – with holdings worth $22.8 billion as of June 21, according to weekly figures.

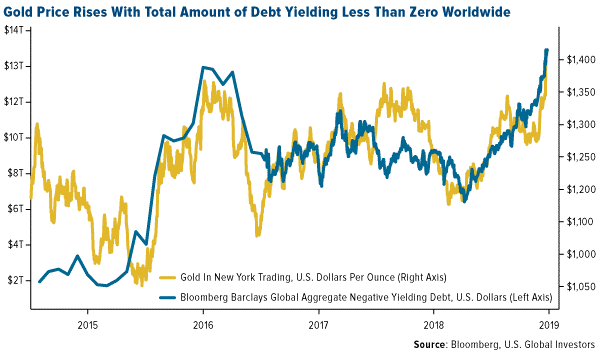

- Gold’s rise to a six-year high might be reflective of its status as a “positive yielding asset,” writes Bloomberg, particularly in relation to much of the world’s debt yielding less than zero. In fact, below-zero debt now makes up almost 40 percent of the value of all government bonds outstanding –a very profound shift. “As long as the capital gain is good enough, it doesn’t matter if the yields are underwater”…when seen in this light, Bloomberg explains, there’s a more straightforward choice between gold and sovereign debt. As Ambrose Evans-Pritchard writes, “The old refrain that gold is dead money because it pays no yield has lost its sting.”

Weaknesses

- The worst performing metal the week was silver, which fell 0.19 percent, coming down slightly on expectations of reduced economic activity. In a weekly Bloomberg survey, gold traders and analysts turned bearish amid concerns that the metal is due for a correction after rallying to a six-year high. The yellow metal hit the pause button as comments from the Federal Reserve dampened expectations over the scale of interest rate cuts. According to Bloomberg, Indian brides probably won’t wear quite as much this year. Record high prices and low rainfall are to blame for the slack in demand.

- U.S. jobless claims increased by more than expected, reports Bloomberg, reaching the highest level in seven weeks. Jobless claims rose by 10,000 to 227,000 in the week ended June 22, announced the Labor Department. Despite the national increase, jobless claims remain near historically low levels.

- U.S. new home sales fell in the month of May, reports Bloomberg, dropping by 7.8 percent to a 626,000 annual rate. In the month of April, home-price gains in 20 U.S. cities decelerated for a thirteenth straight month. This is the weakest pace since 2012, indicating further moderation in the housing market, the article continues.

Opportunities

- Federal Reserve Chairman Jerome Powell said that the downside risks to the U.S. economy have increased recently, reports Bloomberg, which reinforces the case among policy makers for somewhat lower interest rates. In another opportunity in the gold space, the drawdown in Comex gold inventories signals a potential shortage of physical supply that adds further weight to the metal’s bull market, writes Bloomberg. “Gold stockpiles tend to move in tandem with prices, but now they are diverging, which signals signs of a gold shortage that may deepen thanks to voracious demand for ETFs that have to be backed by physical bullion,” the article continues.

- At the moment, gold is nothing but a bond alternative, writes Bloomberg. For this reason, the yellow metal has the scope to run toward $1,500. With central banks turning dovish in recent weeks, the amount of negative-yielding bonds pushed to a record $13 trillion. On a 30-week basis, the correlation of this measure with the price of gold rose to 0.7. Why is that? The opportunity cost of owning non-yielding gold falls when bond holders are effectively taxed. Now investors are looking outside their usual refuges as they hunt for stable assets that provide at least a modicum of return, Bloomberg continues. As Bruno Braizinha, BofA’s director of U.S. rates strategy put it, a world starved of yield “implies a tectonic shift in asset allocation,” with greater appetite for emerging-market investments.

- According to a report dated June 24, gold has risen to Morgan Stanley’s top commodity pick on a six-month view. Similarly, RBC Mining and Materials Equity Team says it is taking a more constructive outlook on the yellow metal into the second quarter of 2019 and 2020, raising average price estimates to $1,350 an ounce. Finally, Goldman Sachs Group says that gold doesn’t need fear to prosper. The bank wrote in a report that while a gradual brightening of prospects for the world economy in the second half of 2019 and receding worries of a recession could lead to lower “fear”-driven demand for gold, that will likely be offset by a positive “wealth” effect.

Threats

- Even as U.S. stocks remain near record highs, a growing cohort of investors say they are ready to throw in the towel, reports Bloomberg. According to the latest reading from the Conference Board’s sentiment indicator, the number of Americans expecting equities to decline over the next year jumped the most since 2007 and for the first time since January exceeds those who expect gains. In addition, consumer confidence dropped in the month of June, well below the range of consensus forecasts, reports Bloomberg. Confidence dropped 10 points to 121.5, raising a potential red flag regarding households’ willingness to drive growth beyond trend over the next several months.

- Merrill Lynch’s commodities unit and Morgan Stanley were sued by a group of traders claiming the companies used a tactic known as spoofing to manipulate the market for precious metals futures, writes Bloomberg. The suit was filed a day after Merrill agreed to pay $36.5 million to settle claims by U.S. officials that its commodities division manipulated the price of precious metals futures over a six-year period. The 2010 Dodd-Frank Act made it illegal to place orders with no intention of executing them and since the laws were passed, the government has prosecuted almost a dozen criminal cases, and the CFTC initiated 15 civil complaints in 2018. That is up from nine in 2017, and before then, the regulator averaged about one a year.

- BNP Paribas sees the period at end of 2019 and into 2020 as more favorable for average higher gold prices, writes Bloomberg, but the bank is cautious about further upside potential from current levels in the short term. The gold market has currently been fueled by markets pricing in an interest rate cut as soon as next month, but any hint that this may not happen, could lead to a sharp pullback for prices already at the highest in six years. In a related note, Bloomberg points out that gold and real yields have never been as tightly bound as they are now, which likely means the metal’s rally has squeezed as much as it can from the bond market, which has priced in a fair amount of rate cuts. For gold to climb further, the article explains, it will need help from the dollar.