Submitted by Joseph Carson, former Director of Global Economic Research, Alliance Bernstein

The happy prophecy of endless growth in the economy generating a continuous flow of strong corporate earnings just ran into trouble—the “truth” on profits. According to GDP data released today Q2 corporate earning posted their largest annual decline in several years, and the revised data shows that there has been no growth in operating profits for the past 5 years.

Q2 Real GDP bettered analyst’s expectations growing 2.1% annualized, driven by strong gains in consumer and government spending. Yet, the gain in GDP did not flow to the bottom line for companies.

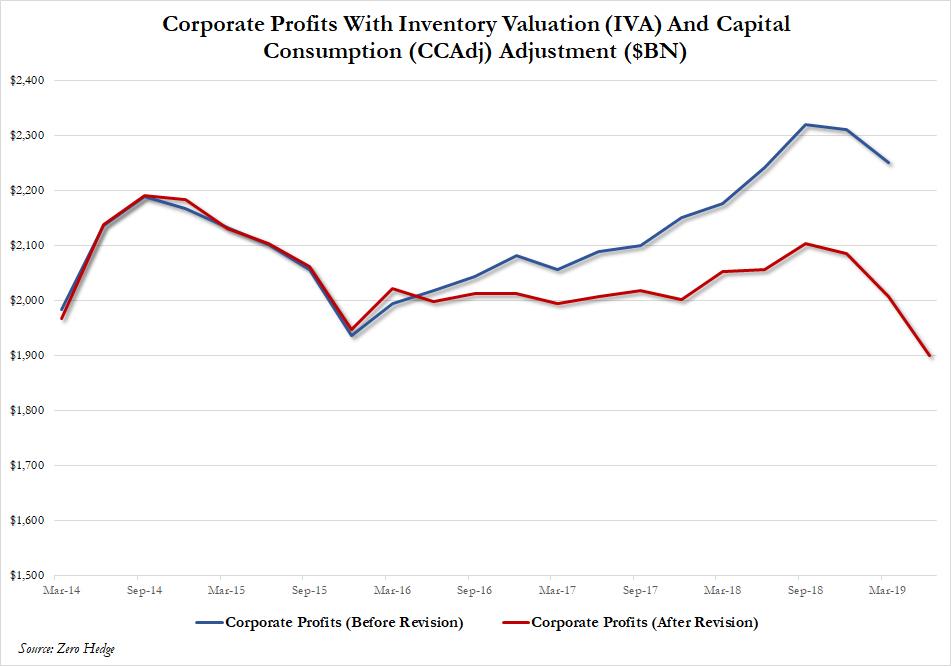

According to the preliminary Q2 GDP results, implied operating profits for the period totaled $1,900 billion, down 5% from Q1, which would represent the third consecutive quarterly decline, and off over 7% from the year ago levels, one the largest declines recorded in several years.

Yet, as ugly as the Q2 numbers appear to be on the surface, what are even more troubling are the sharp downward revisions for the last two years. According to the annual GDP revisions operating profits for 2017 were lowered by $93 billion, or 4.4%, and profits for 2018 were reduced by a whopping $188 billion of 8.3%.

The revised numbers of corporate profits show that operating profits peaked in Q3 2014 and have been moving sideways even since. Operating profits in the GDP accounts and S&P 500 operating profits over the long run track fairly close to one another, although there can be large differences in any given year. Yet, a flat trend for 5 years in operating profits should not be overlooked or ignored especially since during this period S&P 500 share prices have increased over 50%.

Operating profits, or profits from current production, are the purest form of corporate earnings since this series puts all firms on the same accounting framework – it avoids non-GAAP adjustments – and the profit numbers are not adjusted for the number of shares outstanding; the latter which is often reported by S&P 500 companies for equity investors.

The argument being used by equity analysts and strategists that the equity market is cheap or inexpensive relative profits appears to be dubious in light of revised data on operating profits, and it suggests that the “actual ” market multiple is a lot higher than what is being reported by analysts.