via Zerohedge:

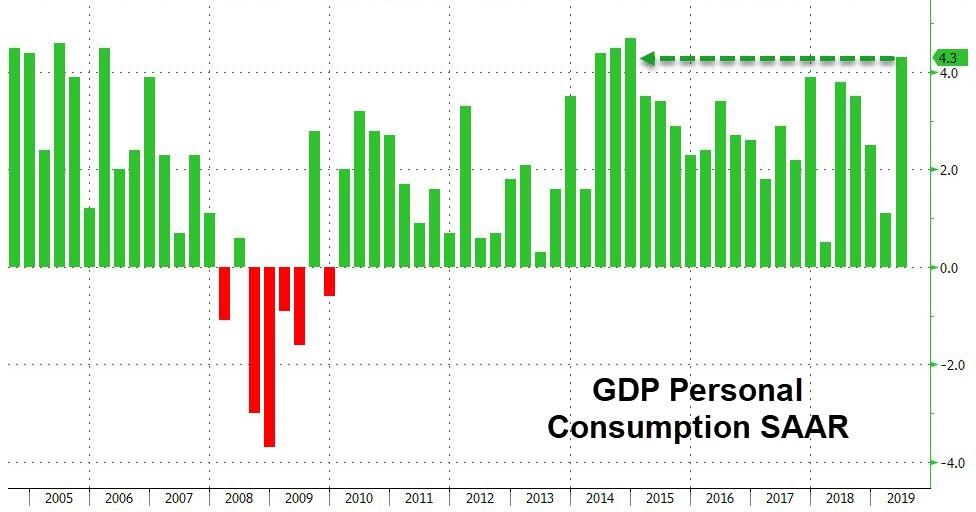

As we reported earlier, Q2 GDP printed far stronger than expected, with US households going on an all-out spending spree and at 2.85%, or contributing 138% of the bottom line 2.1% GDP print, personal consumption soared an annualized 4.3%, the strongest print going back to 2014!

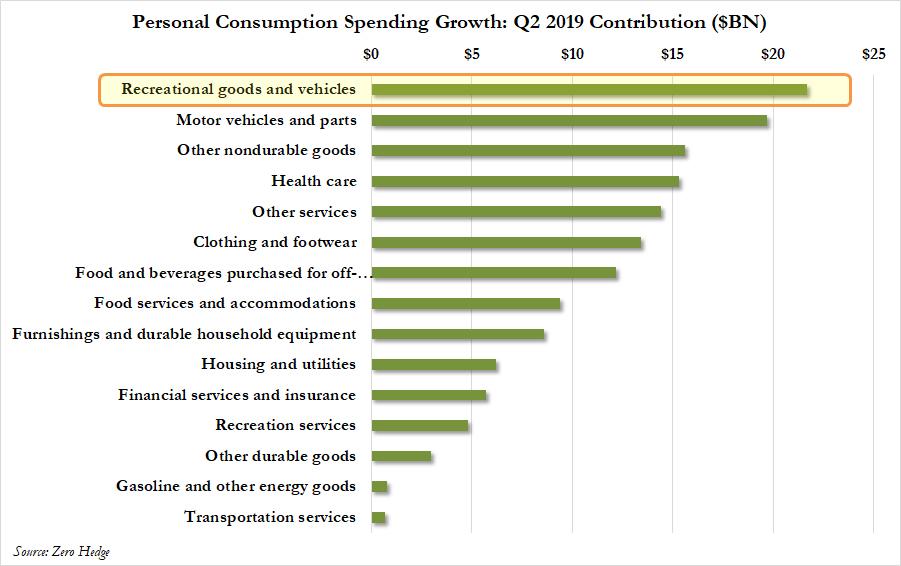

So, as we always do, we decided to take a look at what Americans supposedly spent the most money on in Q2, to find the source of this unexpected spending splurge. What we first found is that, unlike most quarters when there was a decline in spending in at least one category, in Q2 spending actually increased in every single category across goods and services.

Now, traditionally we would expect healthcare – a legacy of America’s aging demographic and the Obamacare tax – to provide the bulk of the upside, but in Q2 we found only a relatively modest contribution, with a spending increase of only $15.3 billion compared to Q1. Another surprise was that at a time when auto dealers continue to report declining auto sales on a Y/Y basis, spending on motor vehicles and parts somehow increased by $19.7 billion in the quarter.

But what was the main driver of spending in the second quarter? Well, for some inexplicable reason, in Q2 the American consumer was scrambling to buy… recreational vehicles!?

Here is the breakdown of all the categories that constituted Personal Consumption in the second quarter:

Regular readers will recall that this is not the first time this particular category emerged as a surprise top spending category: both two and three years ago, in Q1 of 2016 and then again in Q1 of 2017, Americans inexplicably again splurged on RVs (both of those times, there was a political prerogative to show GDP growth as strong as possible).

It is also worth noting, that if it wasn’t for the inexplicable splurge on “Recreational goods and vehicles”, GDP would have missed expectations of a 1.8% increase. To be sure, the farcical surge in RV purchases certainly would explain why the housing recovery has turned from boom to bust.

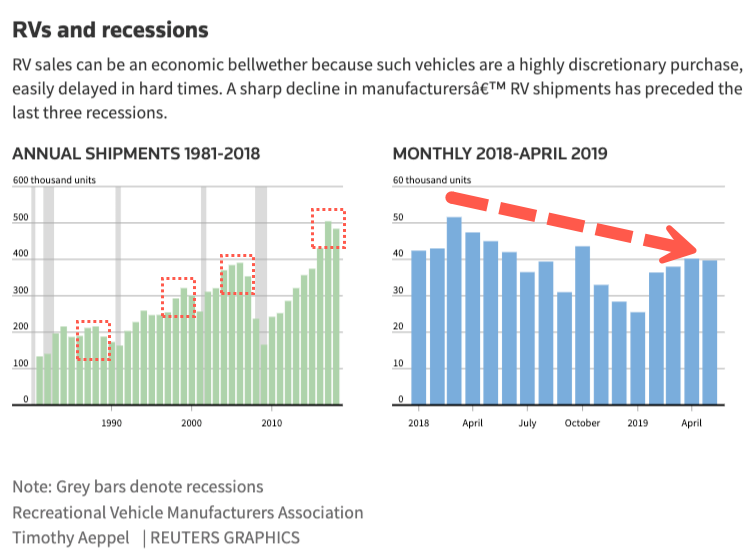

Yet what is most perplexing in light of the “data”, is that just two days ago we reported that the RV industry has taken a massive blow from President Trump’s tariffs on steel and aluminum and other retaliatory duties on thousands of Chinese-made RV parts, from electronics to LED lights to vinyl.

Indeed, at the micro, bottom-up level, domestic shipments of RVs to dealers plummeted 22% in the first five months of this year, compared to the same period last year, after dropping 4% in 2018, according to the Recreational Vehicle Industry Association. As we added “the RV industry’s crisis shows how President Trump’s trade war has backfired, hurting the industry he promised to protect.”

Tariff-related price hikes have forced RV manufacturers to pass on costs to dealerships, which in turn the American consumer bears the brunt of the tariff, has slowed sales at dealers who are cutting orders and laying off workers.

But it’s not just us who pointed out the plunge in RV sales: Michael Hicks, a Ball State University economist who tracks the industry, warned that the collapse in RV shipments could indicate a wider economic downturn. Hicks said shipments had fallen sharply just before the last three U.S. recessions.

“The RV industry is a great bellwether of the economy,” said Hicks, because the vehicles are an expensive and discretionary purchase, easily delayed by consumers who start to worry about their financial stability.

Additionally, Reuters suggested that the RV industry is headed for a significant consolidation after several years of expansion, led to new factories, has oversupplied the market.

Managers at RV manufacturers and suppliers said President Trump’s trade war is why the industry is now crashing.

“The tariff price increases are what tipped the RV business — it started the landslide, no question,” said Tom Bond, the materials and purchasing manager at Adnik Manufacturing, an Elkhart-based division of Norco Industries.

Michael Happe, CEO of Winnebago Industries Inc, said tariffs had forced RV manufacturers to increase costs to dealers

Meanwhile, Thor Industries, which controls almost 50% of the North America RV market, reported its sales have dropped 23% in its fiscal third quarter, which ended in April, compared to a year ago. Production cuts and layoffs have been in full swing at some of Thor’s North American plants.

Thor assembler Demiris Jahmal Williams told Reuters his hours were cut, and his factory has been shut down through July.

“This is the worse I’ve seen it,” he said.

So there’s the paradox: while RV sales are crashing according to makers of RVs, the Bureau of Economic Analysis (i.e., the US government), used this very data set to represent that the US consumer is not only alive and well, but spending more than at any time in the past 5 years!

Surely when looking at such grotesque data manipulation, China can only stand in silent awe and watch as the US shows the world how data fudging is truly done, when the president has a political axe to grind and will steamroll any and all data just to prove that America is great again.