Do you want to make a fortune from investing?

If you do, then you’ve got to do what others don’t. You have to take a different approach… and look for situations most are ignoring.

Like what’s happening in bonds today.

Investors are giddy over stocks rallying. After all the stock market is up 8% in just six sessions. Meanwhile, something is brewing in bond land for only the second time in 30 years.

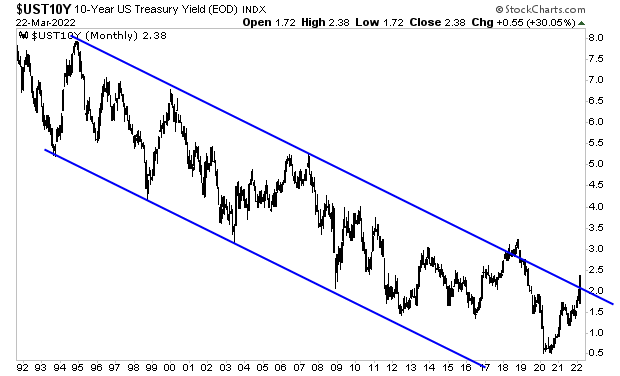

The 10-Year U.S. Treasury is the single most important bond in the world. The yield on this bond represents the “risk free” rate of return against which all risk assets, including stocks, are priced.

And it just broke its downtrend for only the second time in 30 years.

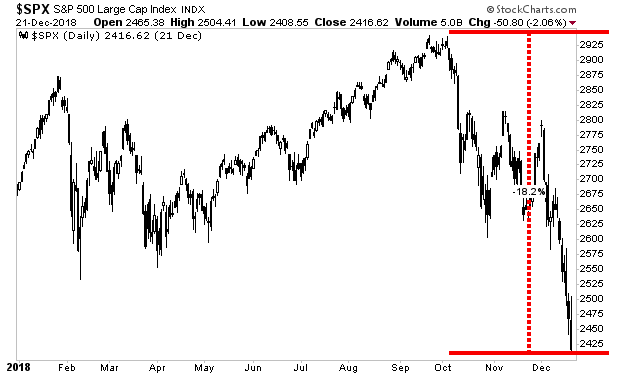

The last time this yield spiked out of its downtrend was in 2018. At that time, the Fed was shrinking its balance sheet by $50 billion per month and raising rates every few months.

The end result?

The $8 trillion corporate bond market blew up, and stocks crashed 20% in a matter of weeks.

This time around, the Fed has only just stopped growing its balance sheet… and has raised rates only one time! Put another way, the yield on the 10-year U.S. Treasury is breaking out and the Fed has barely done anything!!

How long before something “breaks” again and stocks crash? How long before the investors who think like everyone else “stocks are great investments in this environment” get taken to the cleaners?

And how long before those who see things differently make literal fortunes? Just as they always do when the markets are in la la land?