Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

A recent article by James Deporre at thestreet.com asked Will Powell’s Remarks Push the Algos to Make a Move?

Deporre’s article is a recap of a day’s market events beginning with Jerome Powell’s recent testimony to Congress. He suggests that what matters are not Powell’s words, but whether computerized trading programs, known as “algos,” would buy stocks as a result of Powell’s testimony. Summarizing what ended up being an uneventful day of trading activity, Deporre made the following absurd comment which caught our attention:

“On the other hand, the mighty Apple (AAPL) is holding up and seems to function as a de facto money market account these days. It is a great place for some to park cash and that helps to keep the indices hovering near highs.”

While we currently hold Apple stock on behalf of some of our clients, we do so with the full awareness that valuations for Apple and many other stocks are extreme. A reversion back to or below average historical valuations will result in a massive loss of wealth for many investors. As such, we maintain a careful and balanced investment posture and take nothing for granted. Most importantly, we never confuse “parking” cash with owning a stock. Like a shovel and hammer, stocks and cash are valuable tools, but neither is a perfect substitute for the other.

What Apple Is And What It Isn’t

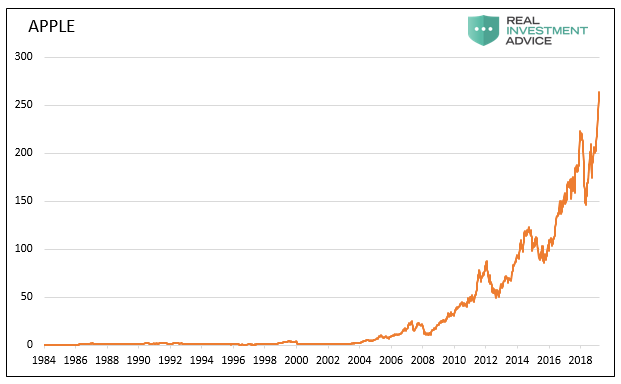

Apple is one of the world’s largest corporations, with innovative products and a great growth trajectory. As reported in its third-quarter 2019 earnings release, the company has a war chest of $245 billion in cash. These facts are not lost on investors. As shown below, Apple shares have risen at a remarkable pace. Since its IPO in 1984, the stock is up almost 70,000% or more than 20% annually. A $1500 investment in 1984 is now worth over a million dollars!

Data Courtesy Bloomberg

Money market mutual funds, also known as cash accounts, are vehicles that allow investors to hold cash and earn the short term rate of interest in the market. These funds invest in very short term, liquid, and highly rated securities. The investments produce little to no price volatility. Many money market mutual funds are governed by the SEC’s 2A7 rules, which greatly limit the credit and liquidity risk of these funds and attempt to ensure investors in them do not have a risk of loss of principal. Given the near riskless nature of money market mutual funds, they offer meager returns.

Buy And Hold

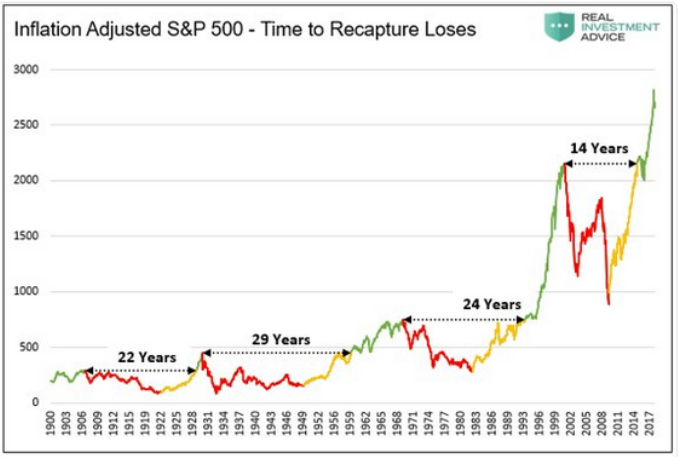

As the Byrds sang, “there is a season- turn – turn- turn. Similarly, there is a time to invest heavily in stocks and a time to scale back on stock holdings and take less risk. It is all too popular for market gurus, especially at market peaks when complacency is the highest, to preach about buy and hold strategies. This advice is based on a misconception that market drawdowns will be short-lived and investors will quickly recoup any losses. Therefore, it is not surprising that the popular investing view today insists that investors should check their brains at the door and remain fully invested in stocks at all times.

As shown below, such logic flies in the face of history.

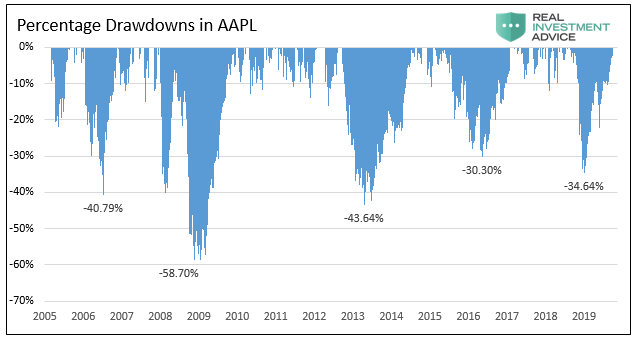

Over the long run, investors in Apple have fared better than the market. As shown, drawdowns over the last decade have been relatively short-lived. However, those setbacks have not been small. Since 2010, Apple’s stock price has dropped by 35-45% on three different occasions and by 20% on one other. So, can we treat Apple like a money market fund and hold it with the certainty of knowing that it will never lose value?

It is important to understand that, in the long run, stock prices are regulated by the cash flows of the underlying corporation. We explained this recently as follows:

“A Honus Wagner baseball card from 1909 was recently auctioned for over $3 million. While that may seem like a lot of money, it is not necessarily expensive. A baseball card is nothing more than paper and ink with no real value. Its street value, or price, is based on the whims of collectors. “Whim” is impossible to value.

Stocks are not baseball cards. Stocks represent ownership in a corporation, and therefore, their share prices are based on a series of future expected earnings and cash flows. Further, there are many other types of investments that serve not only as alternatives, but provide a means to assess relative value.

Today, investors are trading stocks on a “whim,” with scant attention to their value. Unlike a baseball card, when a stock’s market value rises much more than its real value, an inevitable correction will occur. The only question is not if, but when.”

There is an important distinction to be made here between “investing” vs. “speculating.”

Apple’s shares are priced at a historically steep premium to its fundamentals, meaning “whim” is playing a role in recent price appreciation. Whim is speculating. Here are a few fundamental data points to consider, but as you do, keep in mind Apple has bought back a third of their shares outstanding since 2012, making per share data when adjusted for buybacks higher than that shown below.

- Price to book value is the highest it has ever been since the IPO (12.90x)

- Price to earnings (trailing twelve months), price to sales, and price to free cash flow are at the highest levels since 2009

Regardless of whether Apple’s valuation may appear rich, there is little doubt the valuation premium can still rise further in the future. Earnings can grow faster than expected and justify the current valuations. However, the premium can also revert back to historical levels and earnings may disappoint in the future. Apple’s stock price dropped 61% in 2008, and that was following the release of the first iPhone. It is difficult to imagine a better time to have owned shares in the company.

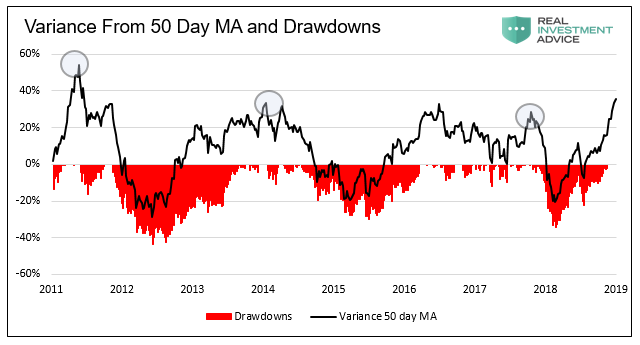

Apple also appears to be over extended on a technical basis. The graph below shows the premium or discount of Apple stock price to its 50 day moving average. As circled, three of the last four times that the stock has been this far above the moving average, a drawdown of at least 20% occurred.

Data Courtesy Bloomberg

Our simple conclusion is that Apple is a speculative investment with zero guarantees and, therefore a poor substitute for a money market fund.

Sorry Mr. Deporre, but Apple is not cash. When markets drop in earnest, so will Apple, as suggested by its beta to the S&P 500 of 1.06. Holding Apple shares will not afford you the ability to take advantage of lower prices when stocks go on sale. Therein lies an important difference between the utilization of cash and stocks in a portfolio.

The graph below shows the percentage drawdowns that occurred in Apple’s stock over the last fifteen years.

Data Courtesy Bloomberg

Summary

There are two key points that Deporre’s article fails to consider.

First, an equity stake in any company – whether a boring utility or hot IPO – is speculative, especially when valuations are above fair value. Value is never guaranteed, but it is far less uncertain when the price paid is below fair value.

Second, cash is king when markets decline. Investors that are fully invested with little cash as an insurance policy tend to sell when markets decline rapidly. Quite often, a low is marked with a massive amount of capitulation selling. Those who harvest gains when markets are over-valued and hold a reasonable amount of their portfolio in cash can buy stocks that trade at a discount to fair value from those who are panicking.

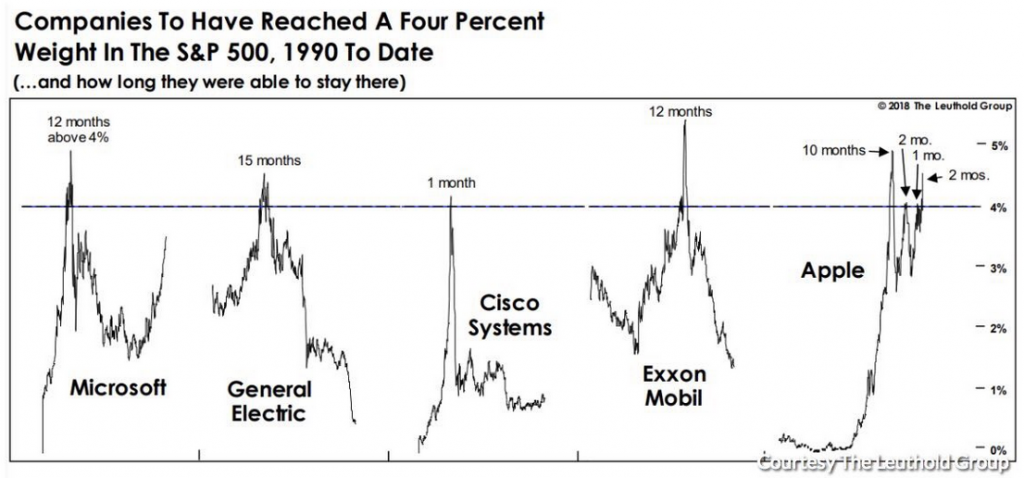

We leave you with an interesting graph from The Leuthold Group.