by Chris Kimble

Banks and financial stocks are at the heart of every economy and play an important role in bull markets.

While they may stumble or lag the broader stock market, they are always on the radar of macro investors. A breakout or steady up-trend (on any time frame) is a bullish sign for the broad market, while a breakdown is a bearish sign.

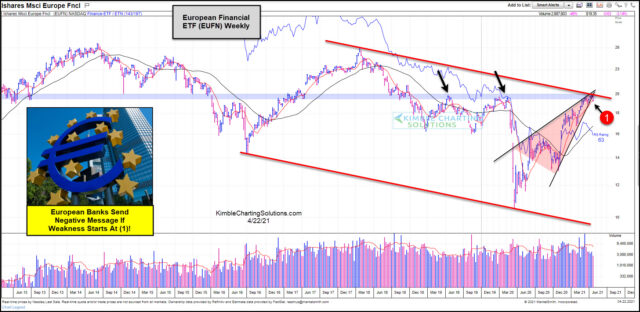

Today, we turn to Europe and the banking sector. More precisely, the European Financial Sector ETF (EUFN) on a “weekly” basis from Marketsmith.com and Investors Business Daily.

As you can see, the European banks have been in a broad falling channel for the past 5 years. BUT they have been trading very strong over the past year. In fact, so strong bullish that the recent leg higher has EUFN testing a confluence of major support/resistance at (1). This area is made up of a long-term support/resistance line (blue line), as well as the upper end of the falling channel.

If that isn’t enough, it’s also created a bearish rising wedge pattern… and that pattern is narrowing quickly. This pattern tends to be bearish, but a move in either direction is possible. Considering the importance of Europe (and the banks), I humbly feel that what EUFN does at (1) is important to stocks globally! Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE