Are millennials a lost generation financially? https://t.co/5kOPr06Pz0 pic.twitter.com/UK9JcAji4J

— St. Louis Fed (@stlouisfed) December 17, 2019

Great Recession and Younger Families

First, the Great Recession was devastating to many families, but younger families were hit harder and lost a larger share of their wealth than older families.

To dive deeper, we looked at families grouped by the decade in which the family head was born. We define older millennials (our focus group) as families headed by someone born between 1980 and 1989. We also focus on the median (or typical) family of each group.

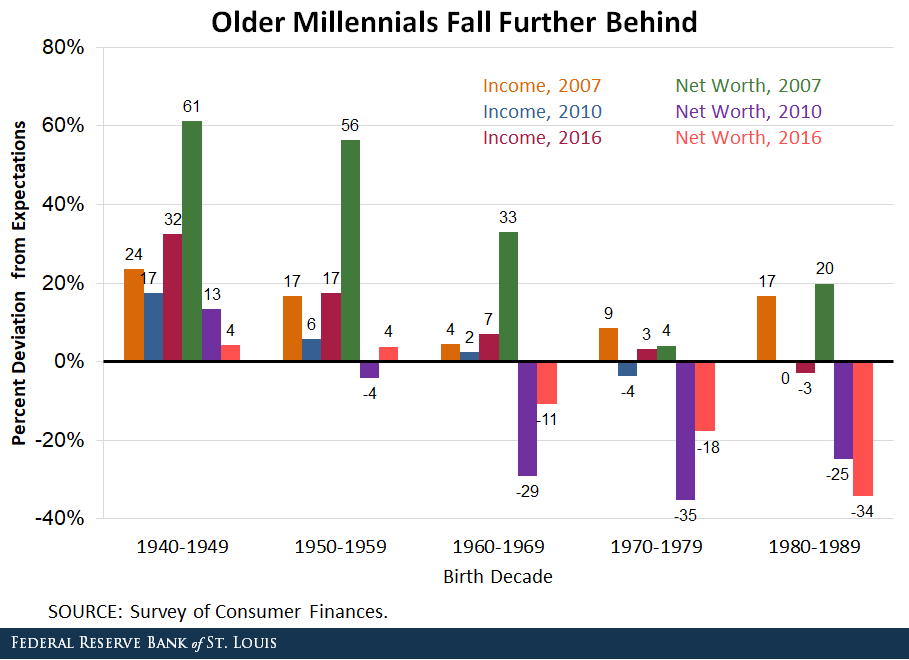

The horizontal line in the figure below shows what we would expect income and wealth to be for a typical family based on previous generations at the same age:

- If the bars are above that line, the typical family in that generation was doing better than expected.

- If the bars are below, that generation was doing worse than expected.

The typical income and wealth observed for each generation fell between 2007 and 2010. While the earnings of typical families had recovered by 2016, the wealth outcomes for most generations were still below expectations.

Finances of Older Millennials

For older millennial families, what we find is troubling: They were the only group to lose ground on both income and wealth in 2010 and then fall even further behind in 2016, to 3% below income expectations and 34% below wealth expectations. As of 2016, older millennial families were the farthest behind.

Wealth Redistribution

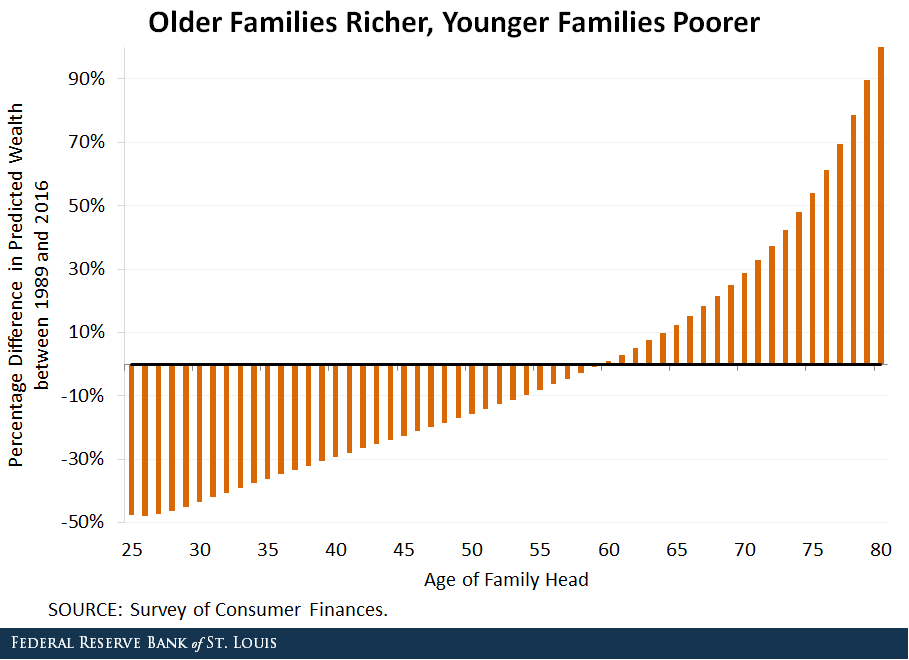

The Great Recession also amplified the trend of wealth redistribution from young to old families, which had been growing for many decades. In the figure below, we compared expected wealth levels in 2016 to those in 1989.

We found age 60 to be a demarcation point. Families with the household head near retirement age and older had higher expected wealth in 2016 than a family the same age in 1989. Younger families had less expected wealth in 2016 than in 1989.

For example, the average age within our group of older millennials was 32 in 2016. Their predicted wealth of $28,000 was 41% below a 32-year-old’s predicted wealth in 1989. For 1950s-born baby boomers (average age of 61 in 2016), their predicted wealth of $191,000 was 3% higher than 61-year-olds’ predicted wealth in 1989.

Millennials, College Education, Wealth and Income

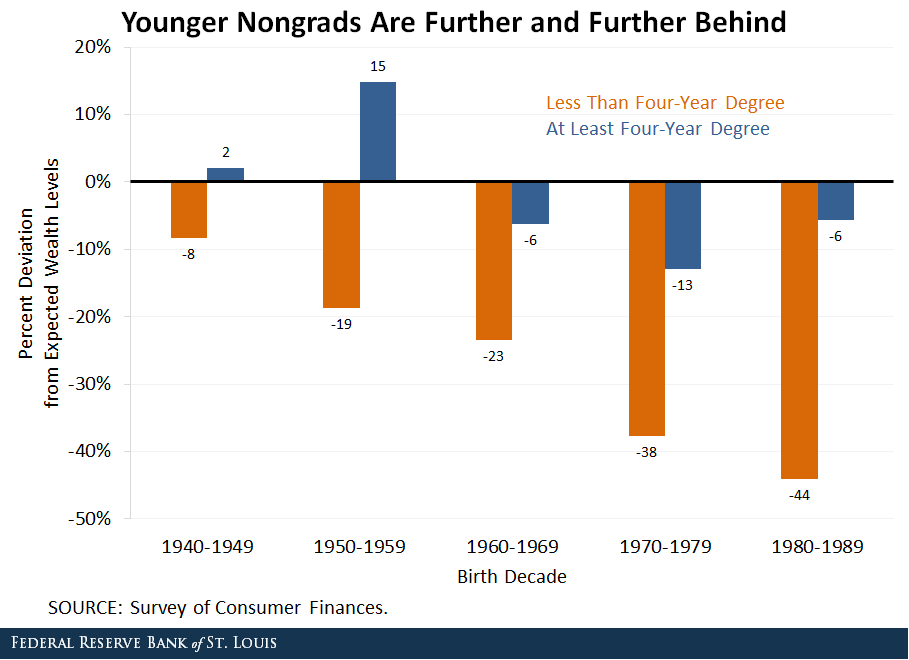

Millennials are also compositionally different than other generations. They are more highly educated than any prior generation, for example, and thus we believed it would be instructive to disaggregate trends by education.

We broke families into two groups:

- Those headed by someone with at least a four-year college degree (hereafter college grads)

- Those headed by someone with less than a four-year degree, including those with two-year degrees (hereafter nongrads)

Millennial college grad families (37% of the 1980s cohort in 2016) were far above predicted income and wealth levels in 2007, but the recession wiped out these advantages. Millennial nongrad families were already at or below norms in 2007, and the recession knocked them even lower.

The figure below is similar to the first one in this post, though expectations are derived from families with the same education (as opposed to all families combined). For example, college grad millennial expected wealth was compared to the wealth level we predicted based on predominantly older college grad generations at the same age.

#CollegeDebt is drowning #millennials.

Before we go throwing #taxpayer dollars at paying off the #debt – there needs to be a mechanism to insure the money was #ACTUALLY used for #college. pic.twitter.com/RHe3lV0vhe— Lance Roberts (@LanceRoberts) December 17, 2019