Authored by Bryce Coward via Knowledge Leaders Capital blog,

All eyes will be on today’s payroll report for clues about what it means for the Fed’s next move. Indeed, the payroll report will be the most important US economic data point between now and the Fed’s next meeting at the end of July, so the stakes are high and expectations have been set. In this post we’ll highlight how this payroll report could either beat or miss expectations and what each case could mean for bonds, stocks, the USD and gold.

Market participants will likely focus on four key data points in the payroll report with the first two in the list below being by far the most relevant for the possible market reaction.

- Change in non-farm employment between May and June (market expects 160K)

- Average hourly earnings (market expects 3.2%)

- Unemployment rate (market expects 3.6%)

- Average weekly hours worked (market expects 34.4)

An employment number below ~140 could be considered a miss while a number above ~170 could be considered a beat. Earnings growth at ~3% or below could be considered a miss while a number ~3.3% or higher could be considered a beat.

When considering how a beat or miss could impact financial markets, it’s important to understand current factors affecting pricing of the various asset classes including market odds of rate cuts, foreign central bank policy, and geopolitics.

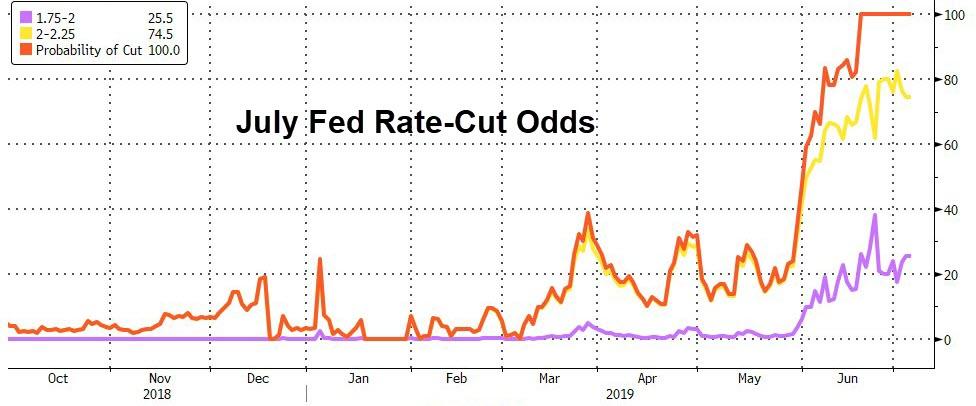

- The bond market is currently pricing a 100% probability of at least a 25bps cut in the Fed Funds rate and a 25% probability of a 50bps cut in rates. That said, Fed members themselves seem to be leaning toward either no cut or a 25bps cut at the most for July. Therefore, it may take quite a large miss to trigger bonds, stocks and gold to price in further cuts by rallying (yields falling), but a relatively small beat for the market to start pricing out a 50bps cut. Needless to say, equities and gold have been rallying in large part due to expectations of a July cut or two, so a big payroll beat would initially be bearish most asset classes except for the USD.

- Foreign central banks including the European Central Bank, Reserve Bank of Australia, and Bank of China are either already easing or signaling more easing ahead. Therefore, the Fed desperately needs to get with the program and start easing policy if it doesn’t wish for the USD to blow higher. Here again, payrolls will be key, with a miss keeping the Fed on track to ease (supporting bonds, equities and gold) while a beat would be quite bullish for the USD and bearish most other asset classes.

- For now, it appears as if the US and China have come to a “trade-truce” and immediate new tariffs seem off the table for the time being. Removing this risk factor will allow the Fed to more acutely focus on Friday’s report for signs of employment or wage growth weakness or strength. As of now, the Fed (outwardly at least) seems most focused on their inability to hit inflation targets. Therefore, the wage growth figure could have out-sized significance on Friday. Here again, good news is bad news with a beat most likely causing stocks, bonds and gold to fall and the USD to rise.

Given market expectations, foreign central bank action and a calming down of the trade war, it could require a fairly significant payroll miss to induce more of the same in July – that being a large rally in stocks, bonds and gold. However, we must also consider that growth has been slowing significantly and is likely to continue to slow for the remainder of the year as we have highlighted here and here. Employment, being the lagging indicator it is, is not likely to provide much information about future growth. Therefore, the kind of report that causes the Fed to not act when in fact they should – we’ll call it a “weak beat” employment report – is likely to keep the long end of the curve anchored while the short end rises.

A flattening/further inversion of the yield curve on Friday and into next week could be viewed as the market beginning to price a policy mistake by the Fed and would be the most bearish intermediate-term outcome for equities in particular.