Trader Who Called Last Week’s ‘Volocaust’ Says “This Is Just An Appetizer”

Professionals investors are still digesting the implications of last week’s explosion of volatility, while some retail traders are struggling to cope with the loss of years’ worth of work.

Meanwhile, one man, who was fortunate enough to have his warnings about the possibility of an explosion of volatility triggered by a dangerously large short-gamma positioning in markets documented by the New York Times, is sitting pretty as his illustration of the risks associated with the market’s dangerous sense of calm have proven to be almost eerily correct.

Ironically, Cole doesn’t see it that way. So he joined Erik Townsend during a special “postgame” session of Townsend’s weekly MacroVoices podcast to offer his two cents on the crash, what caused it, and what he expects will happen next.

While Cole is happy to accept the back-patting and congratulations for having foretold in near-perfect detail the dynamics that would drive this week’s volatility explosion, those who read our piece summarizing Cole’s (uncannily well-timed) interview two weeks ago will remember that short-vol ETPs like XIV represent only a fraction of the collective $2 trillion short-gamma position that touches nearly every corner of the market.

Other components of what calls the ‘implicit’ gamma short – which we’ve touched on this week – include $600 billion invested in risk-parity strategies, $400 billion in volatility-control funds. And $250 billion of risk premium strategies…

Rather than buy the dip, Cole ominously warned that it’s more likely this is the beginning of a much larger selloff.

Or, as Kevin Spacey’s character put it in the movie “Margin Call”, because of vulnerabilities related to the market’s massively short gamma positioning, “there will be turmoil in the markets for the foreseeable future.”

Everyone talks – congratulations about calling this. Well, I don’t think what I’ve really talked about has come to pass yet. The VIX ETPs are the smallest portion of the global short-vol trade. Talk about this idea of about 1.5 to 2 trillion dollars’ worth of short-vol exposure, both explicit and implicit.

Explicit short volatility are VIX exchange-rated products and vol overwriting funds. You know, the VIX ETPs are only 5 billion dollars.

You have 1.5 trillion of implicit short-volatility strategies, strategies that may not be directly shorting options, but use financial engineering to mimic the components of a short-option portfolio. About 1.5 trillion dollars’ worth of these, of exposure, this is what we’re seeing come online now.

This is the real risk. So stocks and bonds sell off together. You have disorderly unwind withdrawal of liquidity. And then, all of a sudden, increasing volatility results in a quick deleveraging of these implicit short-volatility strategies. And this will drive the next leg of the crisis.

So, people say congratulations, you called the short-vol trade. No, nothing has happened yet. This is an appetizer. This is just the appetizer for the unwind that is about to come. I think this is what people should be really afraid of, and I think this is the next leg of this that we will see.

Whether this happens in two weeks or whether this happens over two years, I don’t know. But I strongly believe this will come to pass. And it will be quite disorderly and ugly.

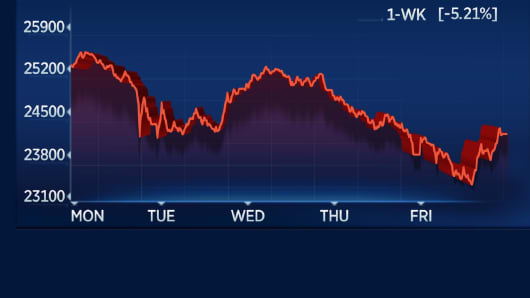

Dow Travels 20,000 Points – Wildest Weeks Since the Financial Crisis

-

The Dow Jones industrial average posted its worst week in two years. Earlier in the session, the index was on track for its worst week since October 2008, during the financial crisis.

-

The stock index has traveled more than 22,000 points this week in a volatile few days that kicked off Monday with the Dow’s biggest closing point drop on record.

-

Stocks are falling as traders worry about rising interest rates, and volatility as measured by the VIX has jumped to its highest since the market turmoil of August 2015.

With another volatile plunge Friday, the Dow Jones industrial averagehas traveled more than 22,000 points this week.

The stock index closed more than 1 percent higher, bringing its weekly losses to the worst since January 2016. Earlier in the session, the Dow was tracking for its worst week since October 2008, during the financial crisis.

St. Louis Fed Financial Stress Index ticks higher for a third straight week, to -1.353 (normal stress=0) https://t.co/zRy1wgmQNy pic.twitter.com/PdJUcGHdIk

— St. Louis Fed (@stlouisfed) February 12, 2018

UST10Y 2.887 & $VIX >20 is not a winning strategy for further stock market gains. All mainstream financial news outlets call for a BTFD, but what if that fails and an actual bear market occurs in a continuation of trend? Trump would be pissed.

— Alastair Williamson (@StockBoardAsset) February 12, 2018