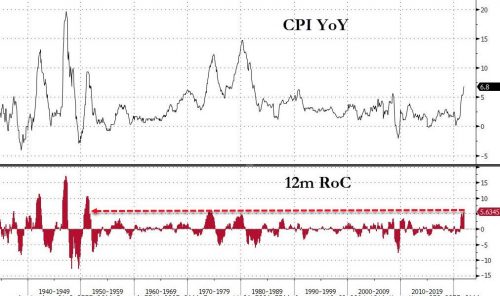

It’s all about inflation, but it’s not about today’s news on inflation. The big news on inflation today is not even that it hit 6.8% — its highest level since 1983 — but that the rate of climb for inflation is the steepest it has been in seventy years. However, even that is not the “big reveal” I’m talking about. Even so, it is worth pausing to note one has to go back to the end of World War II to find inflation rising this quickly. And, of course, I have to give the usual caveat that today’s inflation would be a whole lot worse nominally if it were measured like yesterday’s inflation.

The Fed failed to see it coming

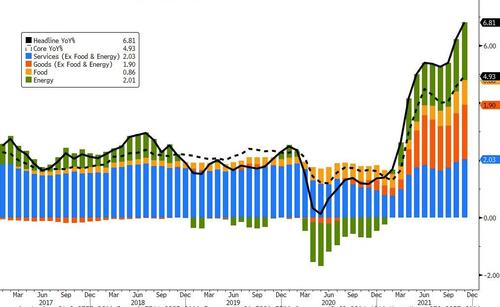

As if Jerome Powell’s recent admission that the Federal reserve was all wrong about inflation –that it was never transitory after all — needed confirmation, all categories of prices measured rose together on a flood tide in today’s report. It was not the look that “transitory” inflation from reopening would have shown where only those things hardest hit by the pandemic — like air fairs, hospitality, energy — rose, but all things rose in a general climate of soaring prices.

Here is a synopsis of the broadest breakdown of pricing categories, showing what happened during the lockdowns, and how the economic crisis that was created by those global lockdowns has affected everything since way out of proportion to the deflation that happened in the lockdowns. The Fed repeatedly said that three-month dip in 2020 was the “base effect” that made it look like things were inflating worse in 2021 than they really were as we compared the same months this year to those months last year. Now, however, we are long past comparing against the “base effect” months, so the Fed woke up to realize what it was saying last spring was never true:

As you can see, not every broad category sank during the lockdowns in the spring of 2020 and their immediate aftermath, but everything has certainly soared since; and the size of the rise is way beyond anything that would have just been due to comparing to the purported “base effect” of the decline that happened for a few months after the start of COVID. You may recall that I argued strenuously against the Fed’s “base effect” argument for months, even as the mainstream media constantly did nothing but parrot the Fed’s claim. That is how poorly financial media understood inflation (as well as those who like to boast about their economic credentials).

But that, too, is not the big reveal of the thing so small almost no one is seeing it, though it comes close.

It is also worth noting, however, that the image above does also support another one of my main theses back in the summer of 2020 and thereafter, which is that the global economy was so badly damaged that it is unable to support the production of goods or the transport of goods necessary, driving up the price of all goods because shortages abound due to non-transitory changes in the work force and due to continued total lockdowns in hot spots around the world and due to the continued curtailing of all economic activity even by lessor COVID-related responses, such as social distancing.

In other words, the damage is both done (nothing we can do about it) in some instances and continuing to be created in others (by the COVID responses we are still requiring). At the same time, Fed free funds have enabled companies to raise prices to consumers because Fed-fattened consumers (via stimmies and enhanced unemployment and now child bonuses) have enabled consumers to pay more for less of an item that is also probably lower in quality.

As easy examples of the “done” damage and the “still unfolding” damage, some restaurants closed for good (end of story, damage done); those that remain open, however, continue to experience severe restrictions placed upon them by new vaccine mandates (limiting their customers in some areas) and by social distancing (requiring lower occupancy) and by customers not returning because they are either still wary of COVID, especially around food, or just don’t want to put up with the falderal that comes with it when going out, and by restaurants disappointing customers because they don’t have some favorite things on their menus due to ongoing supply restraints. There was never anything that looked remotely “transitory” about any of that, so the multitude that parroted the Fed’s message for the past year were nothing short of fools … and there were a lot of them!

Stocks did not fall in early trade today when the news came out because this isn’t the big change in markets yet. The high print on inflation was almost exactly what most people were expecting it to be, so there was no shock value in the number. If anything, there was likely a little sigh of relief that this time that the number was not worse than most expected, as was the case with last month’s increase, which happened back when the Fed was still trying to convince the financial world that inflation was just transitory — a number that finally brought a crashing end to that lie or gross error, as the case may be.

We have, in other words, already come to expect the worse with inflation. 6.8% was the expected number this time. So, just sighs that it wasn’t worse. The biggest sigh of sigh relief was in bonds where yields fell (prices rose) because worse fears were not realized. The big change for bond pricing is not likely to come until…

The big reveal to come

The fact is, inflation is not being priced into bonds, and it may not be for a couple more months. That is why the stock market has remained blind to inflation, and it will remain blind until Fed interference is no longer a factor.

I’ve danced around this point with my general audience, but I laid out the market’s “Big Blindspot” in a special post for my patrons a month ago. I think that article’s truth is going to become generally more obvious from January onward. It’s a big secret hiding in plain sight.

In a sense, it’s actually a very little reveal and should be obvious, and for some of you, it may well be because you are reading more than one site like this and not just relying on the big economic and financial sites that miss the point every time. It is just that it has not been obvious to most, which is, itself, obvious when you read what they have written about inflation and bonds over the past year. When revealed, it seems so simple that it may seem like nothing at all. But, when you think about the number of financial articles that denied inflation over the past year or that readily bought into the Fed’s huge “transitory” argument on the primary basis that bonds have not been pricing it in so it couldn’t be a threat, you realize how significant this blindspot really is.

You can offer patronage at or above the $5 level as an act of kindness now to read it now at “The Big Blindspot That Will Bite Bonds and Stocks in the Butt,” or you can wait until after Christmas, and I’ll give you free access as an act of kindness in the form of a belated Christmas present because its effect will likely begin to be felt in January of 2022, and will ramp up quickly from there, and I want all of my readers to be able to see it as it is happening. I think it will help make sense of what you will see playing out in early 2022.

Don’t expect read a big secret. It’s not! It is a factor so small that it has been overlooked by nearly all … and in such plain sight, but that is exactly what makes it both critical and easy to understand. It may already be starting to become clear to some here because of my hints all around it in recent posts or because the market is starting to show signs of it.

Even though financial news is now rapidly trying to catch up with the Fed’s massive change from “transitory” to “no it isn’t,” financial news in the mainstream media is still not seeing how important this little factor will be in changing markets. I believe it is the fulcrum around which financial markets will turn in the first quarter of 2020. If you haven’t already sussed out what it is from my hints in recent months, you’ll understand why it is nearly inevitable that markets are going to turn over from their perilous heights in the next few months once you see it. What I want is for you to think about its simplicity and the importance of something being missed just because it is so simple.

Something may click when you read that post. On the other hand, if you’ve already figured it out because its truth is embodied in many of my writings this year, just know patronage is what keeps those writings flowing as I do try to help out everyone, whether they are patrons or not, but patrons say there is enough interest to make it worth my while. So, thank you again, to those who say it is worthwhile.

Oh how blind we can be to the simplest of things once they become part of the air we breathe or the water we drink. So, let the simple truth be known.