via CNBC:

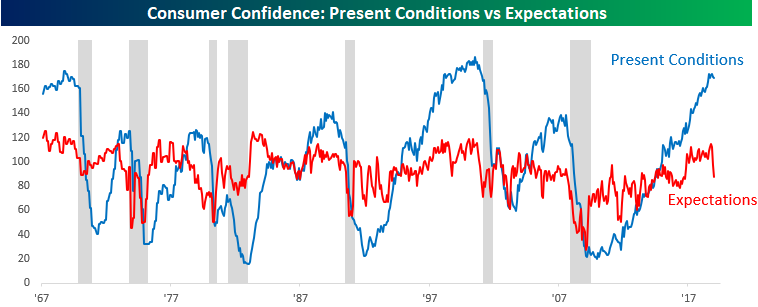

- Consumer confidence at present remains strong, but future expectations are plummeting, according to the Conference Board’s latest readings.

- Such wide gaps often portend significant economic slowdowns ahead.

- “The most recessionary signal at present is consumer future expectations relative to current conditions. It’s one of the worst readings ever,” bond guru Jeffrey Gundlach said in a tweet.

Drooping consumer sentiment is pointing the way to a substantial economic slowdown, if history is any guide.

In particular, the gap between current sentiment and future expectations has blown out wider, according to the Conference Board’s Consumer Confidence Index released Tuesday.

While confidence in the broader confidence index remains strong, falling just slightly month over month, the Expectations Index tumbled from 97.7 to 87.3 from December. Since October, the expectations reading has plunged 24 percent. Conversely, the Present Situation Index is at 169.6, a nudge lower from December’s reading.

Such wide gaps have portended sharp declines in economic activity, as pointed out by several market observers, including DoubleLine Capital’s Jeffrey Gundlach, the so-called Bond King.

“The most recessionary signal at present is consumer future expectations relative to current conditions. It’s one of the worst readings ever,” he said in a tweet.

The most recessionary signal at present is consumer future expectations relative to current conditions. It’s one of the worst readings ever.

— Jeffrey Gundlach (@TruthGundlach) January 29, 2019

The difference between the two readings has only been wider three times in the survey’s history going back to 1967, according to Bespoke Investment Group. Those came in January through March of 2001, the final month being the beginning of a recession.

Moreover, when the gap between the Present Situation and Expectations indexes has exceeded 50 — it is currently at 82.3 — “recessions weren’t far behind,” wrote Bespoke’s Paul Hickey.