New research findings have resulted in the development of a standalone algorithm which now powers the Bull Vix. Prior to this new development the Bull Vix utilized the BBT Algorithm for its alerts. The algorithm has also reduced the volatility of the Bull Vix’s signals which produced an aggregate gain of 448.3% from January 14, 2010 2010 to February 27, 2020.

A back test for all of the historical data available for the CBOE volatility index since 2010 was conducted. The Bull Vix’s track record to trade the VIX related instruments from 24 to 98 trading days after the occurrence of a Bullish Sentiment Anomaly (BSA) was flawless.

The breakthrough was the consolidation of 25 of the Bull Vix’s post BSA occurrence 5-week trading periods into 16 trading periods from 2010 through 2020. It was discovered that 16 of the Bull Vix’s Bullish Sentiment Anomaly (BSA) 5-week trading periods were clustered into seven elongated trading periods. This reduced the number of trading periods to 16 for the 10 years which began on January 14, 2010 and ended on February 27, 2020. It also resulted in all 16 of the periods producing a gain. The durations of the 16 trading periods ranged from 24 to 98 days. The significance of the discovery was the elimination of the drawdowns for investors who have a minimum investment time horizon of 98 days.

Notable performance statistics

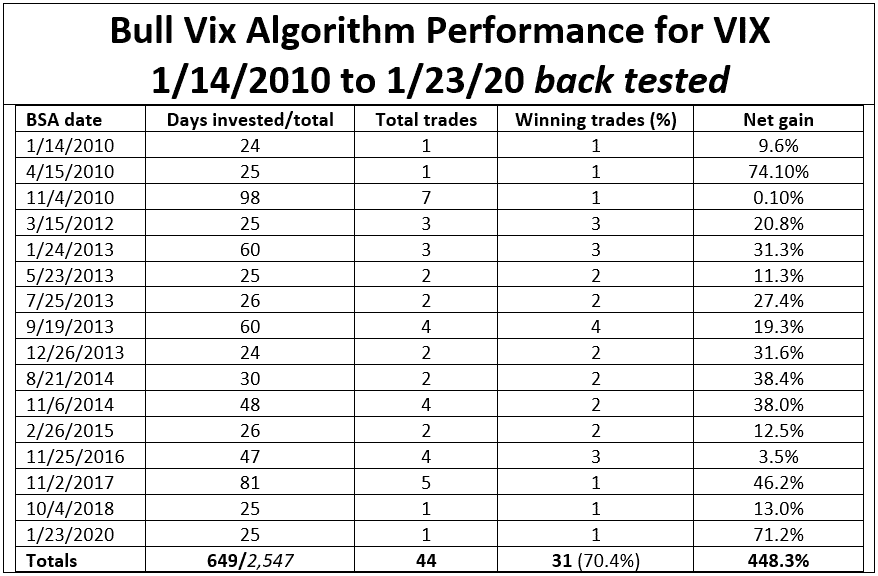

- Aggregate gain for each of the 16 of the trading periods ranged from 0.1% to 74.1%.

- Average gains of 28% per period and 44.8% per year.

- Invested for 25% of time (649/2,547 days) over the 10 years.

The success ratio for the 44 trade alerts issued by Bull Vix as depicted in the table below was 70.4%. The Bull Vix’s trade alerts through 2012, were based on a different variation of the Bullish Sentiment Anomaly (BSA) which requires that the S&P 500 or Dow 30 trade at an all-time high. The 2010 to January 24, 2013 alerts were based on multi-year highs since the S&P 500 did not eclipse its October 2007, all-time high until April of 2013. The gain of 74.1% for May 2010 coincided with the infamous 2010 flash crash.

The Bull Vix is especially ideal for defensive investors and for retirement accounts. From January 14, 2010, through February 27, 2020, the date of the Bull Vix’s most recently concluded trading period, the fully invested S&P 500 increased by 167%. For same period the 25% invested Bull Vix gained 448.3%.

The Bull Vix can also be utilized to hedge or to protect a portfolio against the violent volatility which often occurs after a stock market has reached an all-time high. The Bull Vix’s alerts to trade call options on the VIX and its related securities including the VXX, UVXY and VIXY. Since the VIX and its related securities are extremely volatile the opportunity to for short term gains of several hundred or even more than 1,000% are possible.

Take advantage of Bull Vix’s one-time subscription offerings for alerts to trade Vix related shares or call options.