via Zerohedge:

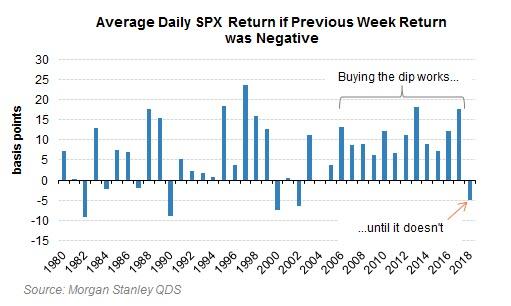

Back in October 2018, Morgan Stanley spooked traders when it declared that for the first time in 13 years, the market’s favorite strategy of “Buy the Dip” had failed to deliver in 2018.

Or maybe not, because just two months later, US stocks enjoyed the biggest rally in recent history lasting 4 consecutive months, as a result of the Fed’s dovish reversal which sent the S&P back to all time highs, however only to sharply reverse in May when Trump reignited the trade war with China, before stocks enjoyed a superb start to June once again, prompting Goldman’s clients to ask if it is again time to “buy the dip“, and more broadly, if BTFD as a strategy has been reincarnated.

A few days ago, Bank of America’s derivatives team answered that question when it observed that US stocks rallied last week (in their best weekly performance since November) as Fed Chair Powell indicated that the Fed is “monitoring” trade negotiations and will “act as appropriate to sustain the expansion”, and Friday’s weaker-than-expected jobs report (+75k last month versus a street average estimate of +175k) fuelled investor hopes that the Fed will cut benchmark rates.

Indeed, as BofA’s economists conceded, last week’s disappointing results now risk an earlier cut than their call for one in September. Additionally, over the weekend, President Trump announced that the US and Mexico had reached a deal to avoid new tariffs on Mexican goods, which helped to lift markets on Monday. Overall, the Dow Jones led US equity indices higher last week with a 4.7% gain, followed by the S&P 500 which added 4.4%. The Nasdaq-100 and Russell 2000 increased 4.1% and 3.3% respectively. The VIX fell 2.4 points week-over-week to 16.30, though it did drop as low as 15.33 intraweek.

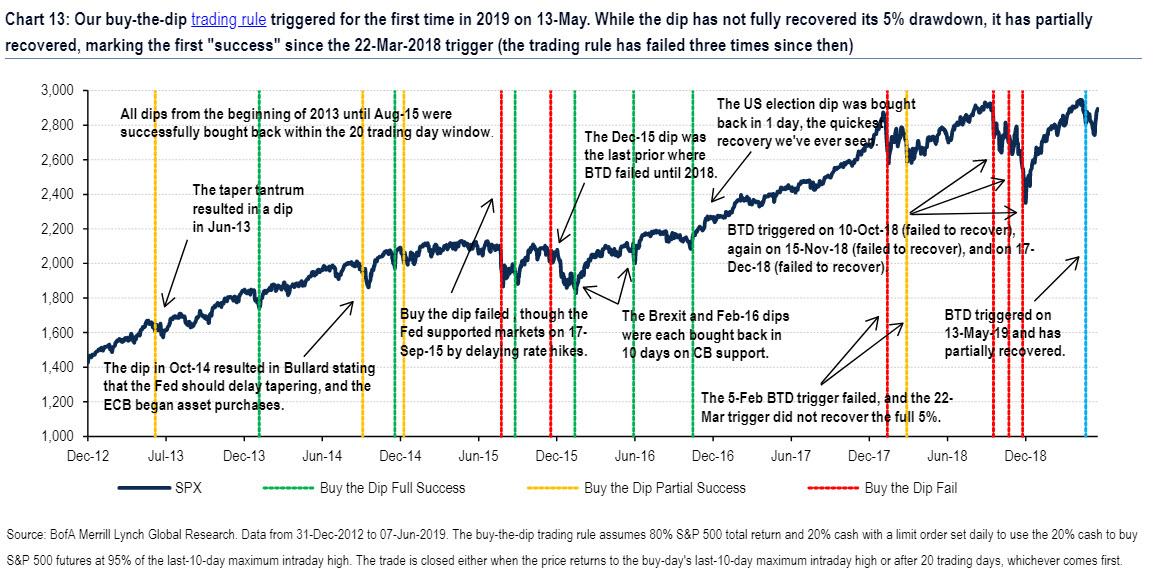

So is “buy-the-dip” back? The answer: BofA’s trading rule was triggered for the first time in 2019 on May 13. And while the dip has not fully recovered its 5% drawdown, it has partially recovered, marking the first “success” of the trading rule in over a year, or specifically since the March 22, 2018 trigger – note that the BTD trading rule has failed three times since then.

So is BTFD back?

The answer will depend on the fate of the current rally, because unless the S&P successfully regains its all time high in the mid-2,900s, it will mark the 4th consecutive time and 5 of the past 6 that the Buy-the-dip has failed to work, or worked only partially.

In that case, it could mean that there will be two consecutive years when arguably the market’s only trading strategy will have failed to fully restore the balance.

What happens then? Well, if buying modest drops is no longer a guaranteed path to trading success, traders may have to re-learn such arcane concepts as valuation and fundamental analysis. How that will impact a trading landscape dominated by millennial traders who have never encountered a bear market, and algos that only know to “do” what everyone else is doing, could end up being a painful – and expensive – observation.