by CachitoVolador

via Bloomberg:

We are primarily funded by readers. Please subscribe and donate to support us!

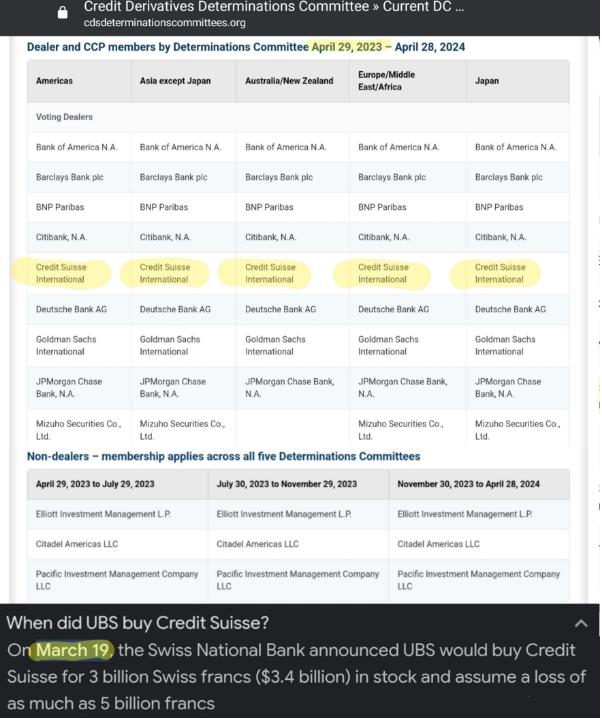

A day after dismissing a question that would have forced a payout on some of Credit Suisse Group AG’s default swaps, a panel that oversees the derivatives market received another query that could trigger the contracts.

The Credit Derivatives Determinations Committee was asked whether a bankruptcy credit event had occurred with regards to the Swiss lender in March, when it was taken over in a hastily arranged deal by rival UBS Group AG, according to a statement on its website.

A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse them if the borrower defaults.

Source: www.investopedia.com/terms/c/creditdefaultswap.asp

So Credit Suisse was allowed on the CDDC after failing? The same CDDC who voted to not pay out on Credit Sus default swaps?